In Louisiana, car insurance covers liability, collision, comprehensive, and uninsured/underinsured motorist risks. Each type offers essential protection for various scenarios involving your vehicle and finances.

Cheap Car Insurance in Louisiana for 2024 (Save Big With These 10 Companies!)

For cheap car insurance in Louisiana, State Farm, Geico, and Progressive are top picks with rates from $33 per month. State Farm offers dependable coverage, Geico is known for affordability, and Progressive provides customizable plans. Explore these options for the best rates and coverage.

UPDATED: Sep 8, 2024Fact Checked

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Sep 8, 2024

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: Sep 8, 2024

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

UPDATED: Sep 8, 2024Fact Checked

2nd Cheapest in Louisiana: Geico

Company Facts

Min Coverage in Louisiana

$38/moA.M. Best Rating

A++ (Superior)Complaint Level

MedPros & Cons

3rd Cheapest in Louisiana: Progressive

3rd Cheapest in Louisiana: Progressive

Company Facts

Min Coverage in Louisiana

$43/moA.M. Best Rating

A+Complaint Level

LowPros & Cons

State Farm, Geico, and Progressive offer the best cheap car insurance in Louisiana, with rates starting from $33 per month. State Farm is our top pick overall for its reliable coverage and extensive agent network. Geico is the most affordable, while Progressive stands out for customizable plans.

This article examines these top providers to help you choose the best coverage for your needs and budget. Find out how to secure the best rates with these trusted insurers. Uncover more about our “Free Car Insurance Information, Advice & Online Quotes” by reading further.

Our Top 10 Company Picks: Cheap Car Insurance in Louisiana

Company Rank Monthly Rates Bundling Discount Best For Jump to Pros/Cons

#1 $33 15% Reliable Claims State Farm

#2 $38 12% Low Rates Geico

#3 $43 10% Flexible Plans Progressive

#4 $44 7% Military Members USAA

#5 $45 9% High-Risk Drivers Direct Auto

#6 $46 11% Versatile Coverage National General

#7 $47 6% Accessible Coverage The General

#8 $48 14% Trusted Provider Nationwide

#9 $55 18% Comprehensive Options Allstate

#10 $57 17% Local Agents Farmers

Compare RatesStart Now →

Ready to find cheaper car insurance coverage? Enter your ZIP code to begin.

Overview

- State Farm leads with the best cheap car insurance in Louisiana at $33/month

- Geico and Progressive offer affordable, competitive coverage options

- Explore how to maximize savings with discounts and customization options

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

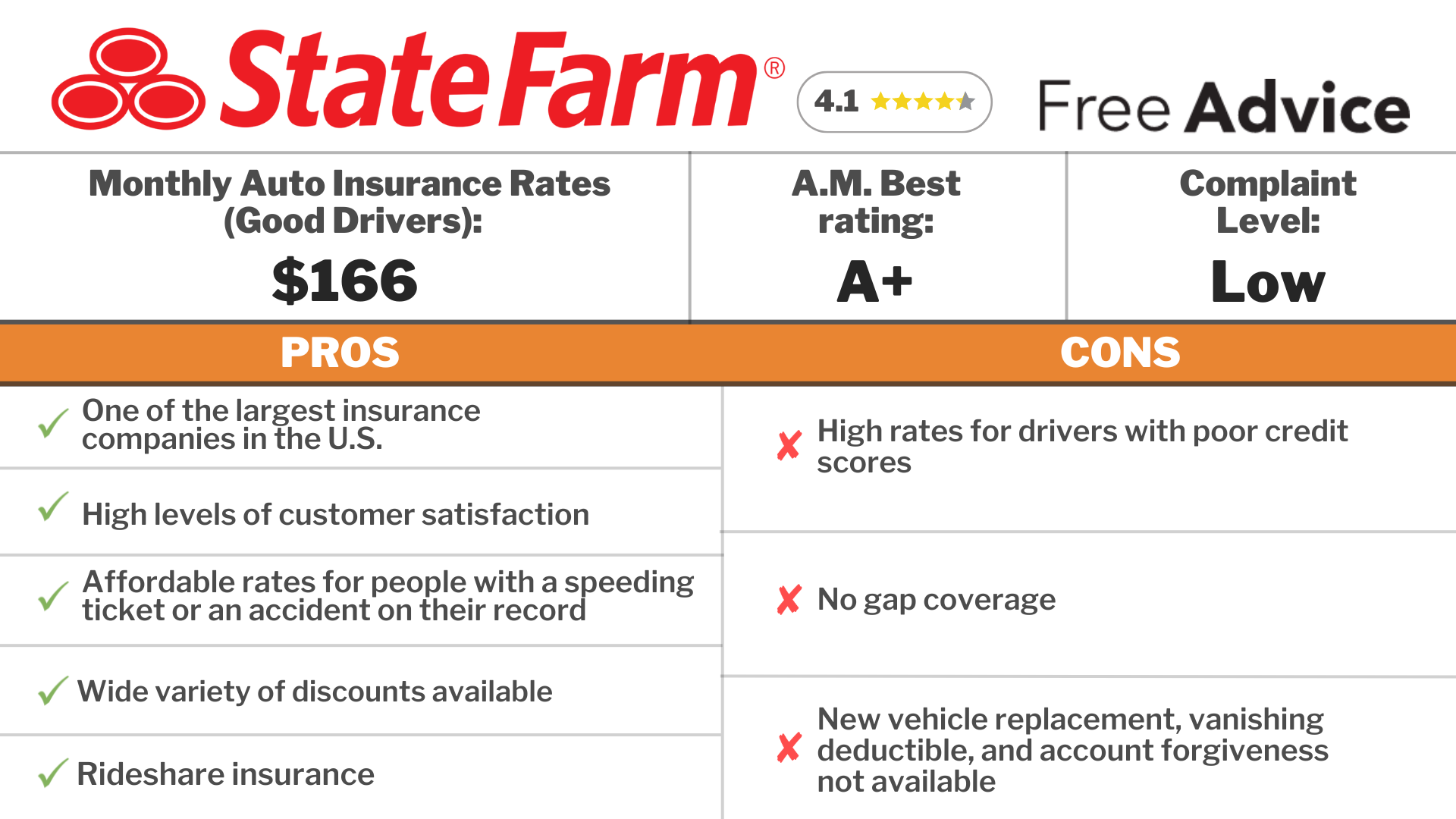

#1 – State Farm: Top Overall Pick

Pros

- Low-Cost Coverage: State Farm provides affordable car insurance in Louisiana, with rates as low as $33 per month, making it an excellent option for drivers focused on savings. Discover more details in our State Farm insurance review & ratings.

- Trustworthy Claims Service: State Farm is renowned for its efficient claims handling, ensuring Louisiana car insurance policyholders can resolve their claims without hassle.

- Discounts for Bundling: With a 15% discount for bundling multiple policies, Louisiana drivers can enjoy additional savings on their car insurance when combining it with other coverages.

Cons

- Limited Discount Options: While bundling discounts are available, State Farm may not offer a wide variety of discounts, which could limit savings opportunities for some Louisiana car insurance shoppers.

- Higher Costs for Risky Drivers: State Farm’s premiums tend to rise significantly for high-risk drivers, making it a less budget-friendly option for those with a history of traffic violations in Louisiana.

#2 – Geico: Best for Affordable Premiums

Pros

- Economical Rates: Geico offers some of the lowest car insurance rates in Louisiana, starting at $38 per month, making it an attractive choice for cost-conscious drivers.

- Extensive Discount Options: Geico provides a broad range of discounts, helping Louisiana car insurance policyholders reduce their overall costs. Learn more by reviewing our Geico insurance review & ratings.

- User-Friendly Digital Tools: Geico’s comprehensive online platform and mobile app make it easy for Louisiana car insurance owners to manage their policies and file claims.

Cons

- Fewer Local Offices: Geico’s emphasis on digital services may be a drawback for Louisiana car insurance policyholders who prefer dealing with agents in person.

- Average Service Quality: While Geico is known for low rates, its customer service is generally rated as average, which might not meet the needs of all Louisiana car insurance customers.

#3 – Progressive: Best for Customizable Plans

Pros

- Tailored Coverage: Progressive offers flexible car insurance policies in Louisiana, allowing drivers to customize their coverage according to their specific requirements. Dive into our Progressive insurance review & ratings for further insights.

- Discounts for Safe Driving: The Snapshot program by Progressive rewards safe drivers in Louisiana with discounts, potentially lowering their car insurance costs over time.

- Reputable Provider: Progressive is a well-established insurance company with a solid reputation, providing Louisiana car insurance owners with reliable coverage options.

Cons

- Higher Starting Rates: With a base rate of $43 per month, Progressive’s pricing is slightly higher than some other budget-friendly car insurance options in Louisiana.

- Inconsistent Application of Discounts: Some Louisiana car insurance customers report issues with the consistent application of discounts, leading to unexpected premium increases.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

#4 – USAA: Best for Military Families

Pros

- Specialized Military Coverage: USAA offers car insurance tailored to the needs of military members in Louisiana, including discounted rates and unique benefits. Refer to our Military car insurance discounts and tips for additional details.

- Top-Rated Customer Support: USAA is highly regarded for its exceptional customer service, ensuring that Louisiana car insurance policyholders have a smooth experience managing their coverage.

- Competitive Rates for Military: USAA provides affordable car insurance to military families in Louisiana, with rates starting at $44 per month, making it a top choice for those who qualify.

Cons

- Exclusive Membership: USAA is only available to military members and their families, excluding many Louisiana car insurance shoppers.

- Limited Physical Locations: USAA’s lack of local offices in Louisiana may be inconvenient for those who prefer face-to-face interactions for managing their car insurance policies.

#5 – Direct Auto: Best for High-Risk Drivers

Pros

- Affordable Rates for High-Risk Drivers: Direct Auto focuses on providing cost-effective car insurance solutions for high-risk drivers in Louisiana, with rates beginning at $45 per month.

- Flexible Payment Plans: Direct Auto offers a variety of payment options, making it easier for Louisiana car insurance policyholders to manage their premiums. Get more information from our car insurance for leased or financed car.

- Specialized Non-Standard Insurance: Direct Auto offers coverage options specifically designed for drivers with unique needs, making it a versatile choice for car insurance in Louisiana.

Cons

- Limited Coverage Varieties: Although Direct Auto is great for high-risk drivers, its coverage options may be more restricted compared to other Louisiana car insurance providers.

- Fewer Discounts: Direct Auto offers fewer discount opportunities, which could lead to higher costs for Louisiana car insurance owners seeking additional savings.

#6 – National General: Best for Diverse Coverage Options

Pros

- Broad Coverage Choices: National General provides a wide array of car insurance options in Louisiana, catering to drivers with varied needs and preferences. Uncover more insights in our “Does National General insurance offer gap insurance?”

- Savings through Bundling: With an 11% discount for bundling, National General allows Louisiana car insurance policyholders to save when combining multiple policies.

- Specialized Insurance for RVs and Motorhomes: National General is a top choice for RV and motorhome owners in Louisiana, offering tailored insurance coverage for these vehicles.

Cons

- Above-Average Rates: With an average monthly rate of $46, National General’s pricing is on the higher side, which may not appeal to those looking for the most affordable car insurance in Louisiana.

- Complex Discount System: The discount structure at National General can be confusing, leading some Louisiana car insurance customers to miss out on potential savings.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

#7 – The General: Best for High-Risk Accessibility

Pros

- Accessible Insurance for High-Risk Drivers: The General offers affordable car insurance in Louisiana, especially for high-risk drivers, with rates starting at $47 per month.

- Convenient SR-22 Filing: The General provides SR-22 filing services, making it easier for Louisiana car insurance policyholders to maintain the required coverage. For more details, explore our “Does The General insurance offer roadside assistance?”

- Streamlined Online Process: The General’s easy-to-use online application process simplifies obtaining car insurance in Louisiana, particularly for those with past driving issues.

Cons

- Higher Premiums: The General’s rates are higher than some other affordable car insurance options in Louisiana, which may not be ideal for budget-conscious drivers.

- Limited Coverage Options: The General’s coverage offerings are more basic, which may not meet the needs of Louisiana car insurance owners seeking more comprehensive policies.

#8 – Nationwide: Best for Trustworthy Service

Pros

- Financial Strength and Stability: Nationwide’s robust financial standing gives Louisiana car insurance owners confidence that their claims will be handled reliably. Access more information in our “Does Nationwide offer liability coverage?”

- Personalized Service through Local Agents: Nationwide’s extensive network of local agents provides tailored service to Louisiana car insurance policyholders, helping them find the right coverage.

- Significant Bundling Discounts: With a 14% discount for bundling, Nationwide helps Louisiana car insurance policyholders save money when combining multiple types of insurance.

Cons

- Relatively High Premiums: Nationwide’s average rate of $48 per month is higher than many competitors, which could be a drawback for those searching for the cheapest car insurance in Louisiana.

- Variable Customer Service Quality: Nationwide’s customer service experiences can vary, which may be a concern for Louisiana car insurance owners who prioritize consistent, high-quality support.

#9 – Allstate: Best for Comprehensive Coverage

Pros

- Wide Range of Coverage Options: Allstate offers a variety of car insurance coverages in Louisiana, including features like accident forgiveness and new car replacement. Take a look at our Allstate Insurance review and ratings for more insights.

- Unique Discount Programs: Allstate provides special discount programs, such as the Safe Driving Bonus, to help Louisiana car insurance owners lower their premiums.

- Advanced Mobile App: Allstate’s mobile app allows Louisiana car insurance owners to manage their policies, file claims, and access important information quickly and easily.

Cons

- Higher Price Point: Allstate’s average monthly premium of $55 is on the higher side, which may not be ideal for Louisiana drivers looking for cheaper car insurance.

- Stringent Underwriting Standards: Allstate’s stricter underwriting criteria may result in higher premiums for Louisiana car insurance owners with less-than-perfect driving records.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

#10 – Farmers: Best for Local Agent Support

Pros

- Strong Local Presence: Farmers provides dedicated local agent support in Louisiana, offering personalized service for car insurance owners who value in-person interactions. Find additional details in our Farmers insurance review & ratings.

- Multiple Discount Opportunities: Farmers offers a wide range of discounts, including those for safe driving and bundling, helping Louisiana car insurance policyholders save on premiums.

- Comprehensive Insurance Coverage: Farmers offers a variety of coverage options, including liability, collision, and comprehensive insurance, making it a reliable choice for car insurance in Louisiana.

Cons

- Highest Premium Rates: With an average monthly rate of $57, Farmers has the highest premiums among the top 10 companies, making it less appealing for budget-conscious drivers in Louisiana.

- Slower Claims Process: Some Louisiana car insurance customers have reported slower claims processing times with Farmers, which could be a disadvantage in urgent situations.

Louisiana Car Insurance Monthly Rates by Provider & Coverage Level

Understanding Louisiana car insurance rates is essential for finding the best coverage for your needs. This guide breaks down the monthly rates for minimum and full coverage from various providers. Whether you’re looking for affordable options or comprehensive protection, comparing these rates can help you make an informed decision.

Louisiana Car Insurance Monthly Rates by Provider & Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $55 | $206 |

| Direct Auto | $45 | $164 |

| Farmers | $57 | $212 |

| Geico | $38 | $141 |

| National General | $46 | $165 |

| Nationwide | $48 | $181 |

| Progressive | $43 | $161 |

| State Farm | $33 | $124 |

| The General | $47 | $175 |

| USAA | $44 | $162 |

Compare RatesStart Now →

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Understanding Car Insurance in Louisiana

Before we delve into finding cheap car insurance in Louisiana, let’s first understand the basics of car insurance. Car insurance is a contract between the policyholder and an insurance company, where the policyholder pays a premium in exchange for financial protection in case of an accident or other covered incidents.

State Farm delivers unmatched reliability and comprehensive coverage, making it the best choice for dependable car insurance in Louisiana.

Eric Stauffer Licensed Insurance Agent

Car insurance is not just a legal requirement, but it also provides peace of mind and financial security. It helps protect you from unexpected expenses that may arise from accidents, theft, or damage to your vehicle. Understanding the different types of coverage and the minimum requirements in Louisiana can help you make informed decisions when choosing the right car insurance policy.

The Basics of Car Insurance

- Liability Coverage: This type of coverage pays for damages caused to other people and their property in an accident where you are at fault. It helps cover medical expenses, property damage, and legal fees if you are sued.

- Collision Coverage: Collision coverage pays for damage to your own vehicle in a collision, regardless of who is at fault. Whether you hit another car or a stationary object, this coverage helps cover the cost of repairs or replacement.

- Comprehensive Coverage: Comprehensive coverage covers damage to your vehicle caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. It provides financial protection for unexpected incidents that are beyond your control.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who doesn’t have insurance or doesn’t have enough coverage to pay for the damages. It helps cover medical expenses, lost wages, and other damages resulting from the accident.

Having a combination of these coverage types can provide comprehensive protection for you and your vehicle, ensuring that you are financially prepared for any unforeseen circumstances on the road. Expand your understanding with our article called “Best Liability-Only Car Insurance.”

Louisiana’s Minimum Car Insurance Requirements

Louisiana law requires drivers to carry minimum liability coverage of 15/30/25. This means that drivers must have at least $15,000 of bodily injury liability coverage per person, $30,000 of bodily injury liability coverage per accident, and $25,000 of property damage liability coverage.

State Farm stands out as the best choice for reliable and comprehensive car insurance in Louisiana, offering excellent coverage with rates starting at $33 per month.

Meeting the minimum requirements is essential to legally operate a vehicle in Louisiana. However, it’s important to note that these minimums may not be sufficient to cover all potential expenses in the event of a serious accident. It is advisable to consider higher coverage limits and additional coverage options to ensure adequate protection.

Insurance companies in Louisiana offer various policies with different coverage options and premiums. It’s always recommended to compare quotes from multiple insurers to find the best car insurance that fits your needs and budget. Additionally, maintaining a good driving record and taking advantage of available discounts can help lower your car insurance premiums even further.

Factors Affecting Car Insurance Rates in Louisiana

Several factors influence car insurance rates in Louisiana. It’s essential to understand these factors to better navigate the search for cheap car insurance.

When it comes to car insurance rates in Louisiana, age and driving experience are significant factors to consider. Insurance companies often categorize younger and inexperienced drivers as higher risk due to their lack of experience on the road.

As a result, these drivers may face higher premiums compared to older, more experienced drivers. It’s important to note that as you gain more years of driving experience, your chances of qualifying for lower insurance rates increase.

Another crucial factor that affects car insurance rates in Louisiana is your driving record. Insurance companies closely evaluate your history of traffic violations, accidents, and other incidents when determining your premiums. A clean driving record is highly valued and can help you secure cheap car insurance.

However, drivers with a history of violations or accidents may face higher premiums due to the increased risk they pose on the road. Aside from age and driving record, the make and model of your vehicle also play a significant role in determining car insurance rates. Insurance companies take into account the likelihood of accidents or theft based on the characteristics of your vehicle.

State Farm offers the most reliable coverage and extensive agent network for affordable car insurance in Louisiana.

Generally, sports cars and luxury vehicles are considered riskier to insure, resulting in higher insurance rates. On the other hand, sedans or minivans are often associated with lower insurance rates due to their lower risk profiles.

It’s important to consider these factors and their impact on car insurance rates when searching for the best coverage in Louisiana. By understanding how age, driving experience, driving record, and vehicle make and model influence insurance premiums, you can make informed decisions and potentially find cheaper car insurance options.

Uncover more details in our article titled “Car Insurance for People Driving Your Car.”

How to Find Cheap Car Insurance in Louisiana

Now that you have a better understanding of car insurance in Louisiana and the factors that influence rates, let’s explore some strategies to find affordable coverage.

Comparison Shopping

One of the most effective ways to find cheap car insurance in Louisiana is to comparison shop. Obtain quotes from multiple insurance providers, considering both local and national companies. Make sure to compare coverage limits and deductibles to get an accurate comparison.

When comparing quotes, it’s important to consider the reputation and customer service of each insurance provider. Look for reviews and ratings from other policyholders to get an idea of their satisfaction with the company. Additionally, consider the financial stability of the insurer. You want to ensure that they have the resources to cover claims in the event of an accident.

Another aspect to consider when comparison shopping is the level of customer support offered by each insurance company. Look for providers that have convenient customer service hours, multiple contact channels (such as phone, email, and online chat), and a responsive claims process.

Having a reliable and efficient support system can make a significant difference when you need assistance with your policy or when filing a claim.

Taking Advantage of Discounts

Many insurance companies offer various discounts that can help reduce your premiums. These discounts may include safe driver discounts, multi-policy discounts (e.g., bundling car and home insurance), or discounts for installing anti-theft devices in your vehicle. Be sure to ask each insurer about the discounts they offer.

State Farm leads with the best overall coverage in Louisiana, combining reliability with extensive local support.

Angie Watts Licensed Real Estate Agent

In addition to the common discounts mentioned above, some insurance providers offer unique discounts based on your lifestyle or occupation. For example, if you have a low annual mileage, you may be eligible for a low-mileage discount. Similarly, some companies offer discounts for certain professions, such as teachers or military personnel. Exploring these lesser-known discounts can potentially save you even more on your car insurance.

When discussing discounts with insurance providers, it’s important to ask about any eligibility requirements or documentation needed to qualify. Some discounts may have specific criteria that you need to meet, so be sure to provide accurate information to the insurance company to ensure you receive all the discounts you are eligible for.

Delve into our article titled “title of the article” for a deeper understanding.

Maintaining a Clean Driving Record

As mentioned earlier, a clean driving record is essential for obtaining affordable car insurance. Avoid traffic violations and accidents to keep your record clean. Some insurance companies offer discounts to drivers with a history of safe driving. Additionally, completing defensive driving courses can sometimes lead to lower rates.

It’s important to note that different insurance providers may have varying policies regarding how long violations or accidents impact your rates. Some companies may only consider the last three years of your driving history, while others may look back further. Understanding how different insurance companies assess driving records can help you make an informed decision when choosing a provider.

In addition to maintaining a clean driving record, you can also consider other factors that insurance companies take into account when determining your premiums. For example, the type of car you drive can influence your rates. Generally, older vehicles with a good safety record and lower repair costs tend to have lower insurance premiums.

Additionally, where you live can also affect your rates. If you live in an area with a higher incidence of car theft or accidents, your premiums may be higher. By considering these additional factors and maintaining a clean driving record, you can improve your chances of finding cheap car insurance in Louisiana.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Top Affordable Car Insurance Providers in Louisiana

When it comes to car insurance in Louisiana, there is no shortage of options. However, finding affordable coverage can be a challenge. Luckily, there are three top providers in the state that are known for offering competitive rates and comprehensive coverage.

Provider 1 Review

Provider 1 is a standout choice for affordable car insurance in Louisiana. They are well-known for their excellent customer service and commitment to providing comprehensive coverage options. Whether you’re a new driver or have years of experience on the road, Provider 1 offers competitive rates that won’t break the bank.

State Farm leads with its unmatched reliability and extensive agent network, making it the best choice for dependable car insurance in Louisiana.

One of the reasons Provider 1 is a top choice is because of their dedication to customer satisfaction. They understand that accidents happen, and their claims process is quick and hassle-free. In addition, their team of knowledgeable agents is always available to answer any questions or concerns you may have. Broaden your perspective with our article entitled “Best Car Insurance for Students.”

Ready to shop around for the best car insurance company? Enter your ZIP code and see which one offers the coverage you need.

Frequently Asked Questions

What factors affect the cost of car insurance in Louisiana?

Several factors can influence the cost of car insurance in Louisiana, including your age, driving record, the type of car you drive, your location, and the coverage options you choose.

Discover a wealth of knowledge in our “Louisiana Auto Accident Law.”

Are there any specific car insurance requirements in Louisiana?

Yes, Louisiana law requires all drivers to carry liability insurance with minimum coverage limits of 15/30/25. This means you must have at least $15,000 coverage for bodily injury per person, $30,000 coverage for bodily injury per accident, and $25,000 coverage for property damage.

Can I get cheap car insurance in Louisiana if I have a poor driving record?

Having a poor driving record can make it more challenging to find cheap car insurance in Louisiana. However, shopping around and comparing quotes from different insurance providers can help you find the most affordable options available to you.

Finding affordable car insurance doesn’t have to be a challenge. Enter your ZIP code into our free comparison tool to find the lowest prices in your area.

What are some ways to lower car insurance costs in Louisiana?

There are several strategies you can use to reduce car insurance costs in Louisiana. These include maintaining a clean driving record, taking defensive driving courses, bundling your car insurance with other policies, increasing your deductibles, and installing safety features in your vehicle.

Is it possible to find cheap car insurance in Louisiana for young drivers?

Finding cheap car insurance for young drivers can be challenging, as they are often considered high-risk by insurance companies. However, some insurance providers offer discounts for good grades, completing driver’s education courses, or being added to a parent’s policy. Shopping around and comparing quotes is essential for young drivers looking for affordable coverage.

Expand your understanding with our “Best Hazard Home Insurance Coverage in Louisiana.”

What are some additional coverage options to consider when purchasing car insurance in Louisiana?

In addition to the required liability coverage, it’s worth considering additional coverage options such as collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, medical payments coverage, and roadside assistance. These additional coverages provide added protection and peace of mind in various situations.

Who has the cheapest car insurance in Louisiana?

Geico, State Farm, and Progressive typically offer some of the cheapest car insurance rates in Louisiana.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool to instantly compare quotes near you.

How much is car insurance in Louisiana per month?

On average, car insurance in Louisiana costs around $130 per month.

What is the minimum car insurance in Louisiana?

Louisiana requires drivers to carry at least 15/30/25 liability coverage, which includes $15,000 for bodily injury per person, $30,000 for total bodily injury per accident, and $25,000 for property damage.

Gain deeper insights by exploring our “Best Car Insurance for Seniors in Louisiana.”

Why is Louisiana car insurance so expensive?

Louisiana car insurance is expensive due to high rates of accidents, traffic violations, and a high number of uninsured drivers, as well as the state’s susceptibility to natural disasters.

How to lower car insurance in Louisiana?

To lower car insurance in Louisiana, consider increasing your deductible, taking advantage of discounts, improving your credit score, and comparing quotes from different providers.

What is full coverage insurance in Louisiana?

Full coverage insurance in Louisiana typically includes liability, collision, and comprehensive coverage, providing broader protection against various risks.

What happens if you drive without insurance in Louisiana?

Driving without insurance in Louisiana can result in fines, license suspension, vehicle impoundment, and legal penalties.

Learn more about our “Best Car Insurance for Drivers After an Accident in Louisiana” for a broader perspective.

When did Louisiana require car insurance?

Louisiana began requiring car insurance in 1964.

Is Louisiana a no-fault state?

No, Louisiana is not a no-fault state; it follows an at-fault system where the driver responsible for the accident is liable for damages.

How much is auto insurance in Louisiana?

Auto insurance in Louisiana averages around $130 per month, varying based on factors like coverage levels and driving history.

Can I sue my own car insurance in Louisiana?

Yes, you can sue your own car insurance company in Louisiana if they fail to meet the terms of your policy or provide fair compensation.

Elevate your knowledge with our “Louisiana Probate Court Resources.”

How to self-insure your car in Louisiana?

To self-insure your car in Louisiana, you must apply for a certificate of self-insurance from the Louisiana Department of Insurance, demonstrating financial responsibility to cover potential liabilities.

Can I keep my totaled car in Louisiana?

Yes, in Louisiana, you can keep your totaled car if you decide to accept a settlement and buy back the vehicle from the insurance company.

What is the minimum car insurance coverage in Louisiana?

The minimum car insurance coverage in Louisiana is 15/30/25 liability coverage, which includes $15,000 per person for bodily injury, $30,000 per accident for bodily injury, and $25,000 for property damage.

What is the penalty for driving without insurance in Louisiana?

The penalty for driving without insurance in Louisiana includes fines, potential license suspension, vehicle impoundment, and other legal consequences.

Find out more by reading our “Parking lot accident Louisiana Auto – Insurance.”

Can I have out-of-state insurance in Louisiana?

No, if you reside in Louisiana, you must have car insurance that meets Louisiana’s coverage requirements.

Is it possible to lower my car insurance rates with a high deductible?

Yes, choosing a higher deductible can lower your car insurance rates, but be prepared to pay more out of pocket in the event of a claim.

Are there insurance options for high-risk drivers in Louisiana?

Yes, high-risk drivers in Louisiana can obtain insurance through providers that specialize in high-risk policies or through Louisiana’s Assigned Risk Plan.

How does age affect car insurance premiums in Louisiana?

Age affects car insurance premiums in Louisiana, with younger drivers typically facing higher rates due to their higher risk profile, while older drivers may see lower rates as they age.

Unlock additional information in our “How to File a Car Insurance Claim With Louisiana Farm Bureau Casualty Insurance.”

Are there discounts available for car insurance in Louisiana?

Yes, many car insurance providers in Louisiana offer discounts for factors such as safe driving, bundling policies, and having anti-theft devices installed in your vehicle.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.