Advanced safety features in your Cadillac significantly influence your car insurance rates. Modern Cadillacs are equipped with state-of-the-art technologies such as automatic emergency braking, lane departure warning, and adaptive cruise control.

Cheap Cadillac Car Insurance in 2024 (Save Money With These 10 Companies)

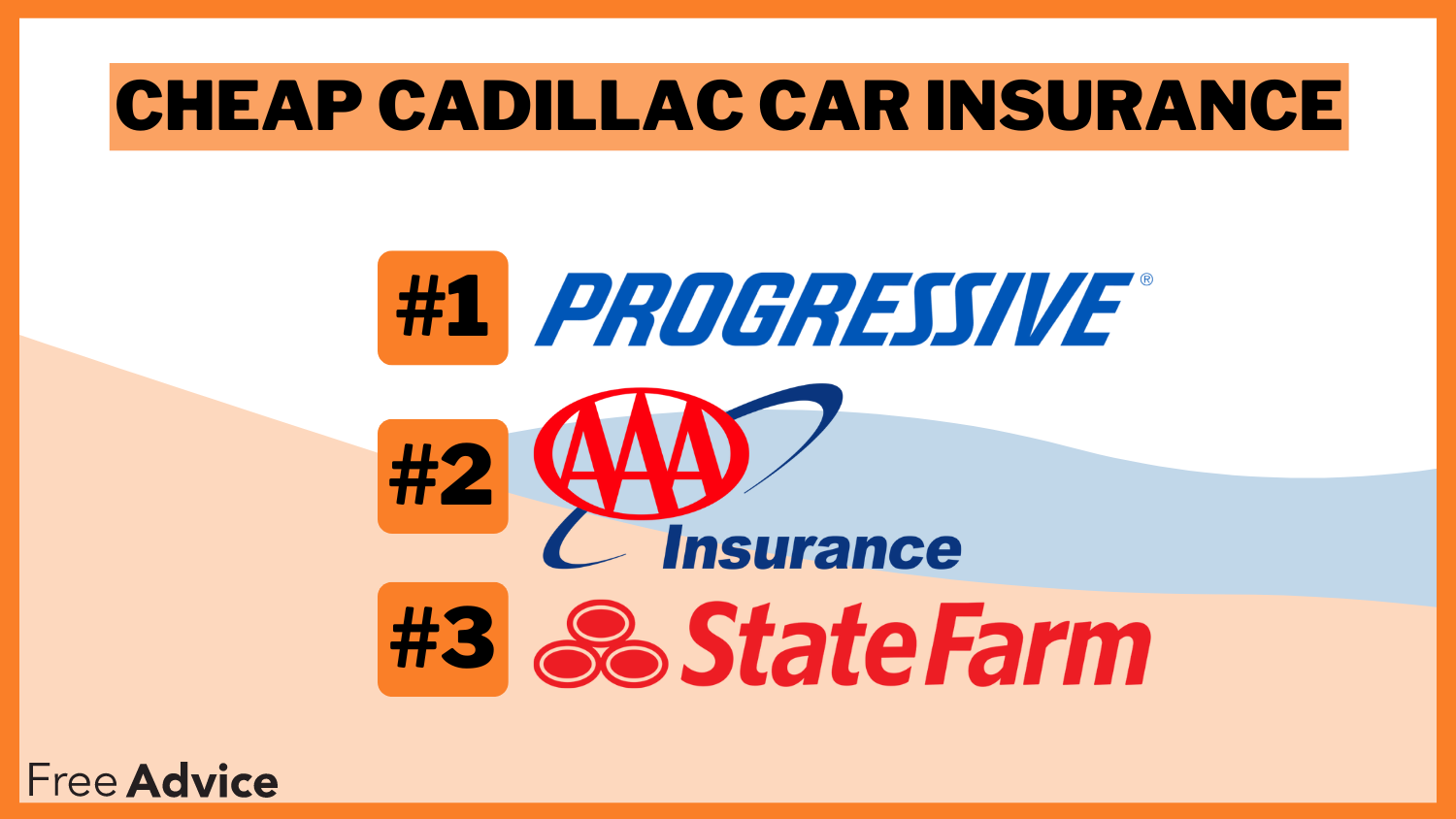

The leading providers of cheap Cadillac car insurance are Progressive, AAA, and State Farm, with monthly rates starting at $58. These providers lead the market by combining affordable rates with comprehensive coverage, making them the top choices for Cadillac car insurance that balances cost and quality.

UPDATED: Sep 27, 2024Fact Checked

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Mary Martin

Published Legal Expert

Mary Martin has been a legal writer and editor for over 20 years, responsible for ensuring that content is straightforward, correct, and helpful for the consumer. In addition, she worked on writing monthly newsletter columns for media, lawyers, and consumers. Ms. Martin also has experience with internal staff and HR operations. Mary was employed for almost 30 years by the nationwide legal publi...

Published Legal Expert

UPDATED: Sep 27, 2024

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: Sep 27, 2024

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

UPDATED: Sep 27, 2024Fact Checked

2nd Cheapest for Cadillac: AAA

2,934 reviews

2,934 reviewsCompany Facts

Min. Coverage for Cadillac

$64/mo

A.M. Best Rating

A

Complaint Level

Low

Pros & Cons

2,934 reviews

2,934 reviews3rd Cheapest for Cadillac: State Farm

17,759 reviews

17,759 reviewsCompany Facts

Min. Coverage for Cadillac

$67/mo

A.M. Best Rating

B

Complaint Level

Low

Pros & Cons

17,759 reviews

17,759 reviewsThe top picks for cheap Cadillac car insurance are Progressive, AAA, and Stat Farm. Progressive has the most competitive rates starting at just $58 per month.

The top three companies excel in providing high-quality Cadillac car insurance at budget-friendly prices, but all of these providers have competitive rates and unique perks for luxury cars.

Our Top 10 Company Picks: Cheap Cadillac Car Insurance| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $58 | A+ | Tight Budgets | Progressive | |

| #2 | $64 | A | Roadside Assistance | AAA |

| #3 | $67 | B | Customer Service | State Farm | |

| #4 | $71 | A+ | Local Agents | Allstate | |

| #5 | $73 | A++ | Bundling Policies | Travelers | |

| #6 | $77 | A | Affinity Discounts | Liberty Mutual |

| #7 | $81 | A | Safe Drivers | Farmers | |

| #8 | $86 | A++ | Coverage Flexibility | Auto-Owners | |

| #9 | $92 | A+ | Dividend Policies | Amica | |

| #10 | $97 | A+ | Organization Discount | The Hartford |

Compare RatesStart Now →

Choosing any of these top providers ensures you get great value without compromising on coverage. Keep reading to compare Cadillac insurance costs, or find cheap car insurance quotes now by entering your ZIP code above.

Overview

- Progressive offers cheap Cadillac car insurance at $58/month

- AAA and State Farm provides affordable Cadillac car insurance coverage

- Balance cost with minimum or full coverage options

When comparing Cadillac car insurance, it’s essential to balance affordability and protection by evaluating minimum versus full coverage, including new car replacement insurance coverage. Minimum coverage meets legal requirements but offers limited protection, while full coverage extends to options like collision, comprehensive, and new car replacement insurance, which is ideal for new Cadillac owners.

Cadillac Car Insurance Monthly Rates by Provider & Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $64 | $121 |

| $71 | $137 | |

| $92 | $171 | |

| $86 | $162 | |

| $81 | $153 | |

| $77 | $148 |

| $58 | $119 | |

| $67 | $129 | |

| $97 | $178 |

| $73 | $141 |

Compare RatesStart Now →

Progressive offers some of the lowest rates, with minimum coverage starting at $58 per month, while full coverage from companies like Amica and The Hartford can range from $171 to $178 per month. Other providers include AAA, with $64 for minimum and $121 for full coverage, and Liberty Mutual, with $77 for minimum and $148 for full coverage.

Progressive offers the best overall Cadillac car insurance with competitive rates starting at just $58 per month.

Brandon Frady Licensed Insurance Agent

While minimum coverage saves money upfront, full coverage—especially with new car replacements—offers better overall protection. Comparing quotes from State Farm, Allstate, and Travelers ensures you find a plan that fits your budget and needs.

Cadillac insurance options range from basic liability to comprehensive policies, and by customizing your plan to include essential features like new car replacement, you can ensure optimal protection at an affordable rate. Ready to find cheaper car insurance coverage? Enter your ZIP code below to begin.

How Safety Tech Can Save You on Cheap Cadillac Car Insurance

These systems enhance driving safety and qualify you for substantial discounts on car insurance, including the best safety features car insurance discounts. Insurers often reward vehicles with these technologies by offering lower premiums, as they reduce the likelihood of accidents, making your Cadillac a less risky option for insurance companies.

When shopping for Cadillac car insurance, highlighting these features can help secure more competitive rates and favorable coverage options, such as new car replacement insurance coverage.

Car Insurance Discounts from the Top Providers for Cadillac| Insurance Company | Available Discounts |

|---|---|

| Multi-policy discount, Safe driver discount, Good student discount, Anti-theft discount, Defensive driving discount, New car discount, Low mileage discount |

| Multi-policy discount, Safe driving bonus, Anti-lock brakes discount, Anti-theft discount, New car discount, Good student discount, Early signing discount | |

| Multi-policy discount, Loyalty discount, Anti-theft discount, Good driving discount, Good student discount, Paid-in-full discount, Low mileage discount | |

| Multi-policy discount, Safety features discount, Good student discount, Anti-theft discount, Paid-in-full discount, Green vehicle discount, Defensive driving discount | |

| Multi-policy discount, Good student discount, Safe driver discount, Anti-theft discount, Signal app discount, Homeowner discount, Professional group discount | |

| Multi-policy discount, Good student discount, Newly married discount, Newly retired discount, Safe driver discount, New car replacement discount, Anti-theft discount |

| Multi-policy discount, Safe driver discount, Continuous insurance discount, Good student discount, Anti-theft discount, Online quote discount, Paid-in-full discount | |

| Multi-policy discount, Safe driver discount, Good student discount, Anti-theft discount, Vehicle safety discount, Steer Clear discount (for young drivers), Drive Safe & Save discount | |

| Multi-policy discount, Driver training discount, Anti-theft discount, Vehicle recovery discount, Good student discount, Bundle & save discount, Paid-in-full discount |

| Multi-policy discount, Safe driver discount, Good student discount, Homeownership discount, Early quote discount, Continuous insurance discount, Green vehicle discount |

Compare RatesStart Now →

Exploring discounts can lower your insurance costs without sacrificing coverage. Many providers offer multi-policy discounts for bundling Cadillac insurance with home coverage, safe driver discounts, and affinity discounts for certain organizations. Total loss car insurance coverage ensures a fair payout if your vehicle is declared a total loss.

Insurers like AAA, Allstate, Amica, Auto-Owners, Farmers, Liberty Mutual, Progressive, State Farm, The Hartford, and Travelers offer discounts. To find affordable Cadillac car insurance, ask about available discounts when getting quotes. This can lead to savings while ensuring protection. Find cheap car insurance quotes by entering your ZIP code below.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Claiming Process for Cadillac Car Insurance

When it comes to Cadillac car insurance, understanding the claiming process can make a significant difference in how quickly and efficiently you receive support after an accident.

Following these steps ensures a smoother experience and helps you get back on the road with minimal stress.

- Report the Incident: Immediately contact your insurance provider to report the accident. Provide essential details to start the claims process.

- Document the Damage: Gather all necessary documentation, including photos of the damage, a copy of the police report (if available), and any witness statements.

- Submit the Claim: File your claim through your insurer’s digital platform or by speaking with a claims representative. Ensure that all required information and documents are included for a complete submission.

- Assessment and Evaluation: Your insurer will review the claim and assess the damage. An adjuster may be assigned to evaluate the situation and determine the extent of coverage.

- Receive Settlement and Repair Instructions: After approval, follow the instructions for repairs. Your insurer will process payments or reimburse you for repair costs based on your policy.

Efficiently navigating the Cadillac car insurance claiming process can ease the stress following an accident and ensure you get the support you need. Find out more by reading our article on Auto insurance claims.

Summary: Cadillac Car Insurance Options

Frequently Asked Questions

What is the lowest form of car insurance for a Cadillac?

The lowest form is liability-only coverage, which covers damage to others but not your Cadillac. Progressive offers rates starting at $58 per month for Cadillac models. Look at our how much does Cadillac SRX car insurance cost? for expanded insights.

How much would insurance be for a Cadillac CTS?

Insurance for a Cadillac CTS starts at around $58 per month for minimum coverage, while full coverage can go up to $178 per month depending on the provider. See if you’re getting the best deal on car insurance by entering your ZIP code below.

What is the lowest car insurance group for a Cadillac?

Cadillacs are usually in higher insurance groups due to their luxury status. However, safety features like automatic braking can lower your premium.

What is zero car insurance for a Cadillac?

“Zero car insurance” likely refers to zero-deductible insurance. This means you won’t pay out of pocket for claims, but premiums will be higher. Delve into the specifics in our article called, how much does Cadillac Escalade EXT car insurance cost?

What age is Cadillac car insurance the lowest?

Cadillac car insurance is typically lowest for drivers aged 50 to 60, as insurers consider them low-risk.

What age is Cadillac car insurance most expensive?

Car insurance for a Cadillac is most expensive for drivers under 25, as they are seen as higher risk.

Which type of car insurance is best for a Cadillac?

Full coverage is best for Cadillacs, including liability, collision, and comprehensive insurance for complete protection. Enhance your knowledge by reading our article how much does Cadillac Eldorado car insurance cost?

What is the best cover for Cadillac car insurance?

The best cover is full coverage, offering protection against both accidents and non-collision incidents like theft.

What car insurance is the most popular for Cadillac owners?

Popular insurers for Cadillac owners include State Farm, Progressive, and AAA, known for affordable and reliable coverage. Ready to find cheaper car insurance coverage? Enter your ZIP code below to begin.

What is the lowest level of car insurance for a Cadillac?

The lowest level is liability-only, which covers damages to others but not your own Cadillac. For a comprehensive understanding, consult our article on how much does Cadillac DTS car insurance cost?

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Mary Martin

Published Legal Expert

Mary Martin has been a legal writer and editor for over 20 years, responsible for ensuring that content is straightforward, correct, and helpful for the consumer. In addition, she worked on writing monthly newsletter columns for media, lawyers, and consumers. Ms. Martin also has experience with internal staff and HR operations. Mary was employed for almost 30 years by the nationwide legal publi...

Published Legal Expert

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.