Best Car Insurance After a DUI in Florida for 2024 (Top 10 Companies Ranked)

State Farm, AAA, and Farmers offer the best car insurance after a DUI in Florida, with rates starting at $36 per month. These providers offer competitive rates and coverage for high-risk drivers. Explore Florida DUI car insurance options to find affordable coverage that fits your needs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: Sep 18, 2024

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: Sep 18, 2024

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

2,934 reviews

2,934 reviewsCompany Facts

Full Coverage After a DUI in Florida

A.M. Best Rating

Complaint Level

Pros & Cons

2,934 reviews

2,934 reviews 2,903 reviews

2,903 reviewsCompany Facts

Full Coverage After a DUI in Florida

A.M. Best Rating

Complaint Level

Pros & Cons

2,903 reviews

2,903 reviewsState Farm offers the best car insurance after a DUI in Florida, with competitive rates starting at $36 per month. AAA and Farmers also provide excellent options, each catering to high-risk drivers with solid coverage.

These companies offer affordable and comprehensive coverage for those with a Florida DUI. Explore the top options to find the best insurance for your needs after a DUI.

Our Top 10 Company Picks: Best Car Insurance After a DUI in Florida| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 16% | B | Many Discounts | State Farm | |

| #2 | 14% | A | Online App | AAA |

| #3 | 12% | A | Local Agents | Farmers | |

| #4 | 18% | A+ | Customer Service | Amica | |

| #5 | 10% | A+ | Add-on Coverages | Allstate | |

| #6 | 20% | A+ | 24/7 Support | Erie |

| #7 | 9% | A+ | Innovative Programs | Progressive | |

| #8 | 17% | A | Student Savings | American Family | |

| #9 | 15% | A++ | Custom Plan | Geico | |

| #10 | 13% | A | Customizable Polices | Liberty Mutual |

Save on your car insurance by using our free comparison tool above to discover which company offers the lowest rates for the best car insurance after a DUI in Florida.

- State Farm is the top pick for DUI insurance in Florida, starting at $36/month

- AAA and Farmers offer strong coverage for high-risk drivers in Florida

- These providers excel in affordability and specialized DUI insurance options

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Many Discounts: State Farm insurance review & ratings show they provide discounts for the best car insurance after a DUI in Florida, helping you save on your policy.

- Bundling Discount: Provides a 16% bundling discount for the best car insurance after a DUI in Florida.

- Coverage Options: Offers a broad range of coverage options for the best car insurance after a DUI in Florida.

- Customer Satisfaction: High customer satisfaction rates for the best car insurance after a DUI in Florida.

Cons

- Bundling Discount: The 16% bundling discount may not be as high as competitors for the best car insurance after a DUI in Florida.

- High-Risk Options: Limited options for high-risk drivers for the best car insurance after a DUI in Florida.

- Premium Costs: Some coverage options may be more expensive for the best car insurance after a DUI in Florida.

#2 – AAA: Best for Online App

Pros

- Bundling Discount: Offers a 14% bundling discount for the best car insurance after a DUI in Florida.

- Online App: Provides an easy-to-use online app for managing the best car insurance after a DUI in Florida.

- Roadside Assistance: Known for excellent roadside assistance with the best car insurance after a DUI in Florida.

- Customer Satisfaction: High customer satisfaction ratings for the best car insurance after a DUI in Florida.

Cons

- Premiums: Based on AAA insurance reviews & ratings, their rates for high-risk drivers offer solid coverage for the best car insurance after a DUI in Florida.

- Coverage Options: Limited coverage options in some areas for the best car insurance after a DUI in Florida.

- Bundling Discount: The 14% bundling discount may not be as competitive for the best car insurance after a DUI in Florida.

#3 – Farmers: Best for Local Agents

Pros

- Bundling Discount: According to the Farmers insurance review & ratings, you can Get a 12% bundling discount for the best car insurance after a DUI in Florida.

- Local Agents: Provides access to knowledgeable local agents for the best car insurance after a DUI in Florida.

- Personalized Service: Known for personalized service with the best car insurance after a DUI in Florida.

- Coverage Variety: Offers a variety of coverage options for the best car insurance after a DUI in Florida.

Cons

- Bundling Discount: The 12% bundling discount is relatively low for the best car insurance after a DUI in Florida.

- Premiums: May have higher premiums for high-risk drivers for the best car insurance after a DUI in Florida.

- Online Management: Limited online management options for the best car insurance after a DUI in Florida.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

#4 – Amica: Best for Customer Service

Pros

- Bundling Discount: Offers an 18% bundling discount for the best car insurance after a DUI in Florida.

- Customer Service: Known for exceptional customer service for the best car insurance after a DUI in Florida.

- A+ Rating: Provides a high A+ rating from A.M. Best for the best car insurance after a DUI in Florida.

- Coverage Options: Offers a range of coverage options and discounts for the best car insurance after a DUI in Florida.

Cons

- Premiums: To see how Amica Insurance handles high-risk drivers, including those seeking the best car insurance after a DUI in Florida, check out the Amica insurance review & ratings.

- Agent Availability: Limited local agent availability for the best car insurance after a DUI in Florida.

- Discount Applicability: The 18% bundling discount may not apply to all drivers for the best car insurance after a DUI in Florida.

#5 – Allstate: Best for Add-on Coverages

Pros

- Bundling Discount: Offers a 10% bundling discount for the best car insurance after a DUI in Florida.

- Add-on Coverages: Provides a variety of add-on coverages for the best car insurance after a DUI in Florida.

- A+ Rating: An A+ rating from A.M. Best highlights why you should check out the Allstate insurance review and ratings for top DUI car insurance in Florida.

- Financial Stability: Known for strong financial stability for the best car insurance after a DUI in Florida.

Cons

- Bundling Discount: The 10% bundling discount is on the lower end for the best car insurance after a DUI in Florida.

- Premiums: May have higher premiums for high-risk drivers for the best car insurance after a DUI in Florida.

- Coverage Costs: Some coverage options can be more expensive for the best car insurance after a DUI in Florida.

#6 – Erie: Best for 24/7 Support

Pros

- Bundling Discount: Offers a 20% bundling discount for the best car insurance after a DUI in Florida.

- 24/7 Support: If you’re asking, “Does Erie Insurance offer non-owner car insurance coverage?” They offer 24/7 customer support, a crucial feature for finding the best car insurance after a DUI in Florida.

- A+ Rating: Provides a high A+ rating from A.M. Best for the best car insurance after a DUI in Florida.

- Competitive Rates: Offers competitive rates for high-risk drivers for the best car insurance after a DUI in Florida.

Cons

- Regional Availability: The 20% bundling discount may not be available in all regions for the best car insurance after a DUI in Florida.

- Limited Availability: Limited availability in some states for the best car insurance after a DUI in Florida.

- Coverage Flexibility: Some coverage options may be less flexible for the best car insurance after a DUI in Florida.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

#7 – Progressive: Best for Innovative Programs

Pros

- Bundling Discount: Offers a 9% bundling discount for the best car insurance after a DUI in Florida.

- Innovative Programs: Known for innovative programs and flexible coverage options for the best car insurance after a DUI in Florida.

- A+ Rating: Based on the Progressive insurance review & ratings, its A+ rating from A.M. Best makes it an excellent option for the best car insurance after a DUI in Florida.

- Competitive Rates: Offers competitive rates for high-risk drivers for the best car insurance after a DUI in Florida.

Cons

- Bundling Discount: The 9% bundling discount is relatively low for the best car insurance after a DUI in Florida.

- Customer Service: Some customers report mixed experiences with claims for the best car insurance after a DUI in Florida.

- Agent Options: May not offer as many local agent options for the best car insurance after a DUI in Florida.

#8 – American Family: Best for Student Savings

Pros

- Bundling Discount: Offers a 17% bundling discount for the best car insurance after a DUI in Florida.

- Student Savings: Provides student savings discounts for the best car insurance after a DUI in Florida.

- Coverage Options: Known for a wide range of coverage options for the best car insurance after a DUI in Florida.

- A Rating: A high A rating from A.M. Best highlights why it’s crucial to understand how to cancel American Family insurance company car insurance if you’re seeking top-rated coverage options.

Cons

- Bundling Discount: The 17% bundling discount may not be available for all drivers for the best car insurance after a DUI in Florida.

- Premiums: Premiums can be higher for high-risk drivers for the best car insurance after a DUI in Florida.

- Coverage Limitations: Some coverage options may be limited for the best car insurance after a DUI in Florida.

#9 – Geico: Best for Custom Plan

Pros

- Bundling Discount: Offers a 15% bundling discount for the best car insurance after a DUI in Florida.

- Customizable Plans: Provides customizable insurance plans for the best car insurance after a DUI in Florida.

- A++ Rating: Based on the Geico insurance review & ratings, the company earns an A++ rating from A.M. Best, making it a standout choice for car insurance after a DUI in Florida.

- Competitive Rates: Known for competitive rates for the best car insurance after a DUI in Florida.

Cons

- Bundling Discount: The 15% bundling discount may not apply to all drivers for the best car insurance after a DUI in Florida.

- Coverage Options: Coverage options can be limited for high-risk drivers for the best car insurance after a DUI in Florida.

- Customer Service: Some customers report mixed experiences with customer service for the best car insurance after a DUI in Florida.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Customizable Policies

Pros

- Bundling Discount: Offers a 13% bundling discount for the best car insurance after a DUI in Florida.

- Customizable Policies: Provides customizable policies for the best car insurance after a DUI in Florida.

- A Rating: For those exploring Liberty Mutual insurance review & ratings, Their high A rating from A.M. Best underscores their strong position for the best car insurance after a DUI in Florida.

- Coverage Variety: Known for a variety of coverage options for the best car insurance after a DUI in Florida.

Cons

- Bundling Discount: The 13% bundling discount is relatively low for the best car insurance after a DUI in Florida.

- Premiums: Higher premiums for some high-risk drivers for the best car insurance after a DUI in Florida.

- Customer Service: Customer service experiences can vary for the best car insurance after a DUI in Florida.

Cost Breakdown for Car Insurance After a DUI in Florida

Erie provides minimum coverage for $42 and full coverage for $107. American Family has higher rates, with minimum coverage at $105 and full coverage at $312.

Jeffrey Manola Licensed Insurance Agent

These options can help you secure the best car insurance for DUI drivers and ensure you get the best car insurance for someone with a DUI. Even with increased costs, you can still find cheap car insurance in Florida by comparing quotes from different providers.

Car Insurance After a DUI in Florida Discount Benefits

Finding discounts after a DUI can be challenging, but several insurance providers offer ways to lower your costs. Here are some options to consider:

- Safe Driver Discounts: Many insurers offer discounts for drivers who maintain a clean driving record following their DUI. This demonstrates responsible behavior and can lead to reduced premiums.

- Defensive Driving Course Discounts: Completing a state-approved defensive driving course can qualify you for lower rates. This course shows commitment to improving driving skills and safety.

- Bundling Discounts: Combining your auto insurance with other policies, such as home or renters insurance, often results in savings. This is a practical way to take advantage of multi-policy discounts.

- Good Student Discounts: For students who excel academically, many insurers offer discounts. Maintaining high grades can make you eligible for reduced rates, reflecting responsible behavior.

For those searching for the best car insurance companies for DUI, these discounts can help you find the best car insurance rates for DUI.

While it may be difficult to secure the best car insurance with a DUI, these strategies could make a difference.

Top Car Insurance Discounts for Florida Drivers With a DUI| Insurance Company | Defensive Driver Discount | Multi-Policy Discount | Multiple Vehicles | Usage-Based Discount | Good Student Discount |

|---|---|---|---|---|---|

| 5% | 10% | 8% | X | 10% |

| 10% | 20% | 15% | 25% | 10% | |

| 5% | 15% | 10% | 30% | 10% | |

| 5% | 15% | 10% | X | 10% | |

| 5% | 20% | 12% | X | 10% |

| 5% | 15% | 10% | X | 10% | |

| 5% | 15% | 10% | 30% | 15% | |

| 5% | 12% | 10% | 30% | 10% |

| 5% | 15% | 12% | 30% | 10% | |

| 5% | 20% | 15% | 30% | 15% |

Explore options from the best DUI auto insurance providers and consider leveraging the best University of Florida alumni discounts for car insurance if applicable.

Florida Report Card: Auto Insurance Discounts| Discount Name | Grade | Savings | Participating Providers |

|---|---|---|---|

| Multi-Policy | A | 25% | State Farm, Geico, Allstate |

| Safe Driver | A- | 20% | Progressive, Liberty Mutual, Geico |

| Good Student | B+ | 15% | State Farm, Allstate, Progressive |

| Anti-Theft Device | B | 10% | Progressive, Liberty Mutual, USAA |

| Defensive Driving | B- | 10% | Geico, State Farm, Nationwide |

| Pay-As-You-Go | C+ | 8% | Nationwide, Liberty Mutual, Allstate |

| Low Mileage | C | 7% | Geico, USAA, Allstate |

| Military/First Responder | C- | 5% | USAA, Geico, Farmers |

| Vehicle Safety Features | D+ | 4% | Liberty Mutual, Nationwide |

| New Vehicle | D | 3% | Progressive, Allstate |

By understanding and utilizing these discounts, you can manage the cost of car insurance after a DUI more effectively.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Insurance Claim Process for DUI Offenders in Florida

Navigating the insurance claim process after a DUI in Florida involves several key steps. Reporting the Incident is the first and crucial step; you should inform your insurer as soon as possible following the accident.

Florida Accidents & Claims per Year by City| City | Accidents per Year | Claims per Year |

|---|---|---|

| Jacksonville | 25,000 | 20,000 |

| Miami | 75,000 | 60,000 |

| Orlando | 35,000 | 28,000 |

| St. Petersburg | 18,000 | 14,000 |

| Tampa | 30,000 | 24,000 |

Next, you need to Submit Documentation, which includes providing essential documents such as police reports and medical records to support your claim. An Assessment follows, where an insurance adjuster evaluates the damages and determines what your policy will cover.

5 Most Common Auto Insurance Claims in Florida| Claim Type | Portion of Claims | Cost per Claim |

|---|---|---|

| Rear-End Collision | 35% | $3,800 |

| Fender Bender | 25% | $2,000 |

| Side-Impact Collision | 15% | $6,500 |

| Single Vehicle Accident | 10% | $4,500 |

| Theft Claim | 5% | $10,000 |

Finally, the Settlement phase occurs, where the insurer will offer a settlement based on their assessment and the terms of your policy. For those dealing with the cost of insurance with a DUI in Florida, it’s essential to understand how these steps impact your rates.

If you’re seeking cheap DUI insurance in Florida, be aware that the claims process and coverage details will affect the overall cost. Knowing what happens if you get a DUI and how it influences your claim can help you manage expectations and find the best DUI car insurance in Florida for your needs.

Embracing Digital Tools for Car Insurance After a DUI in Florida

Insurance companies now offer digital tools that simplify managing car insurance after a DUI in Florida. With these tools, you can quickly obtain car insurance quotes with a DUI by entering your details online, helping you find the best insurance for DUI.

Additionally, mobile apps and websites allow you to manage your policy and make payments with ease. Virtual customer support is also available to assist with any questions or issues.

These digital solutions are particularly useful for finding the best car insurance for drivers with bad credit in Florida, ensuring you can explore all available options for car insurance after a DUI in Florida

Car Insurance Coverage for DUI Offenders in Florida

When looking for the Best DUI car insurance in Florida, consider these essential coverage options to ensure you get the protection you need:

- Liability Coverage: This coverage is legally required and helps pay for damages or injuries you might cause in an accident.

- Comprehensive Coverage: This policy safeguards your vehicle against non-collision incidents, such as theft, vandalism, or damage from natural events.

- Collision Coverage: This type of insurance covers repairs for damage to your car resulting from collisions, whether with another vehicle or an object.

- Uninsured/Underinsured Motorist Coverage: Provides financial protection if you’re involved in an accident with a driver who either doesn’t have enough insurance or no insurance at all.

Choosing the Best DUI insurance involves understanding these coverage options and selecting a policy that meets your needs. Explore offerings from the Best insurance companies for DUI to find a plan that fits your circumstances and offers the best protection.

Florida Report Card: Auto Insurance Premiums| Category | Grade | Explanation |

|---|---|---|

| Vehicle Theft Rate | B- | Moderate theft rate, higher in urban areas |

| Traffic Density | A- | High congestion in cities like Miami, but manageable |

| Weather-Related Risks | C+ | Frequent severe weather events (hurricanes, flooding) |

| Average Claim Size | C | Higher repair costs and claims due to weather-related damages |

| Uninsured Drivers Rate | D | High rate of uninsured drivers, increasing premiums |

Additionally, consider seeking expert Florida DUI defense advice to navigate legal complexities and insurance requirements effectively.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

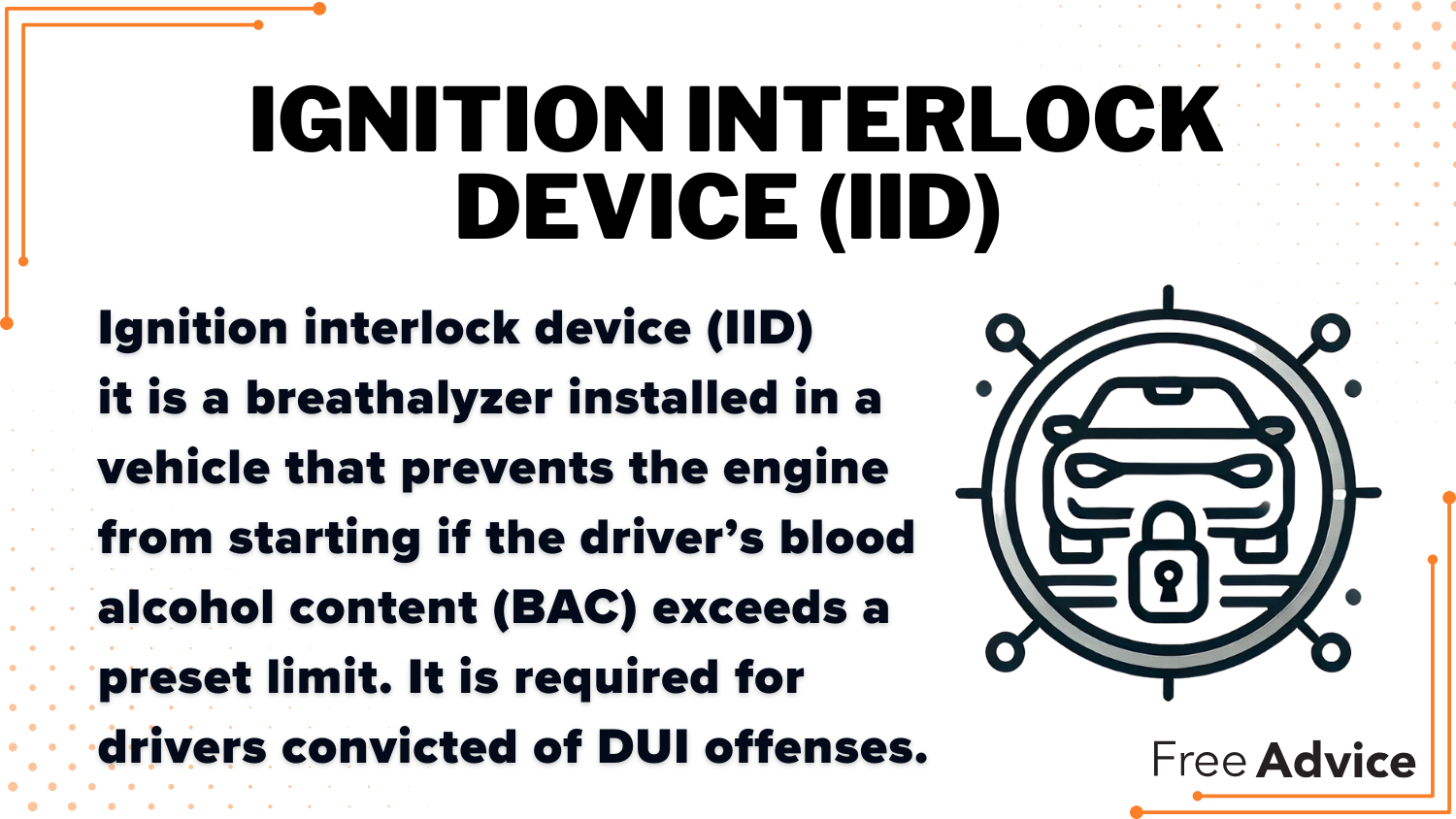

Car Insurance After a DUI in Florida With Focus on Vehicle Safety

When seeking DUI car insurance quotes in Florida, your vehicle’s safety features play a crucial role in determining your premiums. Insurers often evaluate features such as anti-lock brakes, which help prevent skidding during sudden stops, and airbags, which provide critical protection during collisions.

Anti-theft systems can also positively impact your rate by lowering the risk of vehicle theft, while electronic stability control enhances vehicle stability in slippery conditions.

Having these safety features can be beneficial in securing more favorable rates for DUI insurance in Florida. By improving your vehicle’s safety, you not only enhance your protection but also potentially reduce your insurance costs.

Understanding how these features affect Florida car insurance after a DUI can help you make informed decisions and potentially lower your premiums. Always stay informed about changes in drunk driving laws, as these can also influence your insurance rates and options.

Real Stories of Car Insurance After a DUI in Florida

Customer reviews often highlight several key factors when dealing with car insurance after a DUI. Customer service is frequently noted, with a focus on how well insurance providers manage claims and customer inquiries. Premium costs are also a significant concern, with reviews assessing the affordability and competitiveness of rates.

With a monthly rate of $36, State Farm stands out as the best car insurance after a DUI in Florida, providing flexible coverage options like liability, comprehensive, and collision to meet your needs.

Claims handling is another important aspect, with customers evaluating the efficiency and fairness of the claims process. Additionally, features like Electronic Stability Control are recognized for improving vehicle control in challenging conditions.

For those addressing Florida DUI insurance requirements, it’s essential to review different insurance companies for DUI drivers to find the most suitable option. Also, consider whether you should hire a DUI/DWI lawyer to navigate the complexities of your situation effectively.

Roadmap to Car Insurance After a DUI in Florida

Navigating car insurance after a DUI can be challenging, but following a clear step-by-step process can simplify the journey. Here’s how to secure the right coverage:

- Gather Your Documents: Start by collecting all necessary documents, including your DUI record, vehicle information, and personal details.

- Research Providers: Look for insurance companies that specialize in high-risk coverage. These providers are better equipped to handle cases involving DUIs.

- Compare Quotes: Obtain quotes from multiple insurers to understand the range of available rates and coverage options.

- Consider High-Risk Policies: Some insurers offer specialized policies designed for high-risk drivers, which might be more suitable for your needs.

- Choose a Provider: Select an insurance company that meets your coverage needs and fits your budget.

For those dealing with a Pennsylvania DUI, understanding these steps is especially important. Reading up on Pennsylvania DUI insurance requirements can help you find the best options and navigate the insurance process more effectively.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Florida DUI Laws and Their Effect on Car Insurance

In Florida, penalties for a DUI can have significant consequences. Fines may range from $500 to $2,000 for a first offense, and your license could be suspended for 180 days to a year.

Brandon Frady Licensed Insurance Agent

There is also the possibility of up to 6 months in jail and probation requirements in certain cases. Additionally, you might be required to complete mandatory DUI programs, which involve DUI education or treatment.

Understanding these penalties is crucial for managing your car insurance effectively. For valuable DUI trial tips and insights on how these legal issues can affect your insurance, make sure to read up on the relevant guidelines. This knowledge will help you navigate the challenges and possibly mitigate some of the impacts on your insurance rates.

Car Insurance After a DUI in Florida at a Glance

Finding the right car insurance after a DUI in Florida requires a comprehensive approach. Start by understanding the increased costs associated with both minimum and full coverage, and look into any available discounts.

Review various coverage options and take advantage of online tools and resources to simplify the process. For more detailed information on managing a Florida DUI, be sure to read these articles below:

- What defenses are there in a drunk driving case?

- How much does a DUI attorney cost?

- What is the criminal statute of limitations for a DUI/DWI?

These resources will help you better understand your options and legal implications. Consider safety features, read customer reviews, and explore strategies to lower your rates. Additionally, make sure you are familiar with DUI laws and penalties.

Reading up on DUI bail and bonds overview will help you navigate both legal and insurance challenges effectively. To meet legal requirements for car insurance and find the best rates, use our free quote comparison tool by entering your ZIP code below.

Frequently Asked Questions

Can I get car insurance in Florida if I have a DUI on my record?

Yes, you can still obtain car insurance in Florida with a DUI record; however, expect higher premiums due to being classified as a high-risk driver. If you have Out-of-State DUI warrants, it’s especially important to read up on this topic, as these warrants can further impact your insurance options and rates.

Will my car insurance rates increase after a DUI in Florida?

Yes, insurance rates typically increase after a DUI in Florida due to the higher risk associated with DUI convictions. Check out your car insurance options by inputting your ZIP code below and comparing which companies offer the lowest rates for the best car insurance after a DUI in Florida.

How long will a DUI affect my car insurance rates in Florida?

A DUI can affect your car insurance rates in Florida for 3 to 5 years, depending on the insurance company and your driving history.

Are there any car insurance companies in Florida that specialize in DUI coverage?

Yes, some insurance companies specialize in providing coverage for drivers with a DUI on their record, often offering tailored policies for high-risk drivers.

What factors do insurance companies consider when insuring drivers with a DUI in Florida?

Insurance companies assess factors like the DUI’s severity, your age, driving history, and the time since the conviction. To understand how these affect your insurance and the benefits of legal help, check out the advantages of hiring a drunk driving attorney.

Can I get my car insurance rates reduced after a DUI in Florida?

While it may be challenging, you can potentially reduce your rates by completing a DUI education or rehabilitation program, maintaining a clean driving record, and shopping around for quotes.

What types of coverage should I look for in a policy after a DUI in Florida?

Look for policies with essential coverage such as liability, collision, and comprehensive. Additional safety features and discounts for DUI education programs can also be beneficial.

What should I know about the insurance claim process after a DUI in Florida?

Report the incident to your insurer immediately, submit the necessary documentation, undergo an assessment by an insurance adjuster, and receive a settlement based on your policy terms. Looking for affordable car insurance? Start with our free comparison tool below to find the best car insurance after a DUI in Florida.

How can I use discounts to lower my car insurance rates after a DUI in Florida?

You might be able to get discounts for finishing DUI education programs, maintaining a clean driving record, or adding safety features to your car. For specific opportunities related to Florida drunk driving, it’s a good idea to consult your insurance provider. This ensures you don’t miss out on potential savings that could lower your rates.

How long does a DUI affect your insurance in Florida?

A DUI can affect your car insurance rates in Florida for several years. Typically, a DUI remains on your driving record for at least 3 to 5 years, which means higher premiums during that period.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.