By understanding and utilizing the discounts available from these top providers, you can significantly reduce your car insurance costs in Texas. Be sure to explore all your options and ask about these discounts when getting quotes to maximize your savings. Gain a deeper understanding through our “Best Anti Theft System Car Insurance Discounts.”

Cheap Car Insurance in Texas for 2024 (Save Big With These 10 Companies!)

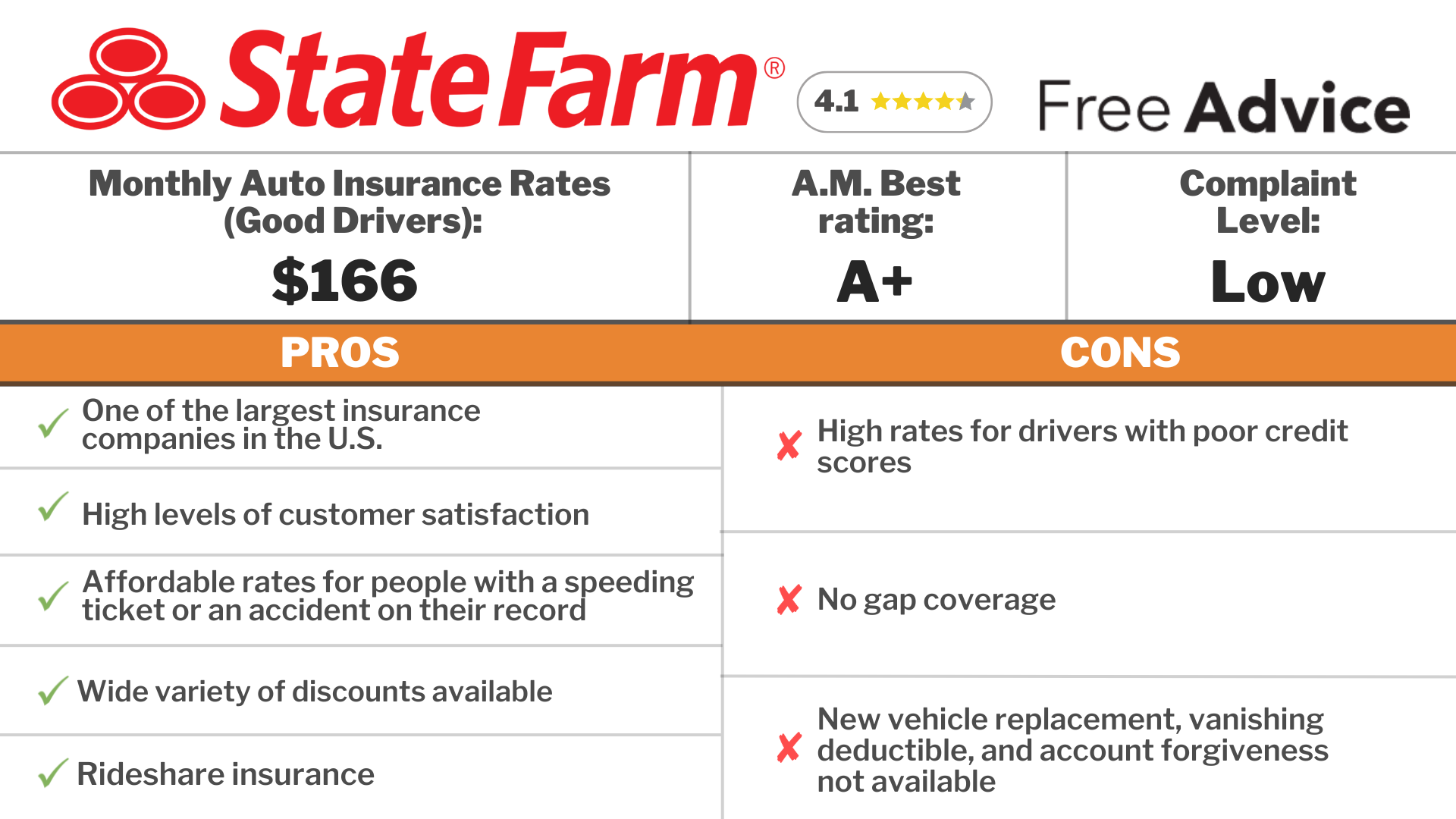

For cheap car insurance in Texas, State Farm, Geico, and Progressive are top picks, with rates starting at $33 per month. State Farm offers great value for young drivers, Geico is perfect for budget-conscious individuals, and Progressive caters to high-risk drivers. Compare their rates to find the best coverage.

UPDATED: Sep 11, 2024Fact Checked

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Sep 11, 2024

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: Sep 11, 2024

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

UPDATED: Sep 11, 2024Fact Checked

2nd Cheapest in Texas: Geico

Company Facts

Min Coverage in Texas

$39/moA.M. Best Rating

A++ (Superior)Complaint Level

MedPros & Cons

3rd Cheapest in Texas: Progressive

3rd Cheapest in Texas: Progressive

Company Facts

Min Coverage in Texas

$45/moA.M. Best Rating

A+Complaint Level

LowPros & Cons

Our Top 10 Company Picks: Cheap Car Insurance in Texas

Company Rank Monthly Rates Bundling Discount Best For Jump to Pros/Cons

#1 $33 17% Young Drivers State Farm

#2 $39 15% Budget-Friendly Geico

#3 $45 12% High Risk Progressive

#4 $46 15% Local Service Texas Farm Bureau

#5 $48 15% Value Seeker Mercury

#6 $51 14% Custom Coverage Farmers

#7 $54 10% Non-Standard The General

#8 $60 10% High-Risk Drivers Dairyland

#9 $66 10% Full Coverage Liberty Mutual

#10 $75 10% Family Plans Allstate

Compare RatesStart Now →

Ready to find cheaper car insurance coverage? Enter your ZIP code to begin.

Overview

Frequently Asked Questions

What factors affect the cost of car insurance in Texas?

Several factors can affect the cost of car insurance in Texas, including your age, driving record, type of car, coverage limits, and deductible amount. Insurance companies also consider factors like your location, credit score, and marital status when determining your premium.

Enhance your knowledge by reading our “Best Car Insurance for Drivers with a DUI in Texas.”

How can I find cheap car insurance in Texas?

To find cheap car insurance in Texas, you can start by comparing quotes from multiple insurance providers. Look for discounts that you may qualify for, such as safe driver discounts, multi-policy discounts, or discounts for taking a defensive driving course. It’s also important to review your coverage needs and adjust your deductible to find a balance between affordability and adequate protection.

What is the minimum car insurance requirement in Texas?

In Texas, the minimum car insurance requirement is liability coverage of at least $30,000 for bodily injury per person, $60,000 for bodily injury per accident, and $25,000 for property damage per accident. This is commonly referred to as 30/60/25 coverage.

Finding affordable car insurance doesn’t have to be a challenge. Enter your ZIP code into our free comparison tool to find the lowest prices in your area.

Is it possible to get car insurance in Texas with a bad driving record?

Yes, it is possible to get car insurance in Texas with a bad driving record. However, insurance companies may consider you a higher risk and charge higher premiums. It’s recommended to compare quotes from different providers to find the best coverage options and rates available to you.

What should I do if I’m involved in a car accident in Texas?

If you’re involved in a car accident in Texas, it’s important to first ensure your safety and the safety of others involved. Then, exchange insurance information with the other party and gather evidence, such as photos and witness statements. It’s crucial to report the accident to your insurance company as soon as possible and cooperate with any investigations or claims processes that follow.

Uncover more by delving into our article entitled “What is the Texas probate system like?“

What is the cheapest car insurance in Texas?

The cheapest car insurance in Texas typically depends on factors like your driving history, location, and the type of coverage you need. Companies like Geico, State Farm, and USAA (for military members) are often among the most affordable options. Comparing quotes from multiple providers is the best way to find the cheapest rate.

How much is car insurance per month in Texas?

The average cost of car insurance per month in Texas is around $110 to $140 for full coverage, but this can vary based on factors like age, driving record, and the type of vehicle.

What is the basic car insurance in Texas?

The basic car insurance in Texas is liability insurance, which includes bodily injury liability and property damage liability. The state minimum requirements are $30,000 per person for bodily injury, $60,000 per accident for bodily injury, and $25,000 for property damage.

See how much you’ll pay for car insurance by entering your ZIP code into our free comparison tool.

Why is car insurance so high in Texas?

Car insurance is high in Texas due to factors like the large population, high number of uninsured drivers, frequent severe weather (such as hailstorms and hurricanes), and higher rates of accidents and claims.

Get a better grasp by checking out our article titled “Best Car Insurance for Veterans in Texas.”

Is it illegal to not have car insurance in Texas?

Yes, it is illegal to drive without car insurance in Texas. The state requires all drivers to have at least the minimum liability coverage. Driving without insurance can result in fines, license suspension, and vehicle impoundment.

What is the cheapest car insurance in Texas full coverage?

The cheapest full coverage car insurance in Texas varies by provider, but companies like Geico, State Farm, and Progressive are often known for offering competitive rates. Full coverage includes liability, collision, and comprehensive insurance.

What car insurance is mandatory in Texas?

The mandatory car insurance in Texas is liability insurance. This includes bodily injury liability and property damage liability, with minimum coverage limits of 30/60/25.

How much is auto insurance in Texas?

Expand your understanding with our article called “Sealing Juvenile Criminal Records in Texas.”

Is Texas a no-fault state?

No, Texas is not a no-fault state. It operates under a tort system, meaning the driver who is at fault in an accident is responsible for paying for the damages.

What is the minimum full coverage insurance in Texas?

Texas doesn’t mandate full coverage insurance, but the minimum coverage includes liability insurance with limits of 30/60/25. Full coverage typically adds collision and comprehensive coverage.

Do you need a driver’s license to get car insurance in Texas?

Yes, you generally need a valid driver’s license to get car insurance in Texas. However, some insurers may offer coverage for drivers with a learner’s permit or non-owner policies.

Can you go to jail for no insurance in Texas?

While you won’t typically go to jail for not having insurance, repeated offenses can result in fines, license suspension, and even jail time in some cases, particularly if you cause an accident while uninsured.

For additional insights, refer to our “How To Cancel Texas Farm Bureau Underwriters.”

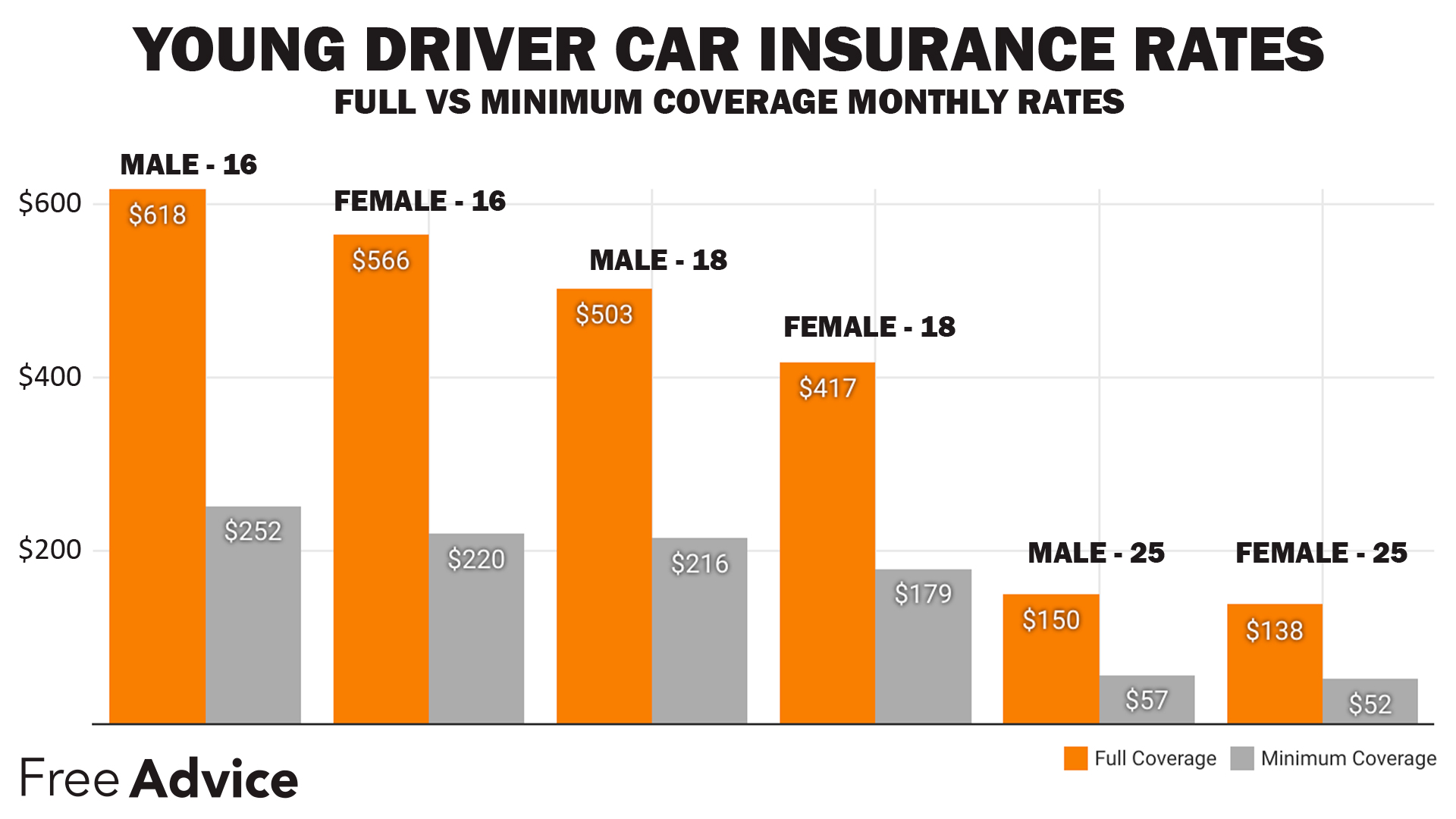

How much is car insurance in Texas for a 25 year old?

For a 25-year-old driver, car insurance in Texas typically costs between $1,000 and $1,500 per year for full coverage, depending on factors like driving history and location.

Is insurance cheaper in Texas?

Insurance rates in Texas are generally higher than the national average due to various factors, including population density and weather-related risks.

How much does car insurance cost per month in Texas?

On average, car insurance costs around $110 to $140 per month in Texas for full coverage, though rates vary based on individual circumstances.

Who has the best car insurance in Texas?

The best car insurance in Texas depends on individual needs, but companies like USAA, State Farm, and Geico are often rated highly for customer satisfaction, affordability, and coverage options.

Gain deeper understanding through our article entitled “Texas Wills, Living Wills & Living Trusts.”

What are the most affordable car insurance companies in Texas?

Companies like Geico, State Farm, and Progressive often offer some of the most affordable rates in Texas.

How can I lower my car insurance premiums in Texas?

You can lower your premiums by maintaining a clean driving record, increasing your deductible, and bundling insurance policies.

Do I need full coverage on my car in Texas?

Full coverage is not legally required in Texas, but if you have a car loan or lease, your lender may require it. Full coverage is advisable for newer or more valuable vehicles to protect against a wider range of risks.

What documents do I need for car insurance in Texas?

To get car insurance in Texas, you’ll typically need your driver’s license, vehicle registration, and proof of prior insurance if applicable. You may also need to provide personal information and details about your vehicle.

Find out more by reading our article titled “How To Cancel Texas Fair Plan Association Car Insurance.“

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.