Cheap Car Insurance in Iowa for 2024 (Save Big With These 10 Companies!)

Cheap car insurance in Iowa starts at $16/month from top providers like State Farm, Progressive, and Farmers. State Farm offers the lowest rates, Progressive provides flexible coverage, and Farmers is great for bundling discounts. Compare these cheapest providers for affordable rates and coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Sep 18, 2024

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: Sep 18, 2024

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

Company Facts

Min. Coverage in Iowa

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage in Iowa

A.M. Best Rating

Complaint Level

Pros & Cons

These companies offer a range of coverage at affordable prices, ensuring Iowa drivers can find the right balance between cost and protection. Broaden your knowledge with our article named “Save Money by Comparing Online Car Insurance Quotes.”

Our Top 10 Company Picks: Cheap Car Insurance in Iowa

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $16 B Wide Availability State Farm

#2 $18 A+ Competitive Pricing Progressive

#3 $19 A Strong Coverage Farmers

#4 $20 A++ Low Rates Geico

#5 $21 A+ Customer Service Amica

#6 $22 A+ Regional Strength Erie

#7 $23 A Flexible Options American Family

#8 $23 A++ Diverse Discounts Travelers

#9 $28 A Comprehensive Coverage Liberty Mutual

#10 $31 A+ Extensive Network Allstate

Need the cheapest car insurance possible? Enter your ZIP code into our free comparison tool to find the most affordable rates for your vehicle.

- Cheap car insurance in Iowa caters to drivers seeking affordable coverage options

- Iowa drivers can find flexible plans and discounts with top insurers like Progressive

- State Farm, the top pick, offers a strong balance of coverage and savings

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

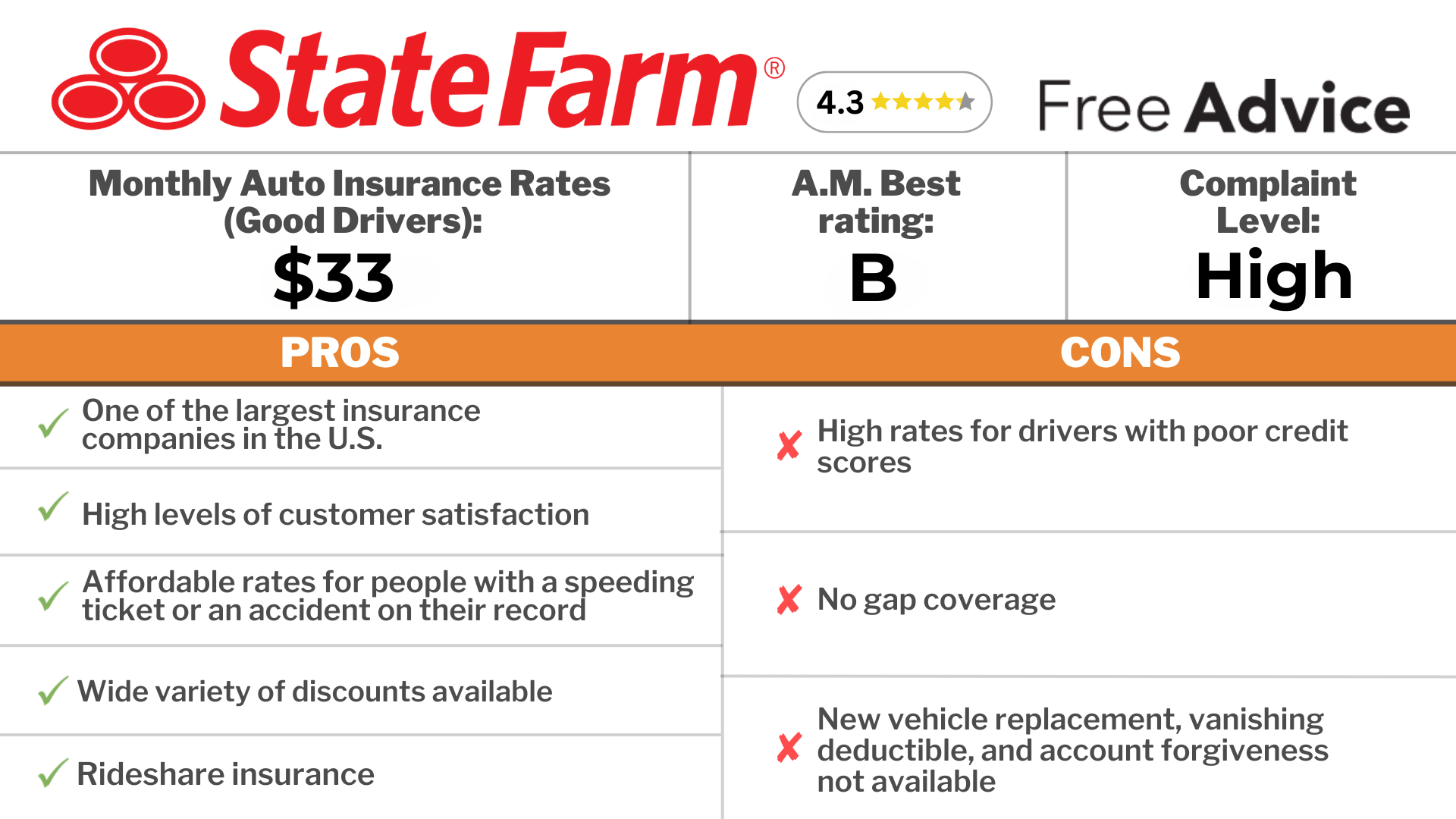

#1 – State Farm: Best for Wide Availability

Pros

- Affordable Rates: State Farm offers some of the cheapest car insurance in Iowa, with rates as low as $16 per month, making it a top choice for budget-conscious drivers.

- Wide Availability: State Farm offers accessible car insurance for drivers across Iowa. See our State Farm insurance review & ratings for details.

- Solid Customer Support: Insurance for Iowa car owners through State Farm includes a reliable claims process and a wide network of local agents to assist with any concerns.

Cons

- Limited Discounts: Compared to other providers, State Farm’s car insurance discounts are less comprehensive, which might reduce potential savings for drivers.

- B Rating by A.M. Best: While offering cheap car insurance in Iowa, the company’s B rating may raise concerns about financial stability for long-term policyholders.

#2 – Progressive: Best for Competitive Pricing

Pros

- Competitive Pricing: Progressive offers low car insurance rates in Iowa, starting at $18 per month, ideal for drivers looking to save on their premiums.

- Cost-Saving Tools: Progressive’s Snapshot program helps safe drivers save more. Check our Progressive insurance review & ratings for insights.

- Wide Range of Coverage Options: Progressive provides a variety of coverage levels, allowing car owners in Iowa to customize their insurance policies.

Cons

- High Premiums for High-Risk Drivers: While offering cheap car insurance in Iowa, Progressive’s rates can significantly increase for drivers with accidents or violations on their record.

- Customer Service Complaints: Some insurance for Iowa car owners may experience slower-than-average customer service response times, especially during claims.

#3 – Farmers: Best for Strong Coverage

Pros

- Comprehensive Coverage: Farmers is known for offering strong car insurance coverage in Iowa, including options for collision, comprehensive, and liability protection.

- Unique Policy Add-Ons: Insurance for car owners through Farmers includes specialty options like accident forgiveness and rideshare coverage, catering to various needs.

- Financial Security: With an A rating from A.M. Best, provides reliable financial security for Iowa car insurance policyholders. Explore our Farmers insurance review & ratings for more.

Cons

- Higher Rates for Add-Ons: While offering strong coverage, car insurance for Iowa owners may become more expensive if you choose multiple add-ons, making it less budget-friendly.

- Limited Discounts: Farmers’ discounts for car insurance are not as competitive as other Iowa providers, potentially limiting savings opportunities.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

#4 – Geico: Best for Low Rates

Pros

- Low Rates: Geico offers rates starting at $20/month. Refer to our Geico insurance review & ratings for details.

- Top Financial Strength: With an A++ rating from A.M. Best, Geico provides peace of mind to car insurance policyholders in Iowa regarding financial stability.

- User-Friendly Mobile App: Geico’s app makes managing car insurance for Iowa drivers simple, with easy access to ID cards, billing, and claims information.

Cons

- Fewer Local Agents: Car insurance for Iowa owners through Geico may feel impersonal due to limited access to local agents compared to other providers.

- Customer Service Variability: While Geico offers affordable insurance, some car owners in Iowa have reported mixed experiences with their customer service response times.

#5 – Amica: Best for Customer Service

Pros

- Outstanding Customer Service: Amica is known for top-tier customer service, ensuring Iowa car insurance owners have a positive experience during claims or inquiries.

- Competitive Rates: Amica provides car insurance starting at $21/month. See our Amica homeowners insurance review for more info.

- Dividend Policies: Amica offers a unique dividend policy option, returning a portion of paid premiums to car insurance policyholders in Iowa.

Cons

- Limited Availability: Amica’s car insurance options may not be as widely available in certain rural parts of Iowa, potentially limiting access for some drivers.

- No Online Tools for Policyholders: While their service is strong, insurance for car owners in Iowa through Amica lacks robust online tools and app-based support compared to competitors.

#6 – Erie: Best for Regional Strength

Pros

- Regional Expertise: Erie is a strong regional player, offering cheap car insurance in Iowa with tailored policies designed for local driving conditions.

- Accident Forgiveness: Insurance for Iowa car owners through Erie includes accident forgiveness, protecting policyholders from rate hikes after their first at-fault accident.

- Competitive Rates: Starting at $22 per month, Erie offers budget-friendly car insurance in Iowa without compromising on coverage quality. Uncover more insights in our Erie homeowners insurance review.

Cons

- Limited Availability: As a regional provider, Erie’s car insurance for Iowa owners may not be available in all areas, especially for those living in more remote locations.

- Fewer Discounts: Erie provides fewer discount options compared to larger companies, which may limit savings for drivers in Iowa seeking cheap insurance.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

#7 – American Family: Best for Flexible Options

Pros

- Flexible Plans: American Family offers customizable policies for Iowa drivers. Check our American Family homeowners insurance review.

- Strong Financial Standing: With an A rating from A.M. Best, American Family provides reliable insurance for Iowa car owners, ensuring policyholder trust.

- Safe Driver Discounts: Insurance for car owners in Iowa through American Family comes with various discount opportunities, especially for safe drivers.

Cons

- Higher Base Rates: While American Family offers flexibility, its starting rate of $23 per month is higher than some competitors for cheap car insurance in Iowa.

- Limited Digital Tools: Insurance for Iowa car owners through American Family lacks the advanced digital tools and mobile app features that other companies provide.

#8 – Travelers: Best for Diverse Discounts

Pros

- Diverse Discounts: Travelers provides savings through bundled home and car insurance. See our Travelers homeowners insurance review for more.

- Comprehensive Coverage Options: Travelers provides a wide range of coverage choices, making it easy for Iowa car owners to find policies that suit their needs.

- Strong Financial Stability: With an A++ rating from A.M. Best, Travelers offers car insurance policyholders in Iowa security and trust in their insurance provider.

Cons

- Higher Starting Rates: Travelers starts at $23 per month for car insurance in Iowa, which may be more expensive than some competitors offering cheaper rates.

- Slower Claims Process: Some Iowa car insurance owners have reported that the claims process with Travelers can be slower than expected, which could be inconvenient.

#9 – Liberty Mutual: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Liberty Mutual offers one of the most extensive car insurance coverage options in Iowa, including unique add-ons like new car replacement and better car replacement.

- Multiple Discounts: Liberty Mutual offers a wide range of car insurance discounts. Read our Liberty Mutual insurance review & ratings for details.

- Financial Security: With an A rating from A.M. Best, Liberty Mutual is a solid option for car insurance in Iowa, ensuring financial reliability for policyholders.

Cons

- Higher Premiums: Liberty Mutual’s starting rate of $28 per month makes it one of the more expensive options for cheap car insurance in Iowa.

- Limited Local Agent Network: Insurance for Iowa car owners may feel less personal, as Liberty Mutual has fewer local agents available for in-person support.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

#10 – Allstate: Best for Extensive Network

Pros

- Extensive Network: Allstate provides a robust network of agents throughout Iowa, making car insurance easily accessible and personalized for drivers.

- Innovative Tools: Allstate’s Drivewise rewards Iowa drivers for safe habits with discounts. Check our Allstate Insurance review and ratings for more details.

- Solid Financial Strength: With an A+ rating from A.M. Best, Allstate ensures that car insurance policyholders in Iowa can trust the company’s financial stability.

Cons

- Higher Premiums: Allstate’s starting rate of $31 per month is one of the highest for cheap car insurance in Iowa, which may not appeal to budget-conscious drivers.

- Limited Discount Availability: Insurance for car owners in Iowa may have fewer discount options compared to other providers, making it less attractive for drivers seeking additional savings.

Iowa Car Insurance Monthly Rates by Provider and Coverage Level

Finding affordable car insurance in Iowa is essential for drivers looking to balance cost and coverage. This guide compares monthly rates for minimum and full coverage from top providers in Iowa, helping you make an informed decision based on your budget and needs.

Iowa Car Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

$31 $126

$23 $95

$21 $87

$22 $88

$19 $82

$20 $81

$28 $116

$18 $75

$16 $65

$23 $92

Iowa Car Insurance Discounts by Provider

Insurance Company Available Discounts

Multi-Policy, Safe Driver, Good Student, Anti-Theft, Homeowner

Multi-Policy, Safe Driver, Good Student, Vehicle Safety Features, Loyalty

Multi-Policy, Safe Driver, Good Student, Homeowner, Loyalty

Multi-Policy, Safe Driver, Good Student, Anti-Theft, Homeowner

Multi-Policy, Safe Driver, Good Student, Anti-Theft, Homeowner

Multi-Policy, Safe Driver, Good Student, Military, Anti-Theft

Multi-Policy, Safe Driver, Good Student, Vehicle Safety Features, Homeowner

Multi-Policy, Snapshot, Safe Driver, Homeowner, Student

Safe Driver, Multi-Policy, Good Student, Defensive Driving, Vehicle Safety Features

Multi-Policy, Safe Driver, Good Student, Homeowner, Hybrid/Electric Vehicle

– Iowa Car Insurance Discounts by Provider

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Understanding Car Insurance in Iowa

Before jumping into the search for cheap car insurance in Iowa, it’s important to have a good understanding of how car insurance works in the state. Car insurance provides financial protection in case of accidents, theft, or damage to your vehicle. It is a legal requirement in Iowa to have liability insurance, which covers the cost of injuries or property damage you may cause to others in an accident.

Iowa Accidents & Claims per Year by City

City Accidents per Year Claims per Year

Ames 1,100 850

Ankeny 1,000 750

Cedar Rapids 2,500 1,800

Davenport 2,200 1,600

Des Moines 3,200 2,300

Dubuque 1,200 900

Iowa City 1,700 1,250

Sioux City 1,800 1,300

Waterloo 1,400 1,000

West Des Moines 1,500 1,100

When it comes to car insurance, it’s essential to know the basics. Car insurance is divided into different types of coverage. Liability insurance is the minimum required coverage and protects others if you are at fault in an accident. This coverage helps pay for the medical expenses, property damage, and legal fees of the affected party.

State Farm offers the best combination of affordability and coverage options for car insurance in Iowa.

Comprehensive insurance covers damage to your vehicle from non-collision events such as theft, vandalism, or natural disasters. Collision insurance covers damage to your vehicle in case of an accident where you are at fault. These additional coverages provide extra protection for your vehicle and peace of mind. Unlock additional information in our “Pay-Per-Mile Insurance Coverage.”

The Basics of Car Insurance

Liability insurance is the foundation of car insurance coverage. It helps protect you financially if you cause an accident that results in bodily injury or property damage to others. In Iowa, the minimum liability coverage limits are set at 25/50/25. This means you need at least $25,000 for bodily injury liability per person, $50,000 for bodily injury liability per accident, and $25,000 for property damage liability per accident.

Comprehensive insurance, on the other hand, covers a wide range of non-collision events that could damage your vehicle. For example, if your car is stolen, comprehensive insurance will help cover the cost of replacing it. If your vehicle is damaged due to vandalism or a natural disaster like a hailstorm, comprehensive insurance will assist in covering the repair costs. This coverage provides valuable protection against unexpected events that are beyond your control.

Collision insurance is designed to cover the cost of repairs or replacement if your vehicle is damaged in an accident where you are at fault. Whether it’s a fender bender or a more severe collision, collision insurance ensures that you won’t be left with a hefty repair bill. This coverage is particularly important if you have a newer or more expensive vehicle, as the repair costs can be substantial.

State Requirements for Car Insurance in Iowa

Iowa law requires drivers to have liability insurance with minimum coverage limits of 25/50/25. These minimum requirements provide a basic level of protection, but many drivers choose to purchase additional coverage for added peace of mind.

While the state minimums are a starting point, it’s important to consider your individual needs and circumstances when selecting car insurance. Factors such as the value of your vehicle, your driving history, and your financial situation should all be taken into account.

Justin Wright Licensed Insurance Agent

It’s worth noting that higher coverage limits and additional coverage options may increase your premium, but they can also provide greater protection and financial security in the event of an accident.

When shopping for car insurance in Iowa, it’s essential to compare quotes from multiple insurers to ensure you are getting the best coverage at the most competitive price. Understanding the different types of coverage and the state requirements will help you make an informed decision and find the car insurance policy that suits your needs.

Factors Influencing Car Insurance Rates in Iowa

Several factors can impact the cost of car insurance in Iowa. Understanding these factors can help you find ways to lower your premiums.

When it comes to car insurance rates in Iowa, there are a multitude of factors that can influence how much you will pay. While some of these factors may seem obvious, others may surprise you. Let’s take a closer look at some of the key factors that insurance companies take into consideration when determining your rates.

Age and Driving Experience

One of the most significant factors that can affect your car insurance rates is your age and driving experience. It’s no secret that younger and inexperienced drivers tend to pay higher insurance premiums. This is because insurance companies consider them to be higher risk due to their lack of experience on the road.

On the other hand, older drivers with clean driving records often enjoy lower rates as they are perceived as more responsible and less likely to engage in risky driving behaviors.

However, it’s important to note that age is not the sole determining factor. Even if you are a young driver, you can still take steps to lower your premiums. Completing a defensive driving course or maintaining a good academic record can demonstrate to insurance companies that you are a responsible driver, potentially resulting in lower rates.

Vehicle Make and Model

Another factor that insurance companies consider when calculating your rates is the make and model of your vehicle. It’s no secret that certain cars are more expensive to insure than others. Generally, expensive or high-performance cars are more expensive to insure due to the higher cost of repairs and increased risk of theft.

However, it’s not just luxury or sports cars that fall into this category. Even factors such as the safety features of your vehicle can impact your insurance rates. Cars equipped with advanced safety features, such as anti-lock brakes, airbags, and collision avoidance systems, may qualify for discounts on your premiums.

Driving Record and Claims History

Perhaps one of the most obvious factors that can influence your car insurance rates is your driving record and claims history. Insurance companies take into account your past driving behavior as an indicator of your future risk. Having a clean driving record with no accidents or traffic violations can help you secure lower insurance rates.

5 Common Car Insurance Claims in Iowa

Claim Type Portion of Claims Cost per Claim

Collision 35% $4,000

Comprehensive 25% $1,500

Personal Injury 15% $10,000

Property Damage 20% $3,500

Uninsured Motorist 5% $8,000

On the other hand, if you have a history of accidents or claims, insurance companies may consider you to be a higher risk driver. This can result in higher premiums as they anticipate a higher likelihood of having to pay out for future claims. It’s worth noting that even if you have a less-than-perfect driving record, there are still steps you can take to potentially lower your rates.

Some insurance companies offer accident forgiveness programs, which means that your rates may not increase after your first accident. Additionally, taking defensive driving courses or installing telematics devices in your vehicle to monitor your driving behavior can also help demonstrate to insurance companies that you are actively working to improve your skills and reduce your risk on the road.

As you can see, there are several factors that can influence car insurance rates in Iowa. By understanding these factors and taking proactive steps to mitigate risk, you can potentially lower your premiums and save money in the long run. Access supplementary details in our “Telematics Insurance Coverage.”

How to Find Cheap Car Insurance in Iowa

Now that you have a better understanding of car insurance in Iowa and the factors influencing rates, let’s explore some tips on finding cheap car insurance.

When it comes to finding affordable car insurance in Iowa, it’s important to do your research and explore all your options. By taking the time to compare different insurance providers and understand the discounts available, you can save a significant amount of money on your premiums.

Comparison Shopping for Car Insurance

One of the most effective ways to find cheap car insurance in Iowa is to shop around and compare quotes from different insurance providers. Take advantage of online comparison tools and request quotes from multiple companies to find the best rates.

When comparing quotes, it’s important to consider not only the price but also the coverage and customer service provided by each company. Make sure you understand the terms and conditions of each policy and what is included in the coverage. This will help you make an informed decision and choose the best car insurance for your needs.

Taking Advantage of Discounts

Insurance companies offer various discounts that can help you save money on your premiums. These discounts may include safe driver discounts, bundling multiple policies, or having certain safety features installed in your vehicle. Be sure to inquire about all available discounts when obtaining quotes.

Iowa Report Card: Car Insurance Premiums

Category Grade Explanation

Vehicle Theft Rate B Below national average, but still present

Traffic Density A Low traffic density, fewer accidents

Weather-Related Risks C Severe weather increases claim risks

Average Claim Size B+ Moderate, rising due to repair costs

Uninsured Drivers Rate A- Lower-than-average uninsured driver rate

Safe driver discounts are often given to individuals who have a clean driving record and have not been involved in any accidents or received any traffic violations. By demonstrating responsible driving habits, you can qualify for lower premiums and enjoy the benefits of being a safe driver.

Bundling multiple policies, such as car insurance and homeowner’s insurance, with the same company can also lead to significant savings. Insurance providers often offer discounts for customers who choose to insure multiple assets with them. So, if you’re a homeowner, it’s worth considering bundling your car insurance with your homeowner’s insurance to maximize your savings.

Iowa Report Card: Car Insurance Discounts

Discount Name Grade Savings Participating Providers

Anti-Theft B+ 15% Nationwide, State Farm, Liberty Mutual, Allstate

Defensive Driving B 10% State Farm, Geico, Nationwide, Progressive

Good Student A- 20% Allstate, State Farm, Geico, Nationwide, USAA

Low Mileage B 10% Progressive, Nationwide, State Farm

Loyalty A- 15% State Farm, Allstate, USAA

Multi-Policy A 25% Allstate, State Farm, Nationwide, Progressive, USAA

New Car B+ 15% State Farm, Progressive, Nationwide

Paperless Billing B 10% Nationwide, Progressive, Geico

Safe Driver A 30% Allstate, Geico, Progressive, State Farm, USAA

Vehicle Safety B+ 10% State Farm, Nationwide, Progressive

Additionally, some insurance companies offer discounts for vehicles equipped with certain safety features, such as anti-lock brakes, airbags, or anti-theft devices. These features not only enhance the safety of your vehicle but can also help reduce the risk of theft or accidents, making you eligible for lower premiums.

Maintaining a Clean Driving Record

Avoiding accidents and traffic violations is not only critical for your safety but also for keeping your insurance rates low. Maintaining a clean driving record demonstrates responsibility and can qualify you for lower premiums.

By following traffic laws, practicing defensive driving techniques, and being mindful of your surroundings, you can minimize the risk of accidents and traffic violations. This will not only help keep you safe on the road but can also lead to long-term savings on your car insurance premiums.

It’s important to note that even a single accident or traffic violation can have a significant impact on your insurance rates. So, it’s crucial to prioritize safe driving habits and avoid any actions that could potentially lead to an increase in your premiums.

State Farm offers the best combination of affordability and coverage for car insurance in Iowa, making it the top choice for drivers.

In conclusion, finding cheap car insurance in Iowa requires diligent research, comparison shopping, and taking advantage of available discounts. By exploring different insurance providers, understanding the discounts offered, and maintaining a clean driving record, you can secure affordable car insurance that meets your needs without breaking the bank.

Enhance your comprehension with our “Best PIP Car Insurance Coverage.”

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Top Affordable Car Insurance Providers in Iowa

When it comes to car insurance in Iowa, finding a provider that offers competitive rates is essential. While the cost of car insurance varies depending on individual circumstances, there are several insurance providers in Iowa that are known for their affordable options.

State Farm

By doing your research and carefully assessing your coverage needs, you can find affordable car insurance that provides the protection you require at a price that fits your budget. Obtain further insights from our “Types of Car Insurance They Offer.”

Frequently Asked Questions

What factors affect the cost of car insurance in Iowa?

Several factors can affect the cost of car insurance in Iowa, including your age, driving record, type of car, coverage limits, and deductible amount. Insurance companies also consider factors such as your location, annual mileage, and credit history when determining your premium.

For a comprehensive understanding, consult our article titled “How Moving to Iowa Will Affect Your Health Insurance.”

Are there any specific minimum car insurance requirements in Iowa?

Yes, Iowa law requires drivers to carry liability insurance with minimum coverage limits of 20/40/15. This means you must have at least $20,000 in bodily injury liability coverage per person, $40,000 in bodily injury liability coverage per accident, and $15,000 in property damage liability coverage.

How can I find cheap car insurance in Iowa?

To find cheap car insurance in Iowa, you can consider several strategies. First, compare quotes from multiple insurance companies to find the best rates. You can also look for discounts such as multi-policy discounts, safe driving discounts, or discounts for installing safety features in your car. Additionally, maintaining a clean driving record and opting for higher deductibles can help lower your premiums.

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code.

What are the consequences of driving without car insurance in Iowa?

Driving without car insurance in Iowa is illegal and can result in severe consequences. If caught, you may face fines, license suspension, and even potential jail time. Additionally, driving without insurance can leave you financially vulnerable in case of an accident, as you would be personally responsible for covering any damages or injuries.

How can I lower my car insurance premium in Iowa?

To lower your car insurance premium in Iowa, consider increasing your deductibles, maintaining a clean driving record, and taking advantage of available discounts. Additionally, bundling your auto insurance with other types of insurance, such as home or renters, can also reduce your overall premium.

Enhance your knowledge by reading our “Best Car Insurance for Safe Drivers in Iowa.”

Does my age affect my car insurance rates in Iowa?

Yes, your age affects your car insurance rates in Iowa. Younger drivers typically face higher rates due to their higher risk profile, while older drivers may benefit from lower rates as they are often considered more experienced and less risky.

Can bundling policies help me save on car insurance in Iowa?

Yes, bundling policies can help you save on car insurance in Iowa. Many insurance providers offer discounts if you combine multiple types of insurance, such as auto and home insurance, into a single policy.

Affordable car insurance rates are just a click away. Enter your ZIP code into our free quote tool to find the best policy for you.

What is the difference between liability and full coverage insurance in Iowa?

Liability insurance covers damages to other people and their property if you are at fault in an accident, while full coverage insurance includes liability coverage as well as collision and comprehensive coverage, protecting your own vehicle from a wider range of damages.

Are there any specific car models that are cheaper to insure in Iowa?

Yes, specific car models are cheaper to insure in Iowa. Generally, vehicles with lower repair costs, higher safety ratings, and less powerful engines tend to have lower insurance premiums.

Uncover more by delving into our article entitled “Best Car Insurance for Drivers with Speeding Ticket in Iowa.”

How often should I shop around for new car insurance quotes in Iowa?

You should shop around for new car insurance quotes in Iowa at least once a year. Regularly comparing quotes can help ensure you’re getting the best rate and taking advantage of any new discounts or offers.

What are the benefits of getting multiple car insurance quotes in Iowa?

Getting multiple car insurance quotes in Iowa allows you to compare rates and coverage options from different providers, helping you find the most affordable policy that meets your needs and potentially uncover better coverage options.

Can I switch insurance providers without losing coverage?

Yes, you can switch insurance providers without losing coverage. To ensure continuous coverage, overlap the start dates of your new policy with the end date of your old policy, or cancel your old policy only after your new policy is in effect.

What is the process for filing a claim with cheap car insurance in Iowa?

The process for filing a claim with cheap car insurance in Iowa generally involves contacting your insurance provider to report the incident, providing necessary documentation and evidence, and working with an adjuster to assess the damages and determine the payout.

Get a better grasp by checking out our article titled “how long can the police wait to charge you in iowa?“

How does driving less impact my car insurance rates in Iowa?

Driving less impacts your car insurance rates in Iowa by potentially lowering your premium. Insurance companies often offer discounts for low-mileage drivers as less driving reduces the risk of accidents.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.