Retirement Planning Advice for Women

Since women face different challenges in retirement planning, from gender wage gaps to longer lifespans, women planning to retire need to be proactive and start planning early for their retirement. Gaining financial knowledge, considering future needs, maintaining employable skills, and increasing income can help women develop successful retirement plans. The best way to start is by reading retirement planning advice for women.

Read moreFree Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Johnson

Insurance Lawyer

Jeffrey Johnson is a legal writer with a focus on personal injury. He has worked on personal injury and sovereign immunity litigation in addition to experience in family, estate, and criminal law. He earned a J.D. from the University of Baltimore and has worked in legal offices and non-profits in Maryland, Texas, and North Carolina. He has also earned an MFA in screenwriting from Chapman Univer...

Insurance Lawyer

UPDATED: Jul 16, 2023

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: Jul 16, 2023

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

- Only 46% of women workers have retirement plans or participated in retirement plans

- Women workers have different concerns and needs for retirement than men

- Planning for retirement is the best way to ensure retirement is stress free

Getting a head start on retirement planning is a smart move. It allows you to take steps today that will set you up for a better future. Especially for women, it’s important to be proactive about the process and familiarize themselves with retirement planning.

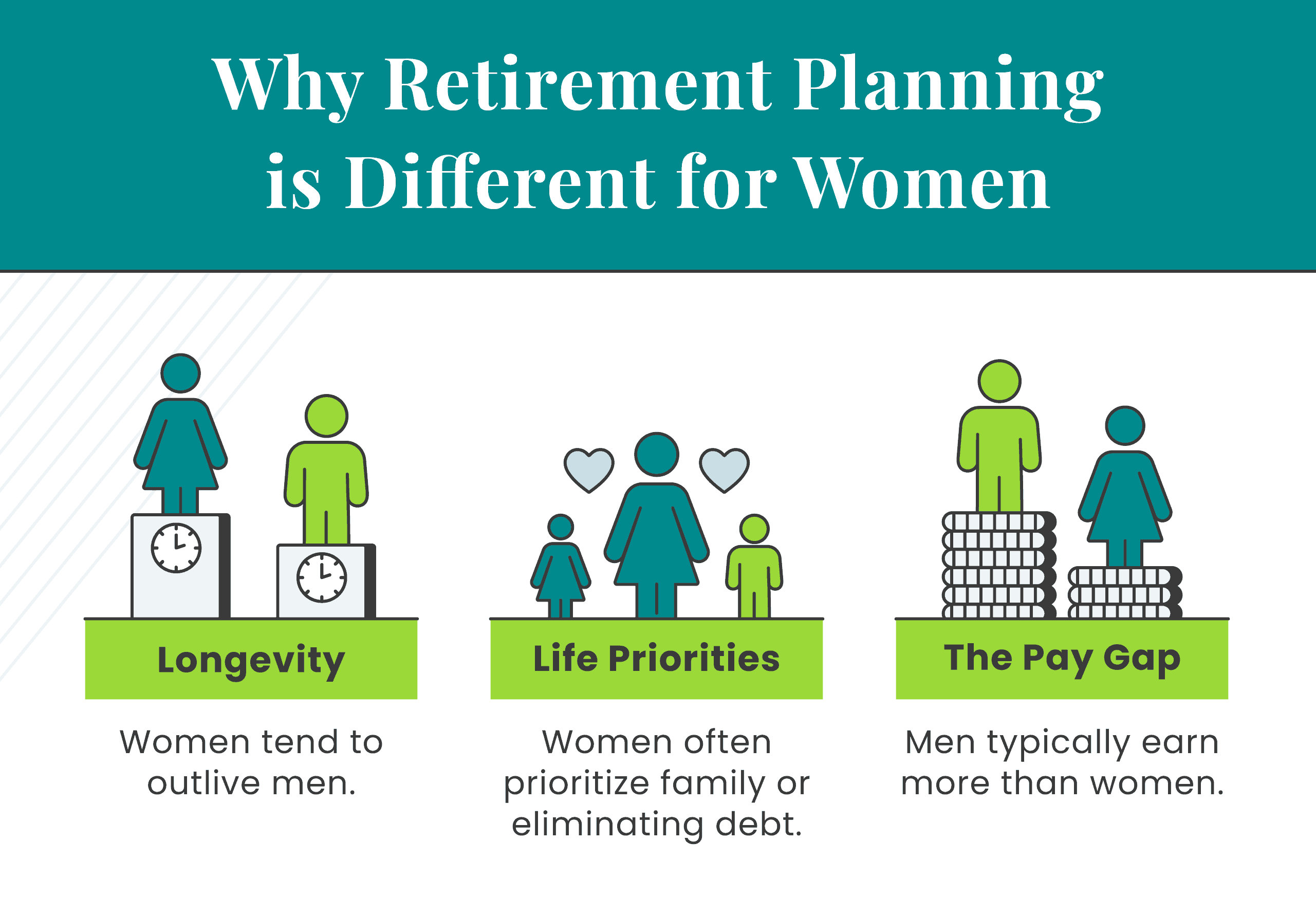

How is retirement planning different for women? Women’s circumstances can affect their ability and willingness to make retirement plans early. Due to the gender pay gap, women often have less money to save for retirement.

They also tend to live longer than men, so they need more earnings to support themselves. Lastly, raising the family and decreasing debt are more important for many women than planning for retirement. If you need help getting your investments and finances in order for retirement, our guide on banking and finance law may be helpful.

One piece of retirement advice for women is to save money on insurance policies so that you can put more money into your retirement plan. Enter your ZIP code into our free tool above to find the best rates in your area for your insurance policies, whether it is home or auto insurance.

Women’s Retirement Planning Steps

New Link Destination prevent common issues from hindering your retirement plans, there are a series of tips you can follow. Read on for a more detailed explanation of our best retirement tips and investment advice for women.

Gain Financial Knowledge

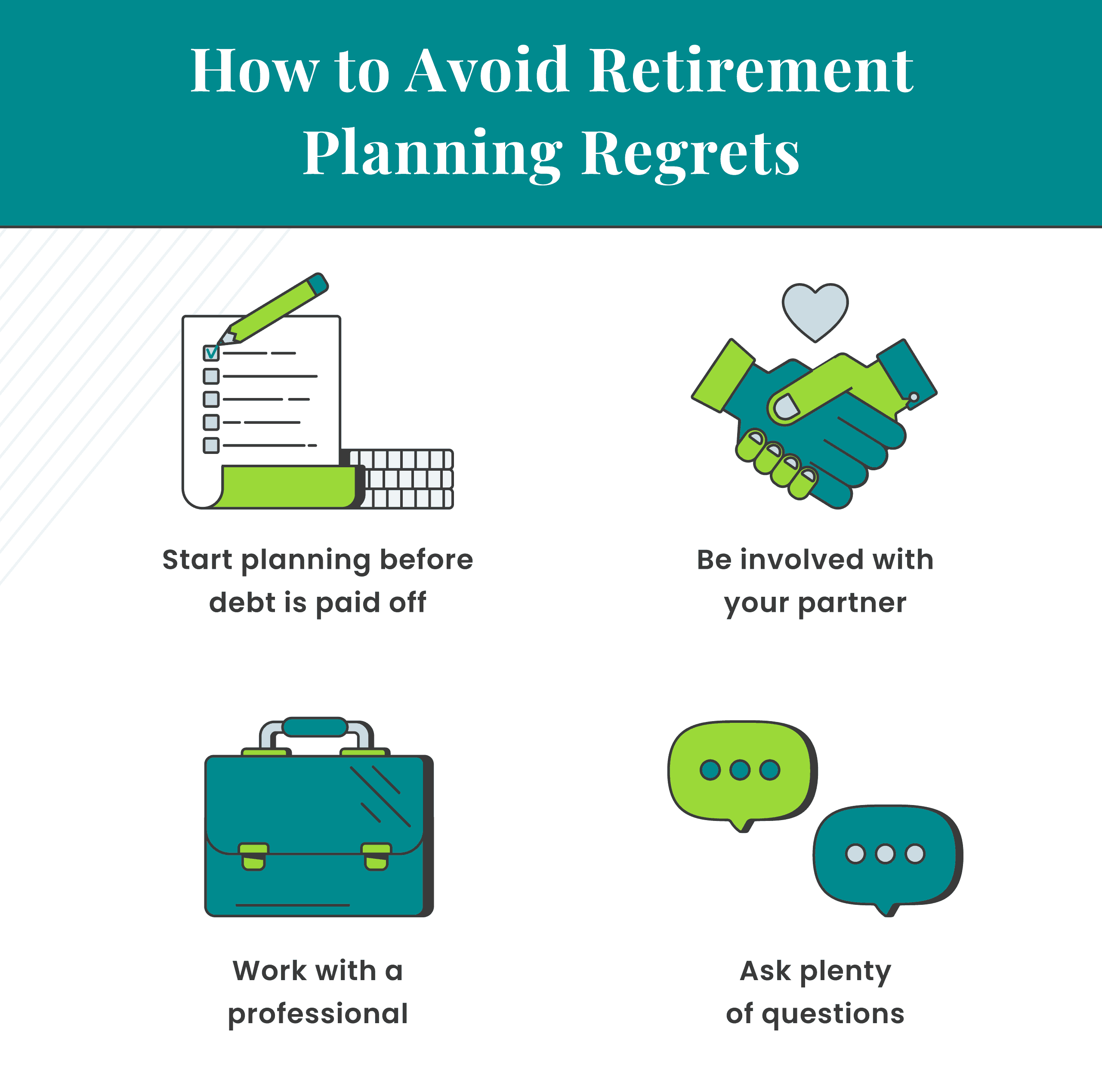

While retirement may seem far off when women are in their 30s, not learning how to handle finances early on can lead to regrets later. When asked about their retirement planning regrets, women reported that their failure to get involved in family finances and gain knowledge from a professional was a mistake.

New Link Destination avoid these errors, you can increase your financial literacy by reading articles and watching informative videos on the topic. You may also want to check your local community college for beginner finance classes or see if any free courses are offered online.

While it may seem time-consuming to learn about personal finance, you are investing in your future, which is well worth the time spent.

In addition, rather than letting a partner take the lead on financial planning, you can and should play a role in the process too. Increasing familiarity with personal finance will help you feel more confident and prepared to handle retirement plans.

While it may seem overwhelming at first, developing knowledge of personal finance is beneficial in the long term.

Consider Future Needs

New Link Destination understand how much to save for retirement, it’s important to think about future expenses. For example, knowing the cost of long-term care options gives you critical information for retirement planning.

If you don’t accurately estimate how much money you will need for retirement, you face running out of assets early in retirement.

Unfortunately, many people underestimate just how much they need to save for retirement. In addition to living costs, there may be unexpected costs that arise. As women age, more healthcare problems may arise, resulting in pricy medical bills.

Retired women may also become involved in new hobbies or travel, which may require spending a bit more than is in the retirement budget. And since women face unique financial planning challenges that men don’t, it is vital for women to be heavily involved in their finances.

Women often live longer than men, meaning they may have to pay for more years of assisted living and health care for medical needs. In addition, since women earn less than men on average, they have less money to put into the future care they need.

The result? Women need to start their financial planning as soon as possible, as they face outliving a spouse or outliving their assets.

Once you determine your future needs, you can take the necessary steps to reach your retirement goals. Don’t wait until tomorrow to get started, as financial planning for the future shouldn’t wait. Read on to see how you can maintain your employable skills so that you don’t have to put off your career to raise children.

Maintain Employable Skills

After leaving the workforce to take care of children, many women are left without a path back into their desired industry once they wish to return to work.

It can be tempting for women to give up on the career path they once had, but having children and leaving to raise them doesn’t mean their career has to be on hold forever.

New Link Destination stay employable, you should keep pursuing your education, maintaining industry knowledge, and making connections. As a result, you’ll have more opportunities to accumulate savings.

For example, women in the medical field (nurses, midwives, etc.) should keep up with their registration and not let it lapse. Staying up to date, even while raising kids, helps the transition back into the workplace go smoothly.

Some of the ways women can stay involved in their careers and keep their resumes up to date when raising children include:

- Participating in related non-profit work

- Staying in contact with your network

- Staying up to date with industry advancements

- Taking part-time courses in your industry

Staying connected to an industry while raising children helps make going back to work less overwhelming and daunting.

Increase Annual Earnings

One of the most important things that women can do to increase earnings is learning to negotiate. Women tend to accept the salary they’re offered, but negotiating can be a powerful way to boost income.

Knowing your value and frequently asking for higher salaries, raises, and promotions are tactics that allow you to earn more money to use for retirement.

The number one thing that holds women back from asking for a raise is fear. If you are nervous about negotiating, there are plenty of tips and tricks you can follow to get the salary you deserve, from asking for an exact number to organizing your thoughts beforehand.

The worst that can happen is a company says no. Even if you are turned down the first time, don’t stop asking for raises and promotions. Eventually, your hard work and persistence will pay off.

In addition, you can increase earnings by pursuing self-employment through side jobs or forms of passive income like dividend stocks and digital file sales.

You should also look into retirement accounts like a 401(k) or Roth IRA. Some employees provide these accounts and will match what you put into it each year. If you don’t have a retirement account through work, you should still open one.

Women who utilize self-employment opportunities and create passive income will be able to put more money toward their retirement.

If you aren’t familiar with passive income opportunities, make sure to talk to a financial advisor. They can help with discovering which investment opportunities are best for you and explain any confusing financial terminology.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Prioritize Retirement Planning

Whether it’s prioritizing other things or feeling intimidated by the prospect of planning or learning about finances, taking steps for retirement isn’t always a primary concern for women. However, starting early allows you to invest in a more comfortable future.

Women should start planning for retirement as soon as they start earning their first paycheck, which is usually in their early 20s. Investments made 30 years ago will have earned a significant amount more than investments made 10 years ago.

Even if you can only put away a thousand a year towards retirement in your 20s, this amount will have grown substantially by the time you are in your 60s.

Take a look at the graphic below to see what are the four basic steps of retirement planning to avoid regrets later.

A great way to begin the process is by opening a retirement account, either through your employer or another IRA option. As we discussed earlier, even if your employer doesn’t have retirement accounts for employees, it is important for you to open up a retirement account. It is one of the most important steps in preparing for your future retirement.

Once you make your account, consider automating your withdrawals to simplify your savings method. Take a look at the other tips below for making the most out of your retirement money.

Retirement planning is essential for everyone, but women deal with certain conditions that can prevent them from taking charge of the process and lead to issues later.

New Link Destination counteract these circumstances, you can gain financial literacy and stability, shift savings priorities, and see your retirement plans come to fruition.

Case Studies: Retirement Planning Advice for Women

Case Study 1: Lack of Financial Knowledge

Emily, in her early 30s, never took an active role in managing her finances. She didn’t educate herself about personal finance or participate in family financial decisions. As a result, she lacked the necessary financial knowledge to plan for retirement effectively. Emily regrets not being proactive earlier and recommends other women start gaining financial literacy as early as possible.

Case Study 2: Underestimating Future Needs

Sophia, a 40-year-old woman, failed to consider her future needs when planning for retirement. She didn’t account for potential healthcare expenses, long-term care costs, and the possibility of outliving her savings.

Consequently, Sophia faced financial challenges during retirement and had to make significant adjustments to her lifestyle. She advises other women to carefully estimate future expenses to avoid financial strain in retirement.

Case Study 3: Career Interruptions and Skills Maintenance

Julia left her career to raise her children, and when she decided to return to work later, she struggled to find suitable employment opportunities. Her skills had become outdated, and she faced difficulties reentering the workforce at a competitive level. Julia recommends women maintain employable skills, stay connected to their industries, and continuously update their resumes even while taking a career break.

Frequently Asked Questions: Women’s Retirement

Planning for retirement can be confusing and overwhelming, but it doesn’t have to be. Many women have questions about how to retire, from when to retire to how much money to save for retirement. Read on to see the answers to commonly asked questions about retirement for women.

#1 – At what age do most single women retire?

The age for single-woman retirement is the same as the average age for retirement for the general population, which is age 65 or older. Retiring before age 65 is considered early retirement.

#2 – How much should a single woman have saved for retirement?

If you are looking into retirement as a single woman, it is important to put enough aside each year to have a stress-free retirement. Most experts recommend saving around 15% of your income every year to put toward your retirement fund.

If you need help calculating what this is, look up a retirement calculator to help you see how much you should be setting aside annually.

#3 – What percentage of women contribute to a retirement account?

According to the Employee Benefits Security Administration (EBSA), only about 46% of women workers have invested in retirement plans.

#4 – What are the first three steps to retirement planning?

As covered earlier, the first and most important steps are to gain financial knowledge, consider future needs, and maintain employable skills. Make sure to also read and write down retirement advice and wishes for the future, so you can plan accordingly.

#5 – What is a good retirement gift for a woman?

During retirement, it’s better to worry about things like travel insurance for trips abroad than if a retirement plan will provide enough income. Therefore, the best retirement gift to give yourself is a sustainable retirement plan so that you can live comfortably and enjoy your retirement years.

However, if you are looking for retirement gifts for women to celebrate retirement, there are plenty of great ideas to be found, from customized wine glasses to travel books.

Now that you’ve read up about women’s retirement planning, find savings to put toward your retirement plan with our free insurance comparison tool that will help you find the best insurance rates in your area.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Jeffrey Johnson

Insurance Lawyer

Jeffrey Johnson is a legal writer with a focus on personal injury. He has worked on personal injury and sovereign immunity litigation in addition to experience in family, estate, and criminal law. He earned a J.D. from the University of Baltimore and has worked in legal offices and non-profits in Maryland, Texas, and North Carolina. He has also earned an MFA in screenwriting from Chapman Univer...

Insurance Lawyer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.