How does the insurance company determine my premium?

If you are wondering, "how do insurance companies determine my premium," you are not alone. Many people get significantly different rates from one insurance company to the next, and it's impossible to know what each company will charge you for coverage until you shop around to compare prices. Some of the most common factors insurance companies consider when assessing your level of risk include your age, credit history, and health history.

Read moreFree Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Johnson

Insurance Lawyer

Jeffrey Johnson is a legal writer with a focus on personal injury. He has worked on personal injury and sovereign immunity litigation in addition to experience in family, estate, and criminal law. He earned a J.D. from the University of Baltimore and has worked in legal offices and non-profits in Maryland, Texas, and North Carolina. He has also earned an MFA in screenwriting from Chapman Univer...

Insurance Lawyer

UPDATED: Jul 25, 2023

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: Jul 25, 2023

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

- Insurance companies learn specific things about you to determine how much of a risk you are

- Your insurance rates will vary from one company to the next depending on a number of factors

- Different types of insurance consider different factors when calculating your premiums

Whether you are purchasing an auto insurance policy or starting a life insurance plan, your insurance rates can vary from one company to the next. This makes a lot of people wonder, “how do companies determine my premium?”

To learn how to calculate your premium, you need to know more about the factors involved in the insurance process. Essentially, insurance companies learn about you in order to determine your risk level.

If you are shopping around for car, home, or health insurance — or if you’re looking for a totally different insurance product — you will want to get quotes from multiple companies to compare them and see how much you could save on your coverage.

Different companies have different underwriting processes even when you’re looking at identical coverages. Just make sure you’re comparing like products before you assume one provider is cheaper than another.

In fact, you can use our free quote tool above to compare quotes from insurance companies in your area today.

Is there a formula for how to calculate my insurance premiums?

There is no way to calculate the insurance premiums you will be given by different insurance companies. All companies are allowed to assess your level of risk in their own way. This means that some companies may focus on factors that another company does not even ask you about.

While you cannot calculate the premium you will receive for any type of insurance, you can learn from the long list of factors most insurance companies consider to see if you’re at risk of paying a higher-than-average premium for coverage.

Different types of insurance focus on different factors that impact your risk level. For example, a car insurance company will want to know about your driving history, while a life insurance company will want to know about your health.

Because of this, you will need to consider the type of insurance you’re looking for in order to get a better idea of how much you’ll be paying for coverage.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

How do I calculate my premium for general insurance?

When it comes to general insurance — which is any insurance product other than life insurance — the factors will vary from one company to the next.

In general, the major factors that general insurance companies will consider when assessing your level of risk include:

- Your age

- Your gender

- The type of coverage you want

- The amount of coverage you want

- Your credit history

- Your driving record

- Your claims history

- Your marital status

You’ll find that some companies have additional factors they consider when developing premiums for policyholders while others don’t.

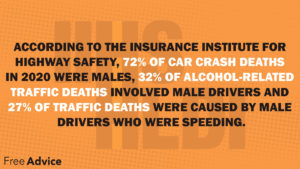

Some states don’t allow insurance companies to use gender to calculate rates but many do. And male rates are typically higher than female rates because males are more likely to participate in risky behavior.

Your rates with one company could be higher or lower than your rates with another insurance company.

This is why it is so important to shop around for coverage. Otherwise, you run the risk of paying too much for the exact same coverage with a different company.

How much are premiums for general insurance?

It’s impossible to know how much you would pay for car insurance or homeowners insurance until you get quotes from an insurance company or speak to an agent.

The table below gives the average annual full coverage car insurance rates in different states. These rates might give you a ballpark when it comes to your own insurance premiums.

Average Annual Full Coverage Car Insurance Rates by State| States | 2015 Average Annual Rates | 2014 Average Annual Rates | 2013 Average Annual Rates | 2012 Average Annual Rates | 2011 Average Annual Rates |

|---|---|---|---|---|---|

| Idaho | $679.89 | $673.13 | $650.57 | $639.19 | $641.96 |

| Iowa | $702.46 | $683.67 | $668.09 | $656.84 | $648.99 |

| Maine | $703.82 | $689.12 | $674.94 | $667.66 | $662.28 |

| Wisconsin | $737.18 | $716.83 | $689.77 | $666.79 | $669.99 |

| Indiana | $755.03 | $728.93 | $704.50 | $724.44 | $710.36 |

| Vermont | $764.02 | $746.79 | $734.82 | $726.57 | $716.14 |

| South Dakota | $766.91 | $744.28 | $717.30 | $690.95 | $669.20 |

| North Dakota | $773.30 | $768.09 | $743.27 | $714.75 | $688.74 |

| Ohio | $788.56 | $766.66 | $738.68 | $714.05 | $697.61 |

| North Carolina | $789.09 | $768.28 | $739.91 | $720.47 | $708.10 |

| New Hampshire | $818.75 | $795.50 | $773.30 | $755.76 | $746.57 |

| Nebraska | $831.02 | $805.99 | $773.64 | $751.18 | $732.21 |

| Virginia | $842.67 | $836.14 | $809.40 | $781.38 | $768.95 |

| Wyoming | $847.44 | $844.33 | $804.52 | $796.14 | $791.14 |

| Kansas | $862.93 | $850.79 | $815.82 | $785.72 | $780.43 |

| Montana | $863.52 | $868.55 | $842.74 | $821.68 | $816.21 |

| Alabama | $868.48 | $837.09 | $811.75 | $788.07 | $784.38 |

| Tennessee | $871.43 | $855.56 | $829.38 | $794.53 | $767.82 |

| Missouri | $872.43 | $845.39 | $819.79 | $799.14 | $790.27 |

| Utah | $872.93 | $852.66 | $820.92 | $805.32 | $809.35 |

| Hawaii | $873.28 | $858.16 | $844.16 | $844.12 | $861.95 |

| Minnesota | $875.49 | $856.62 | $823.70 | $800.24 | $777.17 |

| Illinois | $884.56 | $854.10 | $819.27 | $806.21 | $803.04 |

| Oregon | $904.83 | $894.10 | $856.26 | $818.07 | $804.59 |

| Arkansas | $906.34 | $900.18 | $868.13 | $843.07 | $829.13 |

| New Mexico | $937.59 | $920.42 | $888.83 | $866.19 | $869.85 |

| Kentucky | $938.51 | $917.49 | $904.99 | $888.46 | $872.48 |

| Washington | $968.80 | $952.10 | $914.04 | $891.04 | $889.82 |

| Pennsylvania | $970.51 | $950.42 | $930.48 | $915.83 | $904.47 |

| Arizona | $972.85 | $961.88 | $926.52 | $899.91 | $899.33 |

| South Carolina | $973.10 | $936.69 | $904.22 | $880.82 | $857.70 |

| Colorado | $981.64 | $939.52 | $887.57 | $849.74 | $835.50 |

| California | $986.75 | $951.75 | $922.69 | $891.68 | $881.07 |

| Mississippi | $994.05 | $957.59 | $925.13 | $902.95 | $895.69 |

| Oklahoma | z$1,005.32 | $985.58 | $931.41 | $902.90 | $881.50 |

| West Virginia | $1,025.78 | $1,032.45 | $1,021.37 | $1,005.68 | $992.57 |

| Alaska | $1,027.75 | $1,050.09 | $1,058.15 | $1,053.54 | $1,053.48 |

| Georgia | $1,048.40 | $991.25 | $949.33 | $922.05 | $912.49 |

| Nevada | $1,103.05 | $1,083.42 | $1,047.74 | $1,024.09 | $1,029.87 |

| Texas | $1,109.66 | $1,066.20 | $1,017.81 | $974.68 | $959.87 |

| Maryland | $1,116.45 | $1,096.37 | $1,071.35 | $1,056.82 | $1,048.86 |

| Massachusetts | $1,129.29 | $1,107.76 | $1,080.48 | $1,048.06 | $1,011.14 |

| Connecticut | $1,151.07 | $1,132.78 | $1,109.03 | $1,082.28 | $1,068.18 |

| Delaware | $1,240.57 | $1,215.69 | $1,187.18 | $1,153.59 | $1,134.60 |

| Florida | $1,257.13 | $1,208.77 | $1,209.70 | $1,196.57 | $1,160.13 |

| Rhode Island | $1,303.50 | $1,257.40 | $1,210.55 | $1,176.05 | $1,148.97 |

| District of Columbia | $1,330.73 | $1,324.39 | $1,316.48 | $1,289.49 | $1,276.99 |

| New York | $1,360.66 | $1,327.82 | $1,301.49 | $1,273.70 | $1,236.77 |

| Michigan | $1,364.00 | $1,350.58 | $1,264.20 | $1,171.94 | $1,110.64 |

| New Jersey | $1,382.79 | $1,379.20 | $1,369.70 | $1,334.59 | $1,303.52 |

| Louisiana | $1,405.36 | $1,364.17 | $1,307.72 | $1,275.10 | $1,281.55 |

| U.S. Average | $1,009.38 | $981.77 | $950.92 | $924.45 | $908.43 |

As you can see, rates vary significantly from one state to the next. Car insurance rates have also increased from one year to the next. All of these factors have the potential to impact your car insurance rates.

For a better idea of homeowners insurance coverage, check out the table below, which highlights how the cost of insurance can vary from one company to the next.

Best Annual Homeowners Insurance Rates in Texas for $200,000 Home| Company | Average rates for $200K dwelling |

|---|---|

| Allstate Insurance | $1,932 |

| Amica Insurance | $2,191 |

| Encompass Insurance | $2,970 |

| Farmers Insurance | $1,289 |

| Safeco Insurance | $1,600 |

| State Farm Insurance Company | $2,363 |

| Travelers Companies, Inc. | $2,378 |

For the exact same $200,000 home in Texas, Safeco will cost around $1,600 a year, while homeowners coverage with Encompass Insurance will cost nearly $3,000.

Insurance premiums are difficult to predict until you start your own research. Compare rates from multiple companies, and be sure to speak to agents about any discounts you may qualify for.

How much are premiums for life insurance and health insurance?

Similar to general insurance, premiums for life and health insurance are impossible to calculate without getting quotes from multiple companies first. Once you’ve done this, you can start to calculate the average premium cost.

For life and health insurance, you may find cheaper options through your employer. If not, you can purchase these plans from individual companies. Just be sure to compare rates first to be sure you’re not overpaying.

You can also ask about discounts for these insurance types. A lot of companies offer discounts to people who have a good health history and whose jobs and lifestyles are not very risky.

If you want to learn how to calculate premiums with percentage discounts, you’ll first have to learn how much each discount will lower your insurance rates. You can do this by speaking to an insurance agent.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

How do I lower my insurance premiums?

The best thing you can do to lower your insurance premiums is shop around for coverage on a regular basis. Most experts recommend looking for cheaper coverage once a year.

You can also ask about discounts and continue to live a healthy and safe life. All of these things have the potential to help you pay less for virtually any type of insurance product.

If you’re shopping for insurance, don’t forget to use our free tool below to find and compare rates from top companies in your area today.

Case Studies: Understanding How Insurance Companies Determine Premiums

Case Study 1: Car Insurance Premium Calculation

John is shopping for car insurance and obtains quotes from multiple insurance companies. He discovers that each company offers different rates based on various factors such as his age, driving history, and credit score. John realizes that insurance companies assess his risk level differently, resulting in different premium calculations.

Case Study 2: Homeowners Insurance Premium Calculation

Sarah is purchasing homeowners insurance for her new house. She contacts several insurance companies and receives quotes that vary significantly. While the coverage and property value are the same, different insurers consider factors such as the location of the property, its proximity to natural disaster-prone areas, and Sarah’s claims history, resulting in different premium calculations.

Case Study 3: Health Insurance Premium Calculation

Mark is exploring health insurance options and obtains quotes from different insurance providers. He notices that premiums vary based on factors such as his age, medical history, and lifestyle choices. Mark realizes that insurers assess his health risk differently, leading to variations in premium calculations.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Jeffrey Johnson

Insurance Lawyer

Jeffrey Johnson is a legal writer with a focus on personal injury. He has worked on personal injury and sovereign immunity litigation in addition to experience in family, estate, and criminal law. He earned a J.D. from the University of Baltimore and has worked in legal offices and non-profits in Maryland, Texas, and North Carolina. He has also earned an MFA in screenwriting from Chapman Univer...

Insurance Lawyer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.