Cheap Car Insurance in Massachusetts for 2024 (Save Money With These 10 Companies)

Geico, State Farm, and Travelers are the top choices for cheap car insurance in Massachusetts, with rates as low as $28/month. These three companies provide the best affordable options. Geico is known for low rates, State Farm excels in customer service, and Travelers offers comprehensive coverage across the state.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Sep 5, 2024

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: Sep 5, 2024

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

Company Facts

Min Coverage in Massachusetts

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min Coverage in Massachusetts

A.M. Best Rating

Complaint Level

The best options for cheap car insurance in Massachusetts are Geico, State Farm, and Travelers, offering competitive rates and comprehensive coverage. Geico stands out as the top pick overall due to its affordability and reliable customer service.

State Farm offers excellent customer support, making it a great choice for those prioritizing service. Travelers provide a wide range of coverage options, ensuring drivers can customize their policies to meet specific needs. For a comprehensive understanding, consult our article titled “Best Car Insurance for Safe Drivers in Massachusetts.”

Our Top 10 Company Picks: Cheap Car Insurance in Massachusetts

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $28 A++ Efficient Operations Geico

#2 $30 B Large Network State Farm

#3 $34 A++ Competitive Rates Travelers

#4 $35 A++ Member Focused USAA

#5 $37 A+ Usage-Based Discounts Progressive

#6 $39 A Customer Loyalty American Family

#7 $40 A+ Broad Coverage Nationwide

#8 $47 A Bundling Opportunities Farmers

#9 $56 A+ Safe Driving Allstate

#10 $61 A Flexible Discounts Liberty Mutual

This article dives into the details of these companies, helping you understand why they are the best choices for affordable car insurance in the state. Find cheap car insurance quotes by entering your ZIP code.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Affordable Rates: Geico is well-known for offering some of the lowest car insurance rates in Massachusetts, making it a top choice for budget-conscious drivers. Gain deeper insights by perusing our article named “Geico Insurance Review & Ratings“

- User-Friendly Online Tools: Geico’s robust online platform makes it easy to manage car insurance in Massachusetts, from getting quotes to filing claims.

- Strong Customer Satisfaction: Geico consistently ranks high in customer satisfaction for car insurance in Massachusetts, particularly for ease of use and affordability.

Cons

- Limited Local Agents: Massachusetts drivers who prefer in-person service might find Geico’s limited agent network less convenient.

- Average Coverage Options: While affordable, Geico’s car insurance in Massachusetts may offer fewer optional coverages compared to some competitors.

#2 – State Farm: Best for Reliable and Trustworthy

Pros

- Strong Agent Network: State Farm offers a large network of local agents in Massachusetts, providing personalized car insurance services.

- Excellent Claims Handling: State Farm is highly rated for its efficient claims process, making car insurance in Massachusetts stress-free during an accident.

- Good Student Discounts: State Farm offers discounts for students, helping families save on car insurance in Massachusetts. Dive into the details with our article entitled “State Farm Insurance Review & Ratings.”

Cons

- Higher Premiums: Car insurance in Massachusetts with State Farm may come at a higher cost compared to some other providers.

- Limited Online Features: While State Farm excels in personal service, its online tools for managing car insurance in Massachusetts may not be as advanced as competitors.

#3 – Travelers: Best for Comprehensive Coverage Options

Pros

- Wide Range of Coverages: Travelers offers a variety of coverage options for car insurance in Massachusetts, including several add-ons like gap coverage and accident forgiveness.

- Bundling Discounts: Massachusetts drivers can save on car insurance by bundling policies with Travelers, such as home or renters insurance.

- Strong Financial Stability: Travelers is financially strong, ensuring that your car insurance in Massachusetts will be reliable and claims will be paid promptly. Explore further in our article titled “Do Travelers offer gap insurance?“

Cons

- Average Customer Service: Travelers may not have as high customer service ratings as other car insurance companies in Massachusetts.

- Higher Rates: The comprehensive coverage options with Travelers can make car insurance in Massachusetts more expensive than with some other providers.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

#4 – USAA: Best for Military Families

Pros

- Exclusive Military Discounts: USAA offers significant discounts for military members and their families, making car insurance in Massachusetts more affordable for those who qualify.

- Top-Rated Customer Service: USAA consistently receives top marks for customer service in Massachusetts, especially for handling claims efficiently. Delve into the specifics in our article called “How long does it typically take for USAA to process an car insurance claim?“

- Comprehensive Coverage: USAA offers a wide range of coverage options and additional protections for car insurance in Massachusetts.

Cons

- Eligibility Restrictions: Car insurance with USAA in Massachusetts is only available to military members, veterans, and their families, limiting availability.

- Limited Local Presence: USAA’s physical presence in Massachusetts is limited, which may be less convenient for those who prefer in-person service.

#5 – Progressive: Best for Innovative and Flexible

Pros

- Customizable Policies: Progressive allows Massachusetts drivers to customize their car insurance policies with a variety of options and add-ons. Enhance your knowledge by reading our “Progressive Insurance Review & Ratings.”

- Snapshot Program: Progressive’s Snapshot program offers discounts for safe driving habits, potentially lowering car insurance costs in Massachusetts.

- Strong Online Tools: Progressive’s advanced online and mobile tools make managing car insurance in Massachusetts easy and convenient.

Cons

- Mixed Customer Service Reviews: Progressive may have varying customer service experiences, with some Massachusetts drivers reporting less satisfactory interactions.

- Higher Rates for High-Risk Drivers: Car insurance in Massachusetts with Progressive can be more expensive for those with a poor driving record.

#6 – American Family: Best for Comprehensive Coverage with a Personal Touch

Pros

- Personalized Service: American Family is known for its excellent local agent service, making car insurance in Massachusetts more personalized and accessible.

- Variety of Discounts: American Family offers a range of discounts for car insurance in Massachusetts, including safe driving and bundling policies. Uncover more by delving into our article entitled “Does American Family Insurance offer non-owner car insurance coverage?“

- Flexible Coverage Options: Massachusetts drivers can choose from various coverage options, allowing for a more tailored car insurance policy.

Cons

- Higher Premiums: American Family’s personalized service and flexible coverage options may lead to higher car insurance rates in Massachusetts.

- Limited Availability: American Family may have a smaller presence in some parts of Massachusetts, potentially limiting access to local agents.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Broad Coverage and Accessibility

Pros

- Vanishing Deductible Program: Nationwide offers a vanishing deductible program, which can reduce the cost of car insurance in Massachusetts over time for safe drivers.

- Strong Financial Ratings: Nationwide is financially strong, ensuring reliable car insurance coverage in Massachusetts. Get a better grasp by checking out our article titled “Does Nationwide car insurance cover damage caused by a falling object?“

- Wide Range of Coverage Options: Massachusetts drivers can choose from a broad selection of coverages, making Nationwide’s car insurance policies highly customizable.

Cons

- Average Customer Service: Nationwide’s customer service ratings for car insurance in Massachusetts may not be as high as some competitors.

- Higher Premiums for Add-Ons: Additional coverage options can increase the cost of car insurance in Massachusetts with Nationwide.

#8 – Farmers: Best for Personalized and Comprehensive

Pros

- Local Agent Network: Farmers provides strong local agent support in Massachusetts, offering personalized car insurance service. Expand your understanding with our article called “What types of car insurance coverage does Farmers Insurance offer?“

- Comprehensive Coverage Options: Farmers offers a wide variety of coverage options and add-ons, making car insurance in Massachusetts highly customizable.

- Discounts for Safe Driving: Massachusetts drivers can benefit from Farmers’ safe driving discounts, helping to reduce car insurance costs.

Cons

- Higher Rates: Farmers’ car insurance in Massachusetts can be more expensive, particularly for those who don’t qualify for discounts.

- Limited Online Tools: Farmers may not offer as advanced online tools for managing car insurance in Massachusetts compared to some competitors.

#9 – Allstate: Best for Trusted Nationwide with Local Service

Pros

- Local Agent Network: Allstate has a strong network of local agents in Massachusetts, providing personalized service for car insurance policyholders.

- Safe Driving Programs: Allstate’s Drivewise program offers discounts based on driving habits, helping to lower car insurance costs in Massachusetts. For additional insights, refer to our “Allstate Auto Insurance Review.”

- Comprehensive Coverage: Allstate offers a broad range of coverage options, allowing Massachusetts drivers to tailor their car insurance policies.

Cons

- Higher Premiums: Allstate’s car insurance rates in Massachusetts can be higher, particularly for those not qualifying for discounts.

- Mixed Customer Service Ratings: Customer service experiences with Allstate’s car insurance in Massachusetts can vary, with some drivers reporting less satisfactory interactions.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Flexible and Comprehensive

Pros

- Customizable Coverage: Liberty Mutual offers highly customizable car insurance policies in Massachusetts, allowing drivers to select the coverage they need. Gain deeper understanding through our article entitled “Liberty Mutual Auto Insurance Review.”

- Strong Online and Mobile Tools: Liberty Mutual provides robust online and mobile tools, making it easy for Massachusetts drivers to manage their car insurance policies.

- Multiple Discounts: Liberty Mutual offers a variety of discounts, including bundling and safe driving, which help reduce car insurance costs in Massachusetts.

Cons

- Higher Rates for Full Coverage: Comprehensive car insurance in Massachusetts with Liberty Mutual can be more expensive compared to some other providers.

- Mixed Customer Service Reviews: Liberty Mutual may have mixed customer service ratings in Massachusetts, with some drivers reporting issues with claims processing.

Massachusetts Car Insurance Monthly Rates by Coverage Level & Provider

Massachusetts car insurance rates vary significantly by provider and coverage level. Geico offers the lowest rates for minimum coverage, while USAA provides the most affordable full coverage. Comparing these rates can help you find the best option for your needs.

Massachusetts Car Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

Allstate $56 $143

American Family $39 $99

Farmers $47 $120

Geico $28 $72

Liberty Mutual $61 $155

Nationwide $40 $103

Progressive $37 $95

State Farm $30 $78

Travelers $34 $88

USAA $35 $53

When selecting car insurance in Massachusetts, Geico stands out with the cheapest minimum coverage, while USAA offers the lowest full coverage. Comparing rates from different providers can help you find the best coverage that fits your budget and needs.

Find out more by reading our article titled “Car Insurance Requirements in Massachusetts.“

Understanding Car Insurance in Massachusetts

Car insurance protects you financially in accidents by covering property damage, bodily injury, and medical expenses. In Massachusetts, drivers must meet specific insurance requirements and follow a no-fault system. Assessing your coverage needs and comparing options can help ensure adequate protection.

Broaden your knowledge with our article named “Best Car Insurance for Seniors in Massachusetts.”

The Basics of Car Insurance

Car insurance protects you financially in an accident, covering property damage, bodily injury liability, medical expenses, personal injury protection (PIP), and uninsured/underinsured motorist coverage.

It helps with vehicle repairs, medical costs, and legal fees, regardless of fault, and ensures protection when other drivers lack adequate insurance. Understanding your policy’s terms is crucial for adequate coverage.

Massachusetts Car Insurance Laws

In Massachusetts, drivers must meet specific car insurance requirements, including minimum liability coverage for bodily injury and property damage. The state operates under a no-fault system, where each driver’s insurance covers their own damages regardless of fault.

It’s essential to assess your coverage needs and consider higher limits for better protection. Reviewing various insurance options and comparing quotes can help you find the best coverage to meet your needs and budget.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Car Insurance Discounts From the Top Providers in Massachusetts

Massachusetts drivers can take advantage of various car insurance discounts offered by top providers. These discounts include multi-policy, safe driver, and good student discounts, among others, and can significantly reduce your insurance costs. Explore the available options to maximize your savings.

Maximizing your savings on car insurance in Massachusetts is possible with discounts from top providers. Whether you’re eligible for multi-policy, safe driver, or other discounts, understanding what each company offers can help you lower your premiums.

Explore further with our article entitled “Free Car Insurance Information, Advice & Online Quotes.” Get the right car insurance at the best price — enter your ZIP code to shop for coverage from the top insurers.

How Car Insurance Rates are Set in Massachusetts

When it comes to car insurance rates in Massachusetts, there are several factors that insurance companies take into consideration. Understanding these factors can help you make informed decisions and potentially save money on your premiums.

Gain insights by reading our article titled “Massachusetts Car Accident Pain & Suffering Damages.”

Age and Driving Experience

One of the key factors that insurance companies consider is your age and driving experience. Younger, less experienced drivers are generally considered riskier to insure and therefore often face higher premiums.

This is because statistics show that younger drivers are more likely to be involved in accidents. On the other hand, older drivers with a clean driving record and years of experience behind the wheel may qualify for discounts and enjoy lower insurance rates.

Vehicle Make and Model

The make and model of your vehicle also play a significant role in determining your insurance rates. Insurance companies take into account factors such as the cost of repairs and the likelihood of theft when assessing the risk associated with insuring a particular vehicle.

Generally, cars that are more expensive to repair or have higher theft rates tend to have higher insurance premiums. On the other hand, older and more affordable cars are typically cheaper to insure.

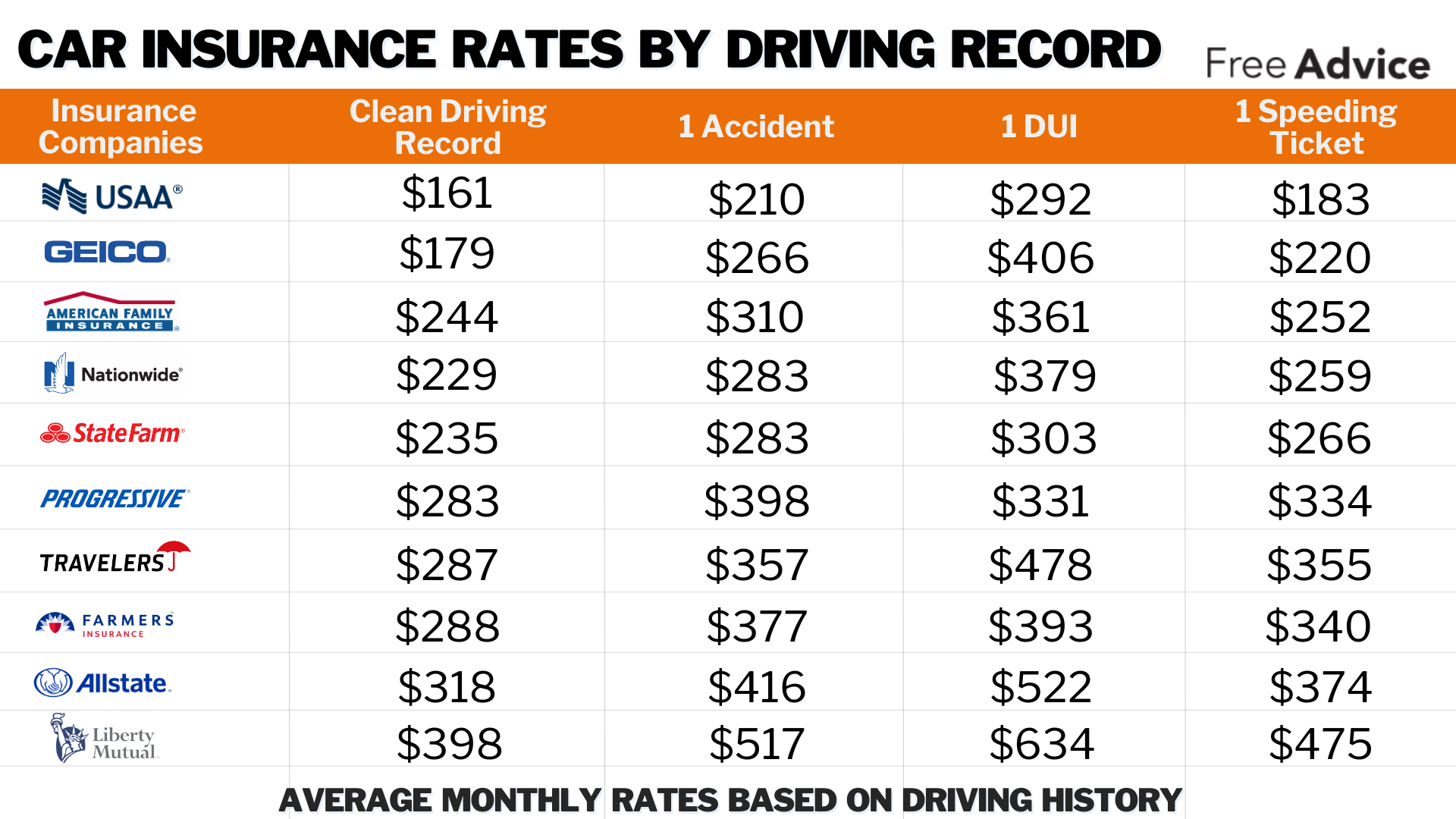

Driving Record and Claims History

Your driving record and claims history are crucial factors that insurance companies consider when determining your car insurance rates. A clean driving record with no accidents, speeding tickets, or other violations demonstrates responsible driving behavior and reduces the risk of future claims.

Drivers with a clean record are more likely to qualify for lower premiums. On the other hand, drivers with a history of accidents, speeding tickets, or other violations may face higher insurance rates due to the increased risk they pose to insurance companies.

It’s important to note that insurance rates can vary significantly depending on the insurance company and their specific underwriting guidelines. Therefore, it’s always a good idea to shop around and compare quotes from multiple insurance providers to ensure you’re getting the best possible rate for your specific circumstances.

How to Find Cheap Car Insurance in Massachusetts

Are you a resident of Massachusetts looking for affordable car insurance? You’re in luck! In this guide, we will explore some effective strategies to help you find the best deals on car insurance in the Bay State.

Deepen your understanding with our article called “Average Auto Insurance Rates by Age and Gender.”

Shopping Around for Quotes

One of the first and most important steps in finding cheap car insurance in Massachusetts is to shop around and compare quotes from different insurers. It’s important to remember that each insurance company has its own unique rating system, which means that prices can vary significantly from one provider to another.

Take the time to obtain quotes from multiple companies and carefully compare coverage levels and prices. By doing so, you can ensure that you are getting the best deal that suits your needs and budget.

Taking Advantage of Discounts

When it comes to saving money on car insurance, taking advantage of discounts can make a significant difference in your premiums. Insurance companies often offer various discounts that can help lower your overall costs.

For example, if you are a student driver, maintaining good grades can make you eligible for a discount. Additionally, completing a defensive driving course can also help you qualify for lower rates.

Furthermore, bundling multiple policies, such as combining your car insurance with your homeowner’s insurance, can lead to additional savings. Make sure to inquire about the available discounts when obtaining quotes from different insurers.

By leveraging these discounts, you can maximize your savings and find cheap car insurance in Massachusetts.

Maintaining a Clean Driving Record

To secure cheap car insurance in Massachusetts, maintain a clean driving record. Insurance companies use your driving history to set premiums, so avoiding accidents and violations can help you qualify for lower rates. Safe driving not only keeps you and others safe but also makes you less risky to insure, leading to potential discounts.

Consistently practicing safe driving habits can lead to better insurance rates. To find affordable coverage, also shop around for quotes and take advantage of available discounts.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Top Affordable Car Insurance Companies in Massachusetts

Looking for the best car insurance? Here’s a quick review of Geico, State Farm, and Travelers. Each offers unique benefits and discounts, catering to different needs and preferences. Compare their features to find the best fit for your insurance needs.

For further details, consult our article named “If my car is declared a total loss, can I still drive it?“

Geico Car Insurance Review

Geico is known for its competitive rates and extensive discounts. The company offers a range of coverage options, including multi-policy and safe driver discounts. Geico’s online tools and customer service are user-friendly, making it easy to manage your policy and file claims.

Daniel Walker Licensed Insurance Agent

Its strong financial stability and quick claims process add to its appeal. Overall, Geico is a solid choice for affordable car insurance with excellent customer support.

State Farm Car Insurance Review

State Farm is renowned for its comprehensive coverage options and personalized service. It offers a variety of discounts, including multi-policy and safe driver savings. State Farm’s extensive network of agents provides personalized support, and its user-friendly app simplifies managing your policy and filing claims.

With strong financial stability and a reputation for excellent customer service, State Farm is a reliable choice for those seeking tailored car insurance solutions. Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code.

Travelers Car Insurance Review

Travelers offer a range of coverage options and discounts, including multi-policy and good driver savings. Known for its robust online tools and mobile app, Travelers makes it easy to manage your policy and file claims. The company provides flexible coverage options and has a reputation for solid customer service.

With competitive rates and various discount opportunities, Travelers is a strong option for drivers looking for customizable insurance solutions.

Geico stands out for its competitive rates and extensive discounts, making it a solid choice for affordable insurance. State Farm is praised for its comprehensive coverage and personalized service, while Travelers offers flexible options and strong online tools. All three are excellent options, so choose the one that best meets your needs.

Frequently Asked Questions

What is the minimum car insurance required in Massachusetts?

$20,000 bodily injury per person, $40,000 per accident, and $5,000 property damage. Discover more by delving into our article entitled “Full Coverage Auto Insurance.”

How can I find cheap car insurance in Massachusetts?

Compare quotes, look for discounts, and maintain a clean driving record.

What factors affect car insurance rates in Massachusetts?

Age, driving record, vehicle type, and location. Shop for the best liability-only car insurance with our free quote comparison tool. Enter your ZIP code to begin.

Is Geico the cheapest car insurance in Massachusetts?

Geico offers some of the lowest rates, starting at $28/month. Get a better grasp by reading our article titled “What is a car insurance deductible and how does it work?“

Can I get discounts on car insurance in Massachusetts?

Yes, discounts for safe driving, bundling, and good student grades.

How does my driving record impact my insurance rates?

A clean record lowers rates; violations increase them.

Are there car insurance discounts for students in Massachusetts?

Yes, good student discounts are often available. Uncover additional insights in our article, “Does my auto insurance cover bullet holes?“

What does liability coverage include in Massachusetts?

Covers bodily injury and property damage to others.

How do I choose the best car insurance company in Massachusetts?

Compare rates, coverage options, and customer reviews.

Does the type of vehicle I drive affect my insurance rates?

Yes, expensive or high-risk vehicles generally cost more to insure. Explore further details in our “Tornado Insurance in Massachusetts.”

What is personal injury protection (PIP) coverage?

Covers medical expenses and lost wages for you and your passengers.

How can I lower my car insurance premiums?

Increase deductibles, bundle policies, and use available discounts. Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool to instantly compare quotes near you.

What should I look for in car insurance coverage?

Adequate liability, comprehensive, collision, and additional coverage as needed. Dive deeper into our “Does my auto insurance cover flat tires?” for a comprehensive understanding.

Is it worth getting uninsured motorist coverage?

Yes, it protects you if you’re in an accident with an uninsured driver.

How often should I review my car insurance policy?

Annually or when your circumstances change.

Can my credit score affect my car insurance rates?

Yes, better credit scores can lead to lower rates. Delve into the depths of our “Does my auto insurance cover break-ins?” for additional insights.

What is the no-fault insurance system in Massachusetts?

Each driver’s insurance covers their injuries regardless of fault.

Are there car insurance options for high-risk drivers in Massachusetts?

Yes, specialized insurers offer coverage for high-risk drivers.

What is collision coverage?

Covers damage to your vehicle from accidents. Uncover more about our “Does auto insurance cover DUI accidents?” by reading further.

How can I file a car insurance claim in Massachusetts?

Contact your insurer, provide the necessary details, and follow their process.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.