Best Car Insurance After a DUI in Texas (Top 10 Companies for 2024)

State Farm, Geico, and Amica offer the best car insurance after a DUI in Texas, with rates starting as low as $42 per month. State Farm provides many discounts, Geico offers customizable plans, and Amica is known for its excellent customer service, making them the top choices for affordable DUI coverage in Texas.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process ...

Licensed Insurance Agent

UPDATED: Sep 28, 2024

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: Sep 28, 2024

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage After a DUI in Texas

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 768 reviews

768 reviewsCompany Facts

Full Coverage After a DUI in Texas

A.M. Best Rating

Complaint Level

Pros & Cons

768 reviews

768 reviewsThe top picks overall for the best car insurance after a DUI in Texas are State Farm, Geico, and Amica, with rates starting as low as $42 per month.

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 14% | B | Many Discounts | State Farm | |

| #2 | 10% | A++ | Custom Plan | Geico | |

| #3 | 18% | A+ | Customer Service | Amica | |

| #4 | 12% | A+ | 24/7 Support | Erie |

| #5 | 17% | A | Student Savings | American Family | |

| #6 | 15% | A | Online App | AAA |

| #7 | 9% | A | Customizable Polices | Liberty Mutual |

| #8 | 16% | A+ | Innovative Programs | Progressive | |

| #9 | 11% | A+ | Add-on Coverages | Allstate | |

| #10 | 19% | A | Local Agents | Farmers |

These companies balance cost, customer service, and flexible policy features to meet the needs of Texans recovering from the best DUI car insurance. For those focused on minimizing expenses without sacrificing coverage, these three insurers provide the best combination of price and protection.

Ready to shop around for the best car insurance DUI company? Enter your ZIP code above and see which one offers the coverage you need.

- DUI drivers in Texas face higher rates but can still get affordable coverage

- State Farm offers the best DUI insurance in Texas, starting at $42 per month

- DUI policies often include higher liability limits for extra protection

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

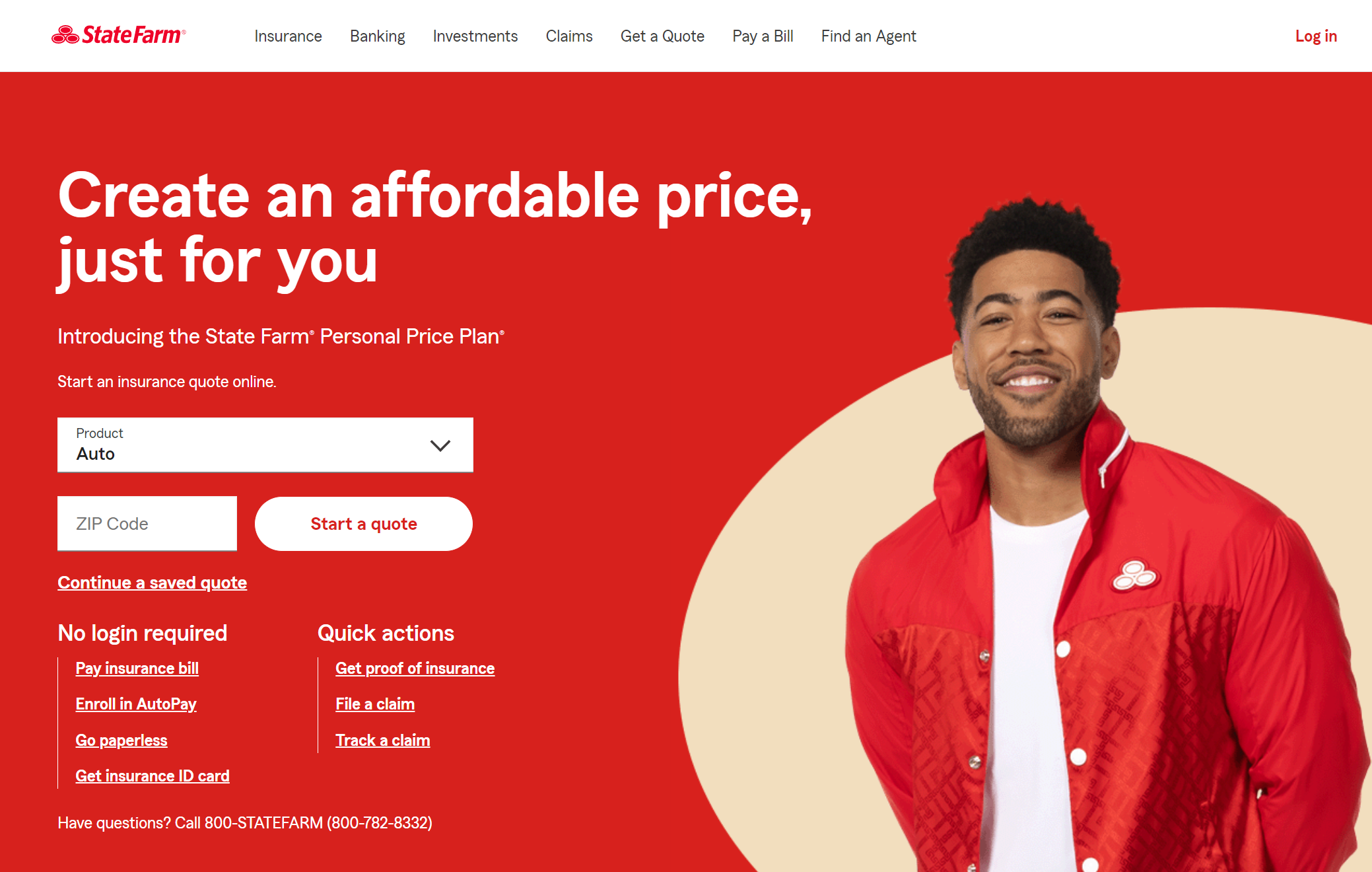

#1 — State Farm: Top Overall Pick

Pros

- Consistent DUI Coverage: State Farm provides reliable coverage for DUI drivers at $55 per month in Texas for minimum coverage.

- Multi-Policy Discounts: Offers savings for the best auto insurance for DUI drivers who bundle multiple policies.

- Strong Agent Network: Extensive agent support for the best insurance for DUI drivers who need personal assistance.

Cons

- Limited Online Features: Fewer online tools compared to competitors for the best insurance DUI drivers.

- Higher Deductibles: DUI drivers may face higher deductibles for certain claims. Check out our guide “Does State Farm Car Insurance Cover Rental Cars When I am Traveling out of Town?“

#2 — Geico: Best for Custom Plan

Pros

- Budget-Friendly Rates: Geico Insurance Reviews provides DUI drivers in Texas with affordable minimum coverage at $45 per month.

- Extensive Online Tools: Offers comprehensive online tools for managing policies efficiently.

- Accident Forgiveness: Helps DUI drivers avoid higher premiums after their first accident.

Cons

- Limited In-Person Support: Geico relies heavily on online services, which may not suit all DUI drivers.

- Higher Full Coverage Rates: Premiums for full coverage are higher than some competitors for DUI drivers.

#3 — Amica: Best for Customer Service

Pros

- Personalized Service: Amica offers customized coverage for DUI drivers in Texas at $86 per month for minimum coverage.

- Reliable Claims Service: Renowned for fast and efficient claims handling, even for high-risk DUI drivers.

- Variety of Coverage Options: Provides flexible coverage plans tailored to DUI drivers. Read our guide “Does Amica Mutual Insurance Offer Non-Owner Car Insurance Coverage?“

Cons

- Above-Average Rates: Monthly rates for DUI drivers at Amica are slightly higher at $86/month.

- Limited Online Tools: Fewer online management tools are available for DUI drivers compared to competitors.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

#4 — Erie: Best for 24/7 Support

Pros

- Lowest DUI Rates: Erie offers the most affordable minimum coverage for DUI drivers at $42 per month in Texas.

- Strong Coverage Options: Provides comprehensive coverage for DUI drivers at low rates.

- Exceptional Customer Service: Known for excellent customer service for high-risk drivers.

Cons

- Limited Availability: Erie is not available nationwide, which may limit options for DUI drivers.

- Fewer Discounts: Fewer discount opportunities compared to larger providers. See our guide “Bundling Home and Auto Insurance With Erie.“

#5 — American Family: Best for Student Savings

Pros

- Balanced Rates: American Family offers DUI drivers in Texas coverage at a $72 per month rate for minimum coverage.

- Strong Customer Support: Known for excellent customer service, especially for high-risk drivers like those for the best car insurance with a DUI.

- Discount Programs: Provides discounts for policyholders who improve their driving records after the best auto insurance with DUI.

Cons

- Fewer Nationwide Locations: Availability may be limited in certain regions for DUI drivers.

- Higher Deductibles: DUI drivers might face higher deductibles on certain policies. (Learn more: How to File a Car Insurance Claim With American Family Insurance Company).

#6 — AAA: Best for Online App

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Pros

- Affordable Rates: AAA offers a competitive rate of $57 per month for DUI drivers in Texas with minimum coverage.

- Comprehensive Policy Options: Provides robust coverage for DUI drivers at an affordable price.

- Discount Opportunities: Based on AAA insurance review, AAA offers discounts for safe driving post-DUI, helping reduce premium costs further.

Cons

- Limited Availability of Discounts: Discounts may not be as extensive for DUI drivers in Texas.

- Higher Rates for Full Coverage: Full coverage policies may be pricier for DUI drivers compared to competitors.

#7 — Liberty Mutual: Best for Customizable Policies

Pros

- Comprehensive Coverage Options: Liberty Mutual offers extensive coverage for DUI drivers at $119 per month for minimum coverage in Texas.

- Strong Nationwide Presence: Available across most states, making it accessible for DUI drivers.

- Discount Availability: Offers discounts for installing anti-theft devices or completing defensive driving courses post-DUI.

Cons

- Higher Monthly Premiums: Rates start at $119/month, which is higher than many competitors for DUI drivers.

- Limited Customization: Fewer customization options are available for the specific needs of DUI drivers. (Read more: Liberty Mutual Auto Insurance Review).

#8 — Progressive: Best for Innovative Programs

Pros

- Popular Choice for DUI Drivers: Progressive offers competitive rates for DUI drivers at $59 per month for minimum coverage in Texas.

- Snapshot Program: Rewards for the best DUI auto insurance drivers for safe driving habits with premium discounts.

- Extensive Coverage: Offers a broad range of coverage options for the best car insurance for DUI drivers.

Cons

- Price Fluctuations: Rates may fluctuate significantly for DUI drivers based on location and driving history.

- Higher Premiums for Add-Ons: Premiums increase with additional coverage options. Explore our “How do I Appeal a Car Insurance Claim with Progressive?“

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

#9 — Allstate: Best for Add-on Coverages

Pros

- Reliable High-Risk Coverage: Allstate specializes in covering DUI drivers in Texas with a minimum coverage rate of $120 per month.

- Wide Range of Policy Options: Offers a variety of policy options for DUI drivers needing coverage. Discover our guide “How do I Renew my Car Insurance Policy With Allstate?“

- Accident Forgiveness: Allstate provides accident forgiveness, which may help auto insurance for DUI drivers avoid premium spikes.

Cons

- Higher Rates: Allstate’s rates are on the higher side at $120/month for minimum coverage post-DUI.

- Limited Discount Opportunities: Fewer discounts are available for drivers with DUI records compared to competitors.

#10 — Farmers: Best for Local Agents

Pros

- Flexible DUI Coverage: Farmers offers flexible plans tailored for DUI drivers in Texas at $71 per month for minimum coverage.

- Customizable Policies: Provides a wide range of policy add-ons for DUI drivers.

- Strong Mobile App: Offers a robust mobile app for managing policies and filing claims easily.

Cons

- Higher Premiums for Full Coverage: Full coverage for DUI drivers can be more expensive. Find out our guide “What Documentation Do I Need to File a Car Insurance Claim with Farmers Insurance?“

- Fewer Discounts for DUI Drivers: Limited discounts specifically for the best insurance for DUI offenders drivers in Texas.

DUI Affects Your Car Insurance Rates in Texas

A DUI in Texas leads to higher car insurance for drivers with DUI premiums, as insurers view these drivers as high-risk. State Farm, Geico, and Amica offer lower rates for cheap car insurance after DUI drivers, with minimum coverage starting at $42 per month, while Allstate and Liberty Mutual charge up to $120 or more. Look through our guide “Will Car Insurance Rates Increase After a DUI?“

Texas DUI Car Insurance Monthly Rates by Provider & Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $57 | $148 |

| $120 | $323 | |

| $72 | $195 | |

| $86 | $283 | |

| $42 | $107 |

| $71 | $191 | |

| $45 | $120 | |

| $119 | $320 |

| $59 | $159 | |

| $55 | $149 |

Full coverage rates also vary widely, with Geico and Erie offering affordable options at $120 and $107, respectively. Allstate and Liberty Mutual have the highest rates, exceeding $320 per month. Shopping around can help DUI drivers find more affordable coverage.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Understanding DUI and Its Impact on Car Insurance

DUI, or “Driving Under the Influence,” refers to operating a vehicle while impaired by alcohol or drugs. The best insurance, if you have a conviction, can severely affect your car insurance for dual driver rates, as insurers view it as high-risk behavior that signals an increased chance of future accidents. Consequently, insurance premiums tend to rise significantly after the best auto insurance with a DUI conviction.

Texas Accidents & Claims per Year by City| City | Accidents per Year | Claims per Year |

|---|---|---|

| Austin | 1,000 | $850 |

| Dallas | 1,600 | $1,300 |

| Fort Worth | 800 | $700 |

| Houston | 1,800 | $1,500 |

| San Antonio | 1,200 | $1,000 |

A DUI is a criminal offense that occurs when a driver exceeds the legal blood alcohol concentration (BAC) limit, which varies by state. For instance, in Texas, the legal BAC limit is 0.08%. If a driver’s BAC surpasses this threshold, they can be charged for the best car insurance for someone with a DUI.

Understanding the legal limits and the seriousness of DUI offenses is essential, as these convictions not only result in legal consequences but also long-term financial impacts, particularly on car insurance rates. View our guide, “How Does a Moving Violation Affect Car Insurance?”

How a DUI Affects Your Car Insurance Rates

A DUI conviction leads to higher car insurance rates due to increased risk. The Best auto insurance companies for DUI drivers see DUIs as indicators of reckless behavior, making drivers more likely to file future claims. To account for this, insurers adjust premiums significantly, reflecting the added financial risk. (Read more: Why Auto Insurance Rates go up).

5 Most Common Auto Insurance Claims in Texas| Claim Type | Portion of Claims | Cost per Claim |

|---|---|---|

| Rear-end Collision | 28% | $4,500 |

| Single Vehicle Accident | 20% | $6,200 |

| Weather-related Damage | 18% | $5,800 |

| Animal Collision | 14% | $3,600 |

| Vandalism/Theft | 10% | $3,000 |

Drivers seeking car insurance quotes with DUI convictions often need an SR-22 certificate, which verifies they have the required liability insurance. This form is commonly required for serious offenses like the best car insurance companies for DUI. Insurers charge higher rates to drivers with an SR-22, as it highlights a higher risk profile, further raising premiums.

The effects of the best car insurance after DUI in the last several years, as insurers continue to assess risk. Drivers may also lose eligibility for discounts offered for clean driving records, compounding the increase. The extent of these impacts varies by location and insurer, so comparing coverage options is essential.

Texas DUI Laws and Penalties

In Texas, driving under the influence (DUI) carries serious legal consequences. Drivers aged 21 or older are prohibited from driving with a blood alcohol concentration (BAC) of 0.08% or higher. Even if you feel capable of driving, exceeding this limit can lead to the best insurance after DUI charges.

Car Insurance Discounts From the Top Providers After a DUI in Texas| Insurance Company | Discount Percentage | Discount Program |

|---|---|---|

| 15% | Defensive Driver Discount |

| 11% | Early Signing Discount | |

| 17% | Smart Home Discount | |

| 18% | Loyalty Discount | |

| 12% | Multi-Policy Discount |

| 19% | Bundled Insurance Discount | |

| 10% | Good Student Discount | |

| 9% | Accident-Free Discount |

| 16% | Paperless Billing Discount | |

| 14% | Safe Driver Discount |

For drivers under 21, Texas enforces a zero-tolerance policy with a legal BAC limit of 0.02%. Commercial drivers face even stricter regulations, as any detectable amount of alcohol in their system can result in a DUI charge. Learn from our guide “First DUI: What you Should Know.”

Texas also has an implied consent law, meaning drivers automatically consent to chemical testing for intoxication when they receive a license. Refusing these tests can lead to immediate license suspension and additional penalties.

Penalties for DUI in Texas

DUI penalties in Texas vary based on prior convictions and the driver’s age. For a first-time offense, fines can reach up to $2,000, and your driver’s license may be suspended for up to a year, severely affecting daily life. In some cases, an ignition interlock device may be required to prevent starting your vehicle if alcohol is detected.

Create a Personal Price Plan® and you could be inducted in the Hall of Bundles. 🏆 pic.twitter.com/vtcp3owWmY

— State Farm (@StateFarm) September 19, 2024

Repeated offenses result in harsher penalties. A second DUI can lead to fines up to $4,000, longer license suspensions, mandatory community service, and possibly jail time. These escalating penalties aim to discourage repeat violations and protect public safety.

Understanding DUI laws and penalties in Texas is crucial. Prioritizing safe driving habits not only protects you but also ensures the safety of others on the road. Responsible choices regarding alcohol and driving are essential to avoid legal consequences and reduce the risk of accidents.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Evaluating Car Insurance Companies After a DUI

When seeking car insurance after a DUI, it’s essential to thoroughly evaluate different insurance companies. Not all providers handle the best auto insurance for DUI convictions in the same way, so it’s vital to consider specific factors.

After a car insurance quote for a DUI conviction, finding car insurance can be a challenging task. Insurance companies typically view DUI convictions as high-risk behavior, often resulting in increased premiums. Check our guide “Does Auto Insurance Cover DUI Accidents?”

Texas Report Card: Auto Insurance Premiums| Category | Grade | Explanation | |

|---|---|---|---|

| Overall Affordability | B+ | Premiums are moderately higher than the national average. | |

| Coverage Options | A | Most insurers offer diverse coverage options. | |

| Customer Service | B | Customer satisfaction is generally good but varies. | |

| Claims Processing | B- | Some delays in processing, but overall decent. | |

| Discount Availability | A- | Various discounts are offered by major providers. |

However, each company may have its own underwriting guidelines, which can vary in how they assess driving records. Some insurers may specialize in higher-risk drivers and offer more competitive rates for those best insurance with a DUI conviction. That’s why it’s crucial to shop around and compare quotes from multiple providers.

Factors to Consider When Choosing an Insurance Company

When evaluating insurance companies, consider the following factors:

- Their experience in handling DUI cases and their overall reputation: It’s important to choose an insurance company that has experience dealing with DUI convictions. They should have a good understanding of the legal and financial implications and be able to provide the necessary support and guidance.

- Customer reviews and ratings: Reading customer reviews and ratings can give you a sense of the insurance company’s customer service quality. Look for feedback from other drivers who have had DUI convictions and see how their claims were handled.

- Their coverage options and additional services: It’s essential to assess the coverage options offered by different insurance companies. Look for policies that provide adequate protection for your needs. Additionally, consider any additional services they may offer, such as roadside assistance or accident forgiveness programs.

- Their rates and discounts: The cost of car insurance is a significant consideration for most drivers. When comparing insurance companies, pay attention to the rates they offer for drivers with DUI convictions. Some companies may provide discounts or special programs specifically tailored to this demographic.

By thoroughly evaluating these factors, you can make an informed decision when choosing an insurance company after a DUI conviction. Remember, the right insurance provider can help you navigate the challenges of post-DUI insurance and provide the support you need.

Tips to Lower Your Insurance Rates After a DUI

While insurance rates tend to increase after a DUI conviction, there are steps you can take to potentially lower your premiums:

Completing a DUI Education Program

Many states, including Texas, require individuals convicted of a DUI to complete a DUI education program. By successfully completing this program, you may demonstrate to insurance companies that you are taking steps to become a safer driver, possibly resulting in lower rates.

Maintaining a Clean Driving Record

Consistently practicing safe driving habits and avoiding any additional traffic violations or accidents can help improve your insurance rates over time. Insurance companies consider your overall driving record when calculating premiums, so a clean record can have a positive impact. To dive deeper, refer to our complete guide titled “Get Low-Cost Car Insurance With Driver Discounts.”

Shopping Around for the Best Rates

Although rates for drivers with a DUI conviction are typically higher, shopping around and comparing quotes from different insurance providers can help you find the most affordable coverage. Each company has its own underwriting guidelines, so rates can vary significantly. Take the time to gather multiple auto insurance quotes with DUI to ensure you find the best rates available.

Texas Report Card: Auto Insurance Discounts| Discount Name | Grade | Savings | Participating Providers |

|---|---|---|---|

| Good Driver Discount | A | 15% | State Farm, Progressive, Geico |

| Multi-Policy Discount |  A- | 10% | Allstate, Farmers, Liberty Mutual |

| Safe Vehicle Discount |  B+ | 8% | Geico, Nationwide, USAA |

| Defensive Driving Course | B | 6% | Liberty Mutual, Allstate |

| Low Mileage Discount |  B- | 5% | State Farm, Progressive |

By understanding the impact of a DUI on your car insurance rates, familiarizing yourself with Texas DUI laws, evaluating insurance companies, and following these tips, you can find the best car insurance options for drivers with a DUI in Texas.

Remember, it’s important to compare quotes and consider the reputation and policies of different providers before making a decision. With the right research and approach, you can secure the coverage you need at a price that fits your budget.

Case Studies: Car Insurance After a DUI in Texas

Understanding how insurance providers support drivers with a DUI can help in making informed choices. Here are three concise case studies highlighting their approaches.

- Case Study #1 — State Farm: State Farm effectively supports drivers’ car insurance with two DUIs by offering personalized service. One driver faced high premiums after a DUI but received tailored options from State Farm, including discounts for completing a defensive driving course. This approach not only reduced their premiums but also provided valuable customer support during a challenging time.

- Case Study #2 — Geico: Geico stands out for its flexibility in handling DUI cases. A customer previously struggled to find affordable coverage but found multiple policy options with Geico. The insurer also incentivized safe driving courses, which helped lower the driver’s premiums over time, making it a solid choice for high-risk individuals.

- Case Study #3 — Amica: Amica prioritizes customer service for the best car insurance rates for DUI clients. A driver who had difficulty securing affordable insurance turned to Amica, which offered discounts for safe driving and bundled policies. This tailored support led to a satisfactory coverage plan that fit the driver’s budget while emphasizing Amica’s commitment to high-risk clients.

In summary, these case studies illustrate the varying strategies that insurance providers employ to assist drivers with a DUI. For additional insights, refer to our detailed guide titled “Full Coverage Auto Insurance.”

Jimmy McMillan Licensed Insurance Agent

By exploring options from companies like State Farm, Geico, and Amica, individuals can find the best insurance solutions tailored to their needs. Enter your ZIP code below in our free tool to start seeing quotes today.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Can I get car insurance in Texas if I have a DUI on my record?

Yes, you can still get car insurance in Texas with a DUI. However, insurers may classify you as high-risk, which typically results in higher premiums. You can also enter your ZIP code below into our free comparison tool to start comparing rates now.

Why do insurance companies consider DUI drivers high risk?

Drivers with a DUI are considered auto insurance for high risk drivers in Texas due to their increased likelihood of accidents, leading to more claims and higher costs for insurers. To learn more, consult our in-depth guide titled “Do I Need Multiple Policies to get Enough Coverage?”

How much will my car insurance rates increase after a DUI in Texas?

Rates can rise significantly after a DUI. On average cost of car insurance per month in texas, premiums may increase by 50-100%, depending on the insurer and other factors.

Will I need an SR-22 after a DUI in Texas?

Yes, after a DUI in Texas, you may need an SR-22, which is a certificate proving you meet the state’s minimum liability insurance requirements.

Are there insurance companies that specialize in high-risk drivers after a DUI?

Yes, companies like State Farm, Geico, and Amica offer coverage for high-risk drivers with competitive rates. To gain additional insights, check out out comprehensive guide titled “How does the insurance company determine my premium?”

How long does a DUI affect car insurance rates in Texas?

A DUI typically affects your rates for 3-5 years, depending on the severity of the offense and the insurer’s policies.

Can I lower my insurance rates after a DUI?

Yes, completing DUI education programs, maintaining a clean driving record, and shopping around for quotes can help lower your rates. To acquire more information, review our in-depth guide titled “What Car Insurance Discounts Does Many Insurance Company Offer?”

What is the best insurance company for DUI drivers in Texas?

State Farm, Geico, and Amica are top choices for DUI drivers, offering competitive rates and tailored coverage options.

Do insurance companies offer discounts to DUI drivers?

Some companies may offer discounts to DUI drivers who complete defensive driving courses or install vehicle tracking devices. Uncover our guide titled “Can I Bundle my Progressive Car Insurance With Other Policies?”

Can a DUI prevent me from getting discounts on my car insurance?

Yes, a DUI may disqualify you from safe driving discounts, but some companies offer other discounts that you may still qualify for. See how much you’ll pay for car insurance by entering your ZIP code below into our free comparison tool .

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.