Best Car Insurance for Ontrac Drivers in 2024 (Your Guide to the Top 10 Companies)

The best car insurance for Ontrac drivers features State Farm, Progressive, and Liberty Mutual, with rates starting at $105 per month. These top providers offer comprehensive coverage, competitive rates, and excellent customer service, ensuring Ontrac drivers get the protection they need.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Mary Martin

Published Legal Expert

Mary Martin has been a legal writer and editor for over 20 years, responsible for ensuring that content is straightforward, correct, and helpful for the consumer. In addition, she worked on writing monthly newsletter columns for media, lawyers, and consumers. Ms. Martin also has experience with internal staff and HR operations. Mary was employed for almost 30 years by the nationwide legal publi...

Published Legal Expert

UPDATED: Sep 20, 2024

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: Sep 20, 2024

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

13,128 reviews

13,128 reviewsCompany Facts

Full Coverage for Ontrac Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

13,128 reviews

13,128 reviews 3,607 reviews

3,607 reviewsCompany Facts

Full Coverage for Ontrac Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

3,607 reviews

3,607 reviewsThe top pick overall for the best car insurance for Ontrac drivers are State Farm, Progressive, and Liberty Mutual, with starting rates of $105 per month.

This article examines these leading providers, evaluating coverage options, premium costs, and customer service to help Ontrac drivers secure the best rates and tailored protection for their needs.

Our Top 10 Company Picks: Best Car Insurance for Ontrac Drivers| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Reliable Discounts | State Farm | |

| #2 | 12% | A+ | Snapshot Program | Progressive | |

| #3 | 20% | A | Customized Coverage | Liberty Mutual |

| #4 | 15% | A+ | Safe Driver | Allstate | |

| #5 | 10% | A+ | Vanishing Deductible | Nationwide |

| #6 | 18% | A | Business Auto | Farmers | |

| #7 | 10% | A+ | Accident Forgiveness | The Hartford |

| #8 | 15% | A | Discount Availability | American Family | |

| #9 | 14% | A | Package Deals | Safeco | |

| #10 | 13% | A++ | Intellidrive Program | Travelers |

Discover how these top companies stand out and choose the insurance that best fits your driving requirements (Read more: Best Life Insurance Policies for Ontrac Drivers).

Affordable car insurance rates are just a click away. Enter your ZIP code into our free quote tool above to find the best policy for you.

- Best car insurance for Ontrac drivers starts at $105/month with tailored coverage

- Ontrac drivers can lower premiums by bundling and safe driving

- State Farm is the top pick with competitive rates and coverage

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

#1 — State Farm: Top Overall Pick

Pros

- Comprehensive Coverage: State Farm excels in offering extensive coverage for Ontrac drivers. Learn more in our State Farm insurance review.

- Low Monthly Rates: Offers affordable rates at $110 per month for Ontrac drivers with minimum coverage.

- Bundling Options: State Farm provides solid discounts for bundling policies, allowing Ontrac drivers to save more.

Cons

- Limited Multi-Policy Discount: State Farm’s bundling discount may be smaller than some Ontrac drivers competitors.

- Premium Costs: Even with discounts, premiums can still be on the higher side for Ontrac drivers full coverage.

#2 — Progressive: Best for Snapshot Program

Pros

- Flexible Coverage: Progressive insurance review provides customizable coverage plans for Ontrac drivers.

- Low Minimum Rates: Charges a reasonable $115 per month for Ontrac drivers with minimum coverage.

- Snapshot Program: Progressive offers discounts through its Snapshot program for safe Ontrac drivers.

Cons

- Claim Processing Speed: Progressive’s claim handling can sometimes be slower compared to Ontrac drivers competitors.

- Higher Premiums: Full coverage rates for Ontrac drivers may be slightly higher than the industry average.

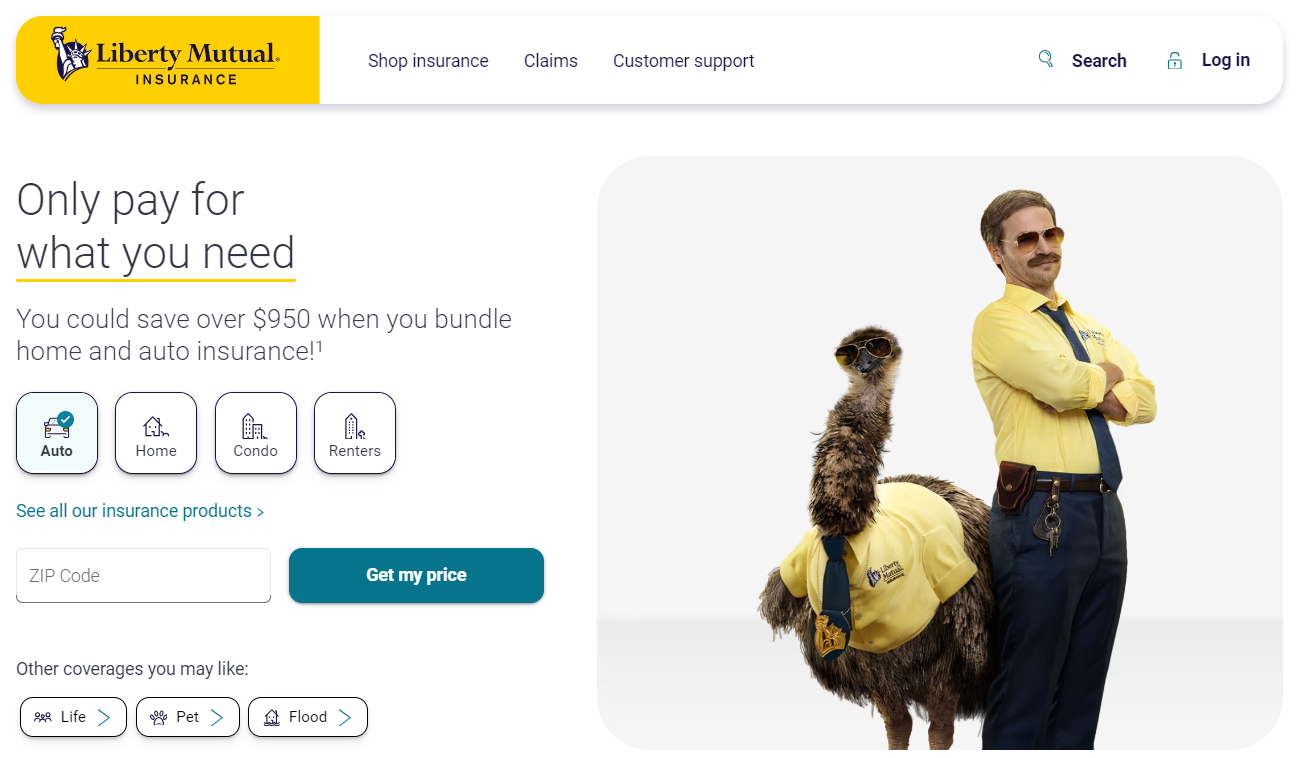

#3 — Liberty Mutual: Best for Customized Coverage

Pros

- Comprehensive Driver Discounts: Liberty Mutual offers a wide range of discounts for Ontrac drivers.

- Competitive Minimum Rate: Liberty Mutual provides minimum coverage starting at $120 per month for Ontrac drivers (Read More: Liberty Mutual Auto Insurance Review).

- Accident Forgiveness: Liberty Mutual includes accident forgiveness, ensuring rates don’t increase for Ontrac drivers after one accident.

Cons

- Higher Premiums: Despite the discounts, premiums for full coverage can be on the higher end for Ontrac drivers.

- Limited Customization: Customization options for coverage may be more limited compared to Ontrac drivers providers.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

#4 — Allstate: Best for Safe Driver

Pros

- Superior Customer Support: Allstate is known for its excellent customer service, benefiting Ontrac drivers.

- Reasonable Minimum Coverage Rates: Offers rates at $125 per month for minimum coverage for Ontrac drivers.

- Claim Satisfaction Guarantee: Allstate auto insurance review provides a unique claim satisfaction guarantee to ensure Ontrac drivers get quality service.

Cons

- High Premium Rates: Allstate’s full coverage rates tend to be higher than many Ontrac drivers providers.

- Limited Discount Opportunities: Discounts for Ontrac drivers may not be as extensive as with other insurers.

#5 — Nationwide: Best for Vanishing Deductible

Pros

- High Customer Satisfaction: Nationwide consistently ranks well in customer service for Ontrac drivers.

- Affordable Minimum Coverage: Offers minimum coverage at $105 per month, competitive for Ontrac drivers.

- Vanishing Deductible: Nationwide’s vanishing deductible feature rewards safe Ontrac drivers by reducing deductibles over time.

Cons

- Higher Rates for Full Coverage: Full coverage auto insurance plans can become expensive for Ontrac drivers compared to other providers.

- Fewer Customization Options: Policy options may not be as flexible as other competitors for Ontrac drivers.

#6 — Farmers: Best for Business Auto

Pros

- Robust Full Coverage: Farmers insurance review is known for its comprehensive full coverage, ideal for Ontrac drivers.

- Competitive Minimum Coverage Rate: Farmers charges $130 per month for Ontrac drivers with minimum coverage.

- Multi-Policy Discounts: Offers attractive discounts when bundling home and auto insurance for Ontrac drivers.

Cons

- High Premiums: Farmers’ full coverage rates are higher than some competitors for Ontrac drivers.

- Limited Availability: Farmers’ coverage is not available in all states, which may affect some Ontrac drivers.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

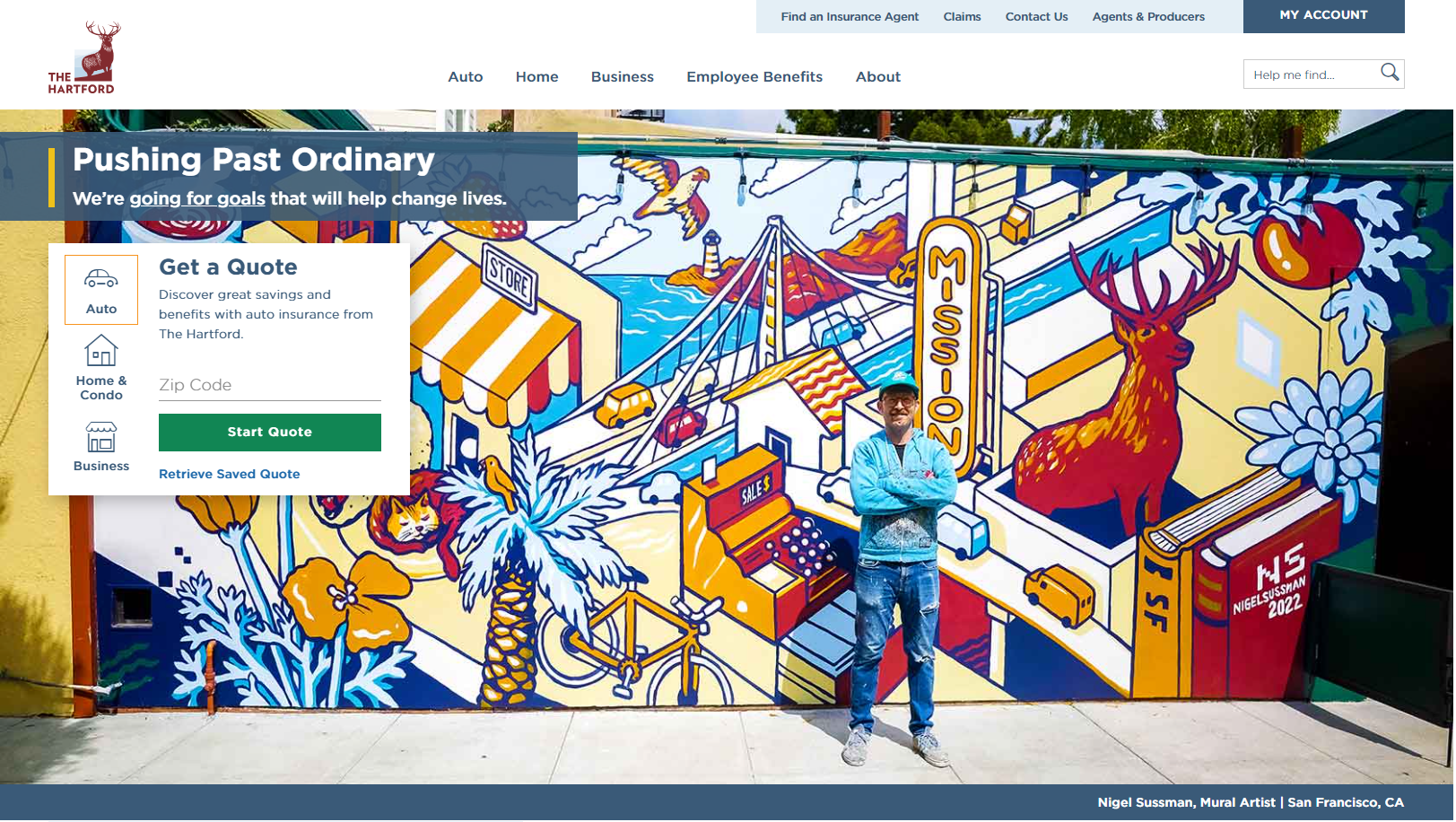

#7 — The Hartford: Best for Accident Forgiveness

Pros

- Tailored for Seniors: The Hartford specializes in policies designed for older Ontrac drivers.

- Minimum Coverage Rate: Offers competitive minimum coverage rates starting at $135 per month for Ontrac drivers.

- AARP Discounts: Provides significant discounts for AARP members who are Ontrac drivers.

Cons

- Limited Appeal for Younger Drivers: The Hartford’s policies may not be as appealing for younger Ontrac drivers. To learn more, consult our in-depth guide titled “How do I Renew my Car Insurance Policy With The Hartford?“

- Higher Premiums for Non-AARP Members: Ontrac drivers who are not AARP members may face higher premiums.

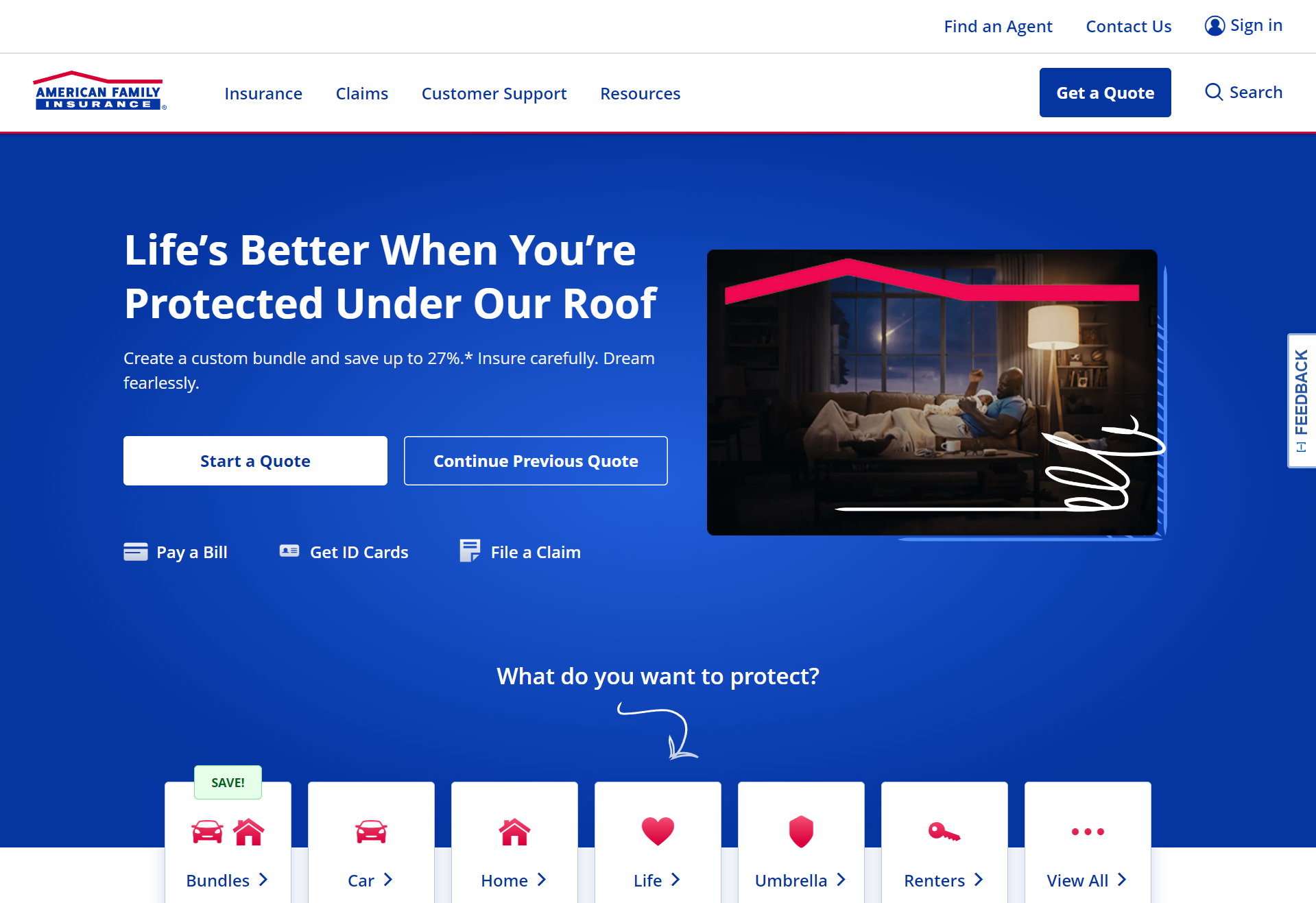

#8 — American Family: Best for Discount Availability

Pros

- Personalized Customer Service: American Family is known for its personalized service to Ontrac drivers (Read more: What Types of Car Insurance Coverage Does American Family Insurance Offer?).

- Affordable Minimum Coverage: Rates start at $118 per month for Ontrac drivers needing minimum coverage.

- Excellent Discounts: Offers numerous discounts, including safe driver and loyalty discounts for Ontrac drivers.

Cons

- Limited Availability: American Family’s coverage is not available in all states, which limits options for Ontrac drivers.

- Higher Full Coverage Premiums: Full coverage premiums can be higher than other competitors for Ontrac drivers.

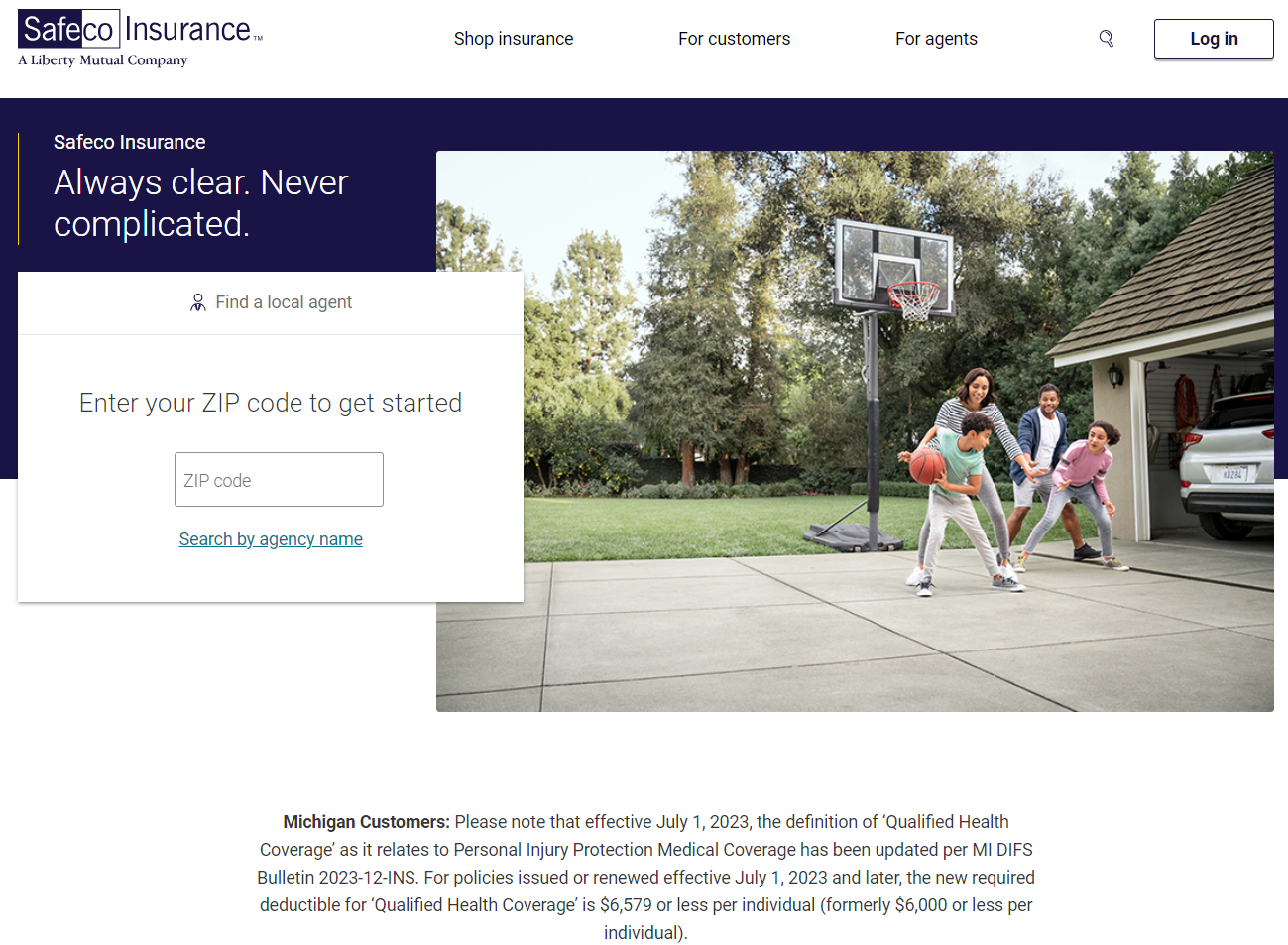

#9 — Safeco: Best for Package Deals

Pros

- Strong Bundling Discounts: Safeco insurance review offers significant discounts for bundling policies, helping Ontrac drivers save.

- Competitive Minimum Coverage: Offers $127 per month for minimum coverage for Ontrac drivers.

- Emergency Roadside Assistance: Provides robust roadside assistance coverage, ideal for Ontrac drivers.

Cons

- High Full Coverage Premiums: Full coverage rates are higher than many other providers for Ontrac drivers.

- Limited Online Tools: Safeco’s online interface and tools may be less user-friendly for Ontrac drivers.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

#10 — Travelers: Best for Intellidrive Program

Pros

- Safe Driver Incentives: Travelers offers significant discounts for safe Ontrac drivers. For more insights, consult our complete guide titled “How can I pay my Travelers Insurance Premium?“

- Affordable Minimum Coverage Rate: Provides $112 per month for Ontrac drivers with minimum coverage.

- Extensive Coverage Options: Travelers offers a variety of coverage plans tailored to Ontrac drivers.

Cons

- Slow Claim Processing: Travelers’ claim processing may be slower compared to Ontrac drivers.

- Higher Full Coverage Rates: Full coverage plans for Ontrac drivers can be relatively expensive.

Tips for Reducing Insurance Costs for Ontrac Drivers

Ontrac drivers face unique risks on the road, often leading to higher insurance premiums. However, there are effective ways to reduce these costs. When selecting the best auto insurance provider, it’s essential to consider factors like coverage options, premium costs, and customer service.

Ontrac Driver Car Insurance Monthly Rates by Provider & Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $125 | $220 | |

| $118 | $205 | |

| $130 | $225 | |

| $120 | $215 |

| $105 | $200 |

| $115 | $210 | |

| $127 | $227 | |

| $110 | $195 | |

| $135 | $230 |

| $112 | $208 |

Safe driving discounts can significantly lower insurance premiums. Many providers offer discounts for maintaining a clean driving record, making safe driving habits crucial for saving money and promoting road safety.

Another strategy is to bundle your auto insurance with other policies, such as home or renters insurance. Many companies provide discounts for consolidating multiple policies, leading to potential savings.

Opting for a higher deductible is another way to reduce premiums. This increases your financial responsibility in case of an accident, but it’s important to ensure the deductible is affordable.

Insurance costs for Ontrac drivers vary based on factors such as vehicle type, driving experience, and location. By comparing quotes from different providers, you can find the most competitive rates for your situation.

In summary, Ontrac drivers should carefully evaluate coverage options, premiums, and customer service. Utilizing discounts, bundling policies, and adjusting deductibles can help lower insurance costs while ensuring adequate coverage. Check out on our guide “Get Low Cost Car Insurance With Driver Discounts.”

Understanding Auto Insurance for Ontrac Drivers

Before diving into the specifics of auto insurance for Ontrac drivers, let’s first understand what Ontrac is. Ontrac is a delivery service that specializes in same-day shipment. They don’t just deliver packages; they offer a wide range of delivery options, including ground delivery and expedited shipping.

Ontrac operates in several states and prides itself on providing fast and reliable delivery services to businesses and consumers alike. Their extensive network allows them to reach customers in urban and suburban areas, ensuring that packages are delivered promptly and efficiently.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Ontrac’s Commitment to Customer Satisfaction

Ontrac’s commitment to customer satisfaction is evident in their dedication to timeliness. They understand that in today’s fast-paced world, people expect their packages to arrive quickly. Whether it’s a last-minute gift or an urgent business document, Ontrac ensures that the delivery is made on time, every time. Explore more insight in our guide “Best Auto Insurance Discounts for Ontrac Drivers.”

Bundle is life! Can’t argue with that logic. 🏠 + 🚗https://t.co/uNYjYTKwoU pic.twitter.com/RRoMMaYbbc

— State Farm (@StateFarm) August 28, 2024

With a fleet of vehicles and a team of skilled drivers, Ontrac is able to handle a variety of delivery needs. From small packages to large shipments, they have the resources to transport items of all sizes. Their efficient tracking system allows customers to monitor the progress of their deliveries, providing peace of mind and transparency.

Specific Insurance Needed for Ontrac Drivers

Ontrac drivers often face unique challenges on the road due to the time-sensitive nature of their deliveries. They may need to drive faster than the average driver to meet delivery deadlines. This increased speed can lead to a higher risk of accidents, which is why specific insurance is needed to address these unique risks.

Car Insurance Discounts from the Top Providers for Ontrac Drivers| Insurance Company | Available Discounts |

|---|---|

| Safe driver, Multi-policy, Anti-lock brakes, Anti-theft device, Early signing, New car, Autopay, Paperless, Full payment, Responsible payer, Deductible rewards | |

| Multi-policy, Safe driver, Defensive driver, Accident-free, Good student, Loyalty, Early signing, Low mileage, Steer into savings, Generational discount | |

| Multi-policy, Safe driver, Good student, Anti-theft, New car replacement, Pay-in-full, Electronic billing, Occupational, Homeowner, Signal (usage-based) discount | |

| Multi-policy, Homeowner, Good student, Anti-theft, Advanced safety features, Early shopper, Alternative energy, Violation-free, RightTrack (usage-based), Military |

| Multi-policy, SmartRide (usage-based), SmartMiles (pay-per-mile), Good student, Accident-free, Anti-theft, Safe driver, Defensive driver, Paperless, Autopay |

| Multi-policy, Multi-vehicle, Snapshot (usage-based), Homeowner, Continuous insurance, Good student, Online quote, Pay-in-full, Paperless, Safe driver | |

| Multi-policy, Multi-vehicle, Safe driver, Good student, Accident prevention, Defensive driving course, New vehicle, Anti-theft, Violation-free, RightTrack (usage-based) | |

| Multi-policy, Multi-vehicle, Safe driver, Defensive driving course, Accident-free, Good student, Driver training, Passive restraint, Anti-theft, Steer Clear (usage-based) | |

| Bundling, Vehicle safety, Defensive driver course, Anti-theft, Good student, Driver training, Paid-in-full, AARP membership, Airbags, Hybrid/electric vehicle, Continuous coverage |

| Multi-policy, Multi-car, Homeownership, Safe driver, Continuous insurance, Hybrid/electric vehicle, New car, Pay-in-full, Paperless, Good payer, IntelliDrive (usage-based) |

Auto insurance for Ontrac drivers takes into account the specific needs and risks associated with their job. It provides coverage for potential damages to the vehicle, liability protection in case of accidents, and coverage for any injuries sustained by the driver or others involved in an incident. Explore our guide titled “Best Liability-Only Car Insurance.”

Furthermore, Ontrac drivers may be required to transport valuable or fragile items, which adds another layer of complexity to their insurance needs. Specialized insurance policies can provide coverage for these types of items, ensuring that both the driver and the customer are protected in the event of loss or damage.

Additionally, Ontrac drivers may be required to drive long distances or work irregular hours, which can contribute to driver fatigue. Insurance policies may include provisions to address these concerns, such as coverage for medical expenses related to fatigue-related accidents or access to resources for driver wellness and rest.

Overall, specific insurance for Ontrac drivers is essential to protect both the drivers and the company from the unique risks they face on the road. By addressing these risks with tailored coverage, Ontrac can continue to provide their customers with fast and reliable delivery services while ensuring the safety and well-being of their drivers.

Factors to Consider When Choosing Auto Insurance

When selecting auto insurance for Ontrac drivers, there are several factors to keep in mind:

Auto insurance is an essential aspect of owning a vehicle. It provides financial protection in case of accidents, theft, or damage to your vehicle. However, choosing the right auto insurance policy can be a daunting task. To ensure you make an informed decision, here are some key factors to consider. Read up more information in our guide “Negotiating Your Car Accident Insurance Settlement.”

Coverage Options

It is essential to choose an insurance policy that provides adequate coverage for both your vehicle and liability in the event of an accident. This includes collision coverage, comprehensive coverage, and liability coverage.

Collision coverage protects your vehicle in case of accidents, regardless of who is at fault. Comprehensive coverage, on the other hand, covers damages caused by incidents other than collisions, such as theft, vandalism, or natural disasters. Liability coverage is crucial as it protects you financially if you are at fault in an accident and cause damage to someone else’s property or injure them.

When considering coverage options, it’s important to assess your needs and the value of your vehicle. If you have a new or expensive car, comprehensive coverage might be a wise choice. However, if your vehicle is older or has a low market value, you might consider adjusting your coverage accordingly to save on premiums.

Cost of Premiums

The cost of insurance premiums is a crucial factor for Ontrac drivers to consider. Look for insurance providers that offer competitive rates while still providing the necessary coverage.

Insurance premiums can vary significantly depending on factors such as your age, driving record, location, and the type of vehicle you drive. It’s essential to obtain quotes from multiple insurance companies to compare prices and find the most affordable option that meets your coverage needs.

While it may be tempting to opt for the cheapest premium, be cautious of extremely low rates, as they may indicate limited coverage or poor customer service. Strike a balance between affordability and adequate coverage to ensure you are protected financially in case of an accident.

Customer Service and Claims Processing

In the event of an accident, the customer service and claims process of your insurance provider can make a significant difference. Look for insurance companies that have a reputation for excellent customer service and efficient claims processing.

Dealing with insurance claims can be a stressful experience, especially during an already challenging time after an accident. A reliable insurance company should have a dedicated claims department that provides prompt and efficient assistance. Research customer reviews and ratings to gauge the level of customer satisfaction with different insurance providers.

Additionally, consider the accessibility and responsiveness of the insurance company’s customer service. Are they available 24/7? Do they have a user-friendly online platform for managing policies and filing claims? These factors can greatly enhance your overall experience and peace of mind.

By carefully considering these factors, Ontrac drivers can make an informed decision when choosing auto insurance. Remember, auto insurance is not just a legal requirement but also a vital financial safeguard. Take the time to research, compare quotes, and evaluate the coverage options to find the best policy that suits your needs and budget.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Top Auto Insurance Providers for Ontrac Drivers

Now that we have covered the factors to consider, let’s take a look at some of the top insurance providers for Ontrac drivers:

State Farm Provider

State Farm offers comprehensive coverage options specifically tailored to Ontrac drivers. They understand the unique risks that Ontrac drivers face on the road and have designed insurance plans to meet those needs. With their extensive knowledge and experience in the industry, State Farm is well-equipped to provide the best coverage for Ontrac drivers.

One of the key reasons why State Farm stands out is their reputation for excellent customer service. They prioritize customer satisfaction and go above and beyond to ensure their clients are well taken care of. Whether it’s answering questions, assisting with claims, or providing guidance on coverage options, State Farm’s customer service team is known for their professionalism and efficiency.

In addition to their exceptional customer service, State Farm also offers competitive premiums. They understand that affordability is an important factor for Ontrac drivers, and they strive to provide insurance plans that are both comprehensive and cost-effective. By offering competitive rates, State Farm ensures that Ontrac drivers can protect themselves and their vehicles without breaking the bank.

Progressive Provider

Progressive is another top insurance provider that understands the unique risks Ontrac drivers face on a daily basis. They have customized insurance options specifically designed to meet the needs of Ontrac drivers, providing them with the peace of mind they deserve while on the road.

One of the standout features of Progressive is their fast claims processing. They recognize that accidents and incidents can happen at any time, and they strive to make the claims process as smooth and efficient as possible. By streamlining the claims process, Progressive ensures that Ontrac drivers can get back on the road quickly, minimizing any disruptions to their work.

In addition to their focus on claims processing, Progressive is dedicated to customer satisfaction. They value their clients and prioritize their needs, ensuring that every interaction with their customer service team is met with professionalism and respect. Whether it’s answering questions, addressing concerns, or providing guidance, Progressive’s customer service team is committed to delivering top-notch service.

Liberty Mutual Provider

Liberty Mutual has established itself as a trusted name in the insurance industry, making them a reliable choice for Ontrac drivers. They offer comprehensive coverage that goes above and beyond the basic requirements, providing Ontrac drivers with the peace of mind they need while on the road.

One of the key advantages of choosing Liberty Mutual is their competitive rates. They understand that affordability is important for Ontrac drivers, and they strive to offer insurance plans that are both comprehensive and cost-effective. By providing competitive rates, Liberty Mutual ensures that Ontrac drivers can protect themselves and their vehicles without straining their budget.

In addition to their competitive rates, Liberty Mutual is known for their exceptional customer service. They believe in building strong relationships with their clients and are committed to providing the best service possible. Whether it’s assisting with claims, answering inquiries, or offering guidance, Liberty Mutual’s customer service team is dedicated to ensuring their clients’ satisfaction.

Overall, Liberty Mutual is a reliable choice for Ontrac drivers who are looking for comprehensive coverage, competitive rates, and exceptional customer service. Browse more insights in our guide “Best Life Insurance Policies for Ontract Drives.”

Case Studies: Tailored Insurance Solutions for Ontrac Drivers

To understand how specialized insurance can benefit Ontrac drivers, let’s examine real-life scenarios where tailored coverage made a significant difference. These case studies highlight the effectiveness of different insurance options in addressing the unique challenges faced by Ontrac drivers.

- Case Study #1 — Comprehensive Coverage with State Farm: John Smith, an Ontrac driver, had his vehicle damaged in a delivery accident. State Farm’s comprehensive coverage paid for repairs and rental expenses, allowing John to continue working with minimal interruption. This case underscores the value of comprehensive coverage for Ontrac drivers.

- Case Study #2 — Savings with Progressive’s Snapshot Program: Emma Lee, using Progressive’s Snapshot Program, saved on her premiums by demonstrating safe driving. The program rewarded her good driving habits with significant discounts, showing how tech-driven programs can lower insurance costs for Ontrac drivers.

- Case Study #3 — Tailored Coverage from Liberty Mutual: Mark Johnson required specialized insurance for his high-value delivery vehicle. Liberty Mutual provided customized coverage that included enhanced liability protection for valuable items. This case highlights the benefits of tailored coverage for Ontrac drivers with unique needs.

These case studies illustrate the impact of choosing the right insurance coverage for Ontrac drivers. By selecting policies that match specific needs and driving habits, drivers can ensure they are well-protected and potentially reduce their costs.

Brad Larson Licensed Insurance Agent

Tailored insurance solutions offer crucial benefits, enhancing both financial security and peace of mind on the road. Uncover our guide titled “Restoration of Benefits.” Affordable car insurance rates are just a click away. Enter your ZIP code into our free quote tool below to find the best policy for you.

Frequently Asked Questions

How do Ontrac drivers qualify for discounts?

Safe driving habits, bundling policies, and maintaining a clean driving record are common ways to qualify for discounts. Check out our guide “What car insurance discounts does affinity mutual insurance company offer?”

What is Ontrac?

Ontrac is a delivery service specializing in same-day and expedited shipments across several U.S. states. See how much you’ll pay for car insurance by entering your ZIP code below into our free comparison tool.

Why do Ontrac drivers need specific car insurance?

Ontrac drivers face higher risks due to tight delivery deadlines, making specialized insurance essential for protecting both their vehicle and liability in case of accidents.

Does Ontrac provide car insurance for drivers?

No, Ontrac drivers are typically independent contractors, responsible for securing their own insurance coverage.

What types of car insurance should Ontrac drivers consider?

Liability, comprehensive, collision, and uninsured/underinsured motorist coverage are essential for Ontrac drivers. Browse for more information in our guide “Can I get a association or affinity group discount on my life insurance policy?”

Which companies offer the best car insurance for Ontrac drivers?

Top providers include State Farm, Progressive, Liberty Mutual, Allstate, and Nationwide, each offering tailored coverage and discounts.

What are some factors to consider when choosing car insurance?

Drivers should consider coverage options, premium costs, customer service, and the insurer’s claims processing efficiency.

Is there specialized coverage for deliveries made by Ontrac drivers?

Yes, some insurers offer policies that cover vehicle damages and liabilities specific to delivery operations.

Can Ontrac drivers save on insurance costs?

Yes, they can reduce premiums by maintaining safe driving records, bundling policies, or opting for higher deductibles. Read up on our guide “What is car insurance “financial responsibility” law?”

How often should Ontrac drivers review their car insurance policy?

It’s recommended to review policies annually or when there are significant life changes to ensure optimal coverage. Your car insurance rates will likely increase after an at-fault accident, but you can find your cheapest coverage option by using our free quote comparison tool below today.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Mary Martin

Published Legal Expert

Mary Martin has been a legal writer and editor for over 20 years, responsible for ensuring that content is straightforward, correct, and helpful for the consumer. In addition, she worked on writing monthly newsletter columns for media, lawyers, and consumers. Ms. Martin also has experience with internal staff and HR operations. Mary was employed for almost 30 years by the nationwide legal publi...

Published Legal Expert

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.